Hello, this is my portfolio in 2025 and some thoughts on my current positions. You will find my cost basis and % weight of the portfolio beside each ticker. I am posting this very late in the year, but I didn’t have time to do it earlier.

Supremex (XTSE:SXP) / Cost Basis: 4.06CAD , Weight: 17.4%

Q4 results were very good. FY FCF of around 30M CAD, which is a 30% FCF yield. What’s more, this FCF is sustainable and actually they could release even some more WC. Prospects look good for the year 2025. Envelope Revenue was down, but QoQ volumes were up in envelope despite consolidation in the Greater Toronto area, where the 3 largest facilities underwent overhaul to be consolidated into 2 to drive efficiency. Lease expiration on one facility will drive rent savings. They have a strong backlog on Envelope for this year and margins will improve. Adjusted EBITDA Margin was 18.8% in Q4.

In Packaging, revenue was also lower, mainly because of restructuring in Specialty Products and closure of one facility outside of Montréal. For illustrative purposes, volumes were down 50% and the company still managed to improve margins because of a strong pricing environment.

In general, the company has made efforts to drive down costs and now it’s time to bring up the volume. From recent Q4 conference call they said basically that tariff threat is not super material for the business. Cross-border only affects the Envelope business and they can work around it.

There is another little catalyst left: The Company will be proceeding with a sale-leaseback of two properties with a book value of $9 million and an appraised value of $57 million. This means the company will free up capital and have 48 million to pay down debt, do M&A, pay dividends, stock repurchases, etc. The market has not recognized this yet.

My fair conservative value is around 10CAD, which is 150% above today’s market price.

Catana Group (XPAR:CATG)/ Cost Basis: 4.98EUR , Weight: 13.7%

Not much has changed since I wrote this up. I still don’t understand how this trades so cheaply, even as a cyclical stock. The company plans to enter the power catamaran market with its YOT brand, which is approximately nine times larger than its current sailing catamaran market. Even capturing a small share of this market would represent tremendous growth for such a small company. To support this expansion, they acquired a stake in Composite Solutions (now Catana Group Portugal), a specialist in developing and producing nautical equipment.

After two years of significant price increases driven by inflation, the company has decided to reduce prices to attract more customers. Additionally, as mentioned in my initial write-up, they are entering the larger units market with the new BALI 5.8, a 58-foot catamaran. Larger units tend to be more resilient and command higher premiums due to their intricate details and the opportunity they provide for producers to differentiate themselves.

Since my initial investment, the company has repurchased 3.5% of its outstanding shares and proposed a dividend of €0.18 per share, representing a 3.6% dividend yield based on my purchase price. This brings the total shareholder yield to 7.1%, which is not too bad for holding.

The company’s Q1 2025 trading update showed a 19% decline in sales. While this is not overly concerning, I expect full-year sales to decline by 10-12%, with profitability also taking a hit. However, this is still a solid company, and much of this decline appears to be priced in, given the stock is down 25% over the past year (45% from its 2022 peak) despite net income increasing by over 40%.

I am comfortable holding this stock for several more years. Even without a return to the red-hot margins seen in 2021 or 2024, and assuming normalized CapEx and some working capital release, I conservatively estimate the company can generate approximately €21 million in normalized free cash flow. This implies a P/FCF ratio of 6.9x. The company’s average and median ROIC since becoming profitable in 2017 is around 20%. While I am typically critical of using ROIC in cyclical businesses, their consistency is noteworthy. I believe this company is worth approximately €9.20 per share, which is 82% above the current price.

Patrizia (XETR:PAT) / Cost Basis: 8.19EUR , Weight: 13.5%

Boring stock, nothing changed. This is a European real estate and infrastructure asset manager. In November, they released a presentation with a roadmap on how they strive to become a 100B asset manager in 2030. I am always skeptical about such medium-term targets because, more often than not, they are just empty promises. Nonetheless, there are some interesting takeaways from the presentation about the business.

Since they are heavy in the infrastructure business, they will be a major beneficiary of whatever packages of investment flow into this sector. They operate in structural growth markets because pension reforms will most likely drive demand for funded pension programs managed by the private sector, and pension funds are Patrizia’s largest client group. They have tremendous expertise and a fortress balance sheet to capitalize on.

Also, 84% of the company’s AUM is locked in to “infinity,” meaning the company has no commitment to return the funds after X period. The average LTV of the funds they manage is around 30%. This lock-up of funds has translated into a 19.4% CAGR in management fees over the 2012-2023 period (AUM has grown 21.3% CAGR in the same time period, which suggests what we already know: that management fees (in %) have come under pressure because of passive index funds).

The company has not yet properly recovered from the pandemic, since transactions handled were under pressure during the pandemic, and now high interest rates have frozen the transaction market altogether. They are working (not hard enough) on lowering costs.

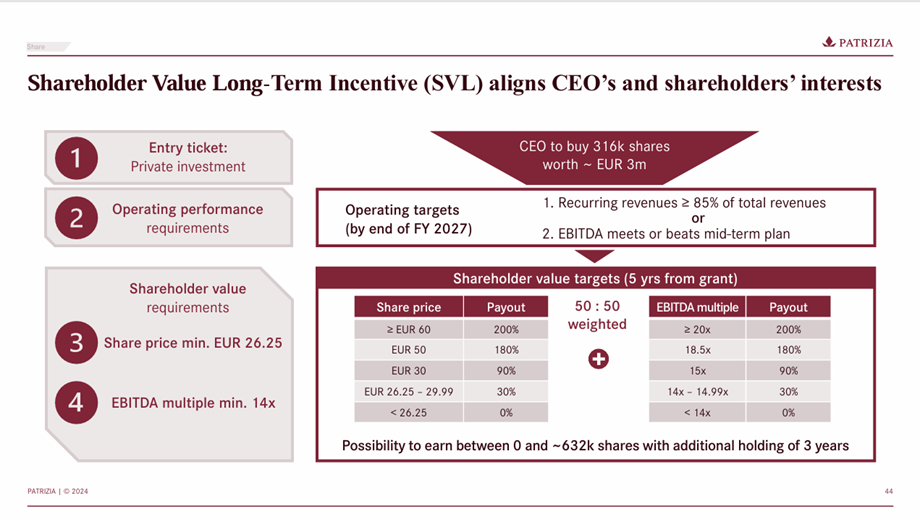

Interestingly enough, the market has not at all reacted to this because, like me, I don’t think the market quite believes this. The current CEO was appointed in early 2023 and has yet to purchase one share. I think the 14x EBITDA multiple is possible because they have traded there before, but I don’t know about the minimum share price of 26.25 EUR if they don’t turn things around significantly.

On valuation, I get almost the same result valuing it at reproduction cost (1.388 billion) as at historical normalized EBITDA and a multiple of 14x (1.315 billion). This would be double the current share price.

I have also tried to figure out what the company could be worth if they achieved their target of becoming a 100B AUM manager by 2030. If this was the case, I estimated, based on historical profitability and fees, that they could easily generate around 210 million in EBITDA. This, at a 14x multiple, is a whopping 350% above the current share price, with modest estimations. Of course, this is most likely never going to happen, but just to give you a glimpse at the potential of the company if they execute.

Sylvania (XLON:SLP) / Cost Basis: 0.49GBP , Weight: 10.4%:

I have already written extensively about PGM’s and about Sylvania in particular, so I won’t extend myself too long on this one. Since I wrote about it, it has come down further. PGM prices have somewhat stabilized, albeit at a lower level of around $1,000 per oz for Palladium and Platinum. The outlook for PGM’s is still moderately positive, with persisting deficits across the most important metals. Mining supply of PGM’s has struggled (172 of SA PGM miners operate at a loss), and recycling has also been impacted as people are keeping their vehicles for longer. Increasing skepticism around BEV’s and a possible resurgence in the automotive sector might push the demand for PGM’s and deplete above-ground stocks. We will see how this plays out.

The Thaba JV, a chrome beneficiation and PGM processing plant that will treat a combination of ROM and historical chrome tailings, should kick in during Q2 2025 and could substantially boost profitability if chrome prices stay elevated.

Exploration activity has also been positive, with encouraging results from the Volspruit PGE-Ni-Cu deposit, where an Updated Scoping Study was undertaken in February 2024. The pre-tax NPV is $69 million for a 14-year LOM at a 12% discount rate and a three-year trailing PGM basket price. At current spot prices, the NPV would be significantly negative.

On the valuation side, if you estimate 76k 4E PGM oz normalized output at a $2,000 PGM basket price when the Thaba JV kicks in and an AISC of $1,100 per oz (significantly higher than the current $971), you get a normalized FCF of around $68 million USD or approximately £54 million. This means the company is currently trading at 2.27x normalized P/FCF. My fair value would be around £0.85–£0.95 per share, which is 80%–102% above the current market price, not accounting for dividends. The company is also buying back stock.

Please bear in mind that this is an SA miner with an uncertain mine life, so don’t go around slapping more than 5x FCF on this.

Crest Hold (XLON:CRST) / Cost basis: 1.86GBP, Weight: 9.6%:

The UK isn’t exactly a popular place right now, and if you throw in the construction industry, you’ve got what might be the most hated combo imaginable. The UK planning system is a nightmare. There’s talk that the new administration might improve things a bit, but who really knows.

Crest Nicholson’s 2024 results were brutal. The fire safety remediation under the Building Safety Act hammered their profitability, with huge provisions needed to fix older buildings that didn’t comply with the new rules. Every financial metric is down, and home completions are even lower than during the pandemic (let that sink in). High real interest rates in an already struggling economy are probably the biggest culprit. For context, real interest rates are around 2% in the UK, compared to 0.2% in the EU and 1.5% in the US. Honestly, they should just cut the dividend entirely, but they’re holding on to a 2.2p/share.

New CEO Martyn Clark seems promising. I like his approach, and he seems serious about getting the company back on track. He’s making operational changes and putting proper internal controls in place where there were none before. Legacy sites are slowly being replaced with higher-margin ones. One thing that always bugged me was the big gap between the expected margins on their landbank and the actual margins they delivered. Turns out, it was more about bad decisions and poor cost control than any real issue with the land itself. Now that build cost inflation is basically flat and they’re managing costs better, that gap might finally close.

They’re also working on optimizing working capital and their land portfolio. Some planned sites look decent on their own but don’t really fit into the bigger picture for the company. I wouldn’t be surprised to see some land sales soon.

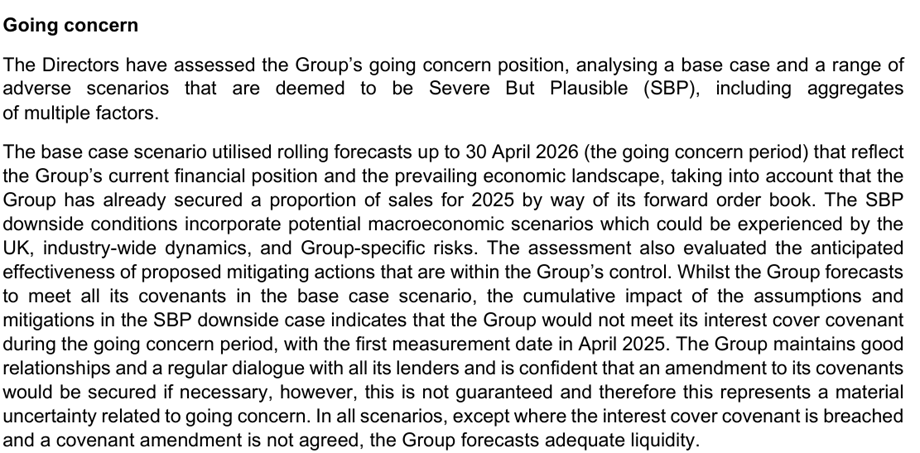

Under their SBP scenario, they’d breach one of their three loan covenants – specifically, the interest cover ratio. The covenants are: max gearing of 70% (they’re at 20.1%), interest cover at least 3x EBIT (they’re at 3.5x), and tangible net worth not less than £500m (they’re at £699.9m). So yeah, they’d miss the interest cover if things stayed bad for a couple of years, but with rate cuts likely coming, that seems unlikely. Plus, they’re still well-capitalized. They’ve got a small £20m maturity in 2025, and their £65m revolving credit facility doesn’t mature until October 2027.

For valuation, if they complete around 2300 homes (just above 2020’s 2247) at an average selling price of £360k for open market and £180k for affordable (with open market making up 78% of completions and affordable 22%), that’s about £756m in revenue. With EBT margins around 9.5% (they used to be over 10-15% pre-pandemic), and some working capital release, they could generate around £95m in normalized free cash flow. That puts them at a P/FCF of 4.71x – not bad for a well-capitalized UK homebuilder. My fair value is about £4.20 per share, which is roughly 145% above the current price.

Natural Alt Intl (XNAS:NAII) / Cost Basis: 5.37USD, Weight: 9.4%

This one has easily been my biggest mistake to date, and in hindsight (obviously), I should not have made it a big position right away. When I first found the company and wrote up about it (two years ago), I didn’t think it was going to get this bad. Fast forward two years, and the company has burnt tons of cash (much more than it can afford) and about 10 million of tangible book value, and they are expecting a net loss for FY2025 too (they recently reported Q2 2025)! This is stupidly bad management. No divis, no share repurchases, and no insiders buying. Currently trading at about 1x NCAV and 0.3x P/TBV.

The last time the company traded at those prices was in 2001. It had lost a big client, and 40% of the revenue was gone in a couple of years. Now we are in a similar situation—the company has lost about 40% of its revenues and is operating at sub-optimal capacity because it decided it was a wise idea to expand at the top of the cycle. When revenues started to reaccelerate, net income picked up, and from the bottom to the top, the company was a 10-bagger and went from a P/TBV of 0.3x to 4x in three years’ time. This is probably not happening this time, though.

So, what is the current situation of the company? Revenues are up 35% YoY and 13% for the six months ending December 31. It’s already a step in the right direction, but the company needs to raise revenues even more to break even and stop burning cash. It’s still burning some cash, but FCF doesn’t look that bad for the last quarter due to some WC release. We’ll see how that goes, but the company still expects a net loss for the FY.

The main issue is liquidity. In a normal environment, the $8.6M cash on the balance sheet would be enough. Nonetheless, in an environment where the company is burning cash, it can be tough. They are not in compliance with the covenants on their credit facility, which allows them to borrow up to $12.5 million, but they are working with Wells Fargo on a modification (which will probably require interest rate increases), and Wells Fargo will not exercise any of their options pursuant to the Credit Agreement. They have already drawn $5 million under the credit facility, so they can borrow $7.5 million more (assuming that Wells Fargo will not downsize the credit facility). So, all in all, the company should have $16 million in available liquidity.

Assuming they continue to burn cash at an elevated rate of $4 million per quarter (this is a stress-case scenario), they have three quarters to get their shit together. This is a severe but plausible scenario (as our friends at Crest would say), and if that were to be true, the company would face serious bankruptcy risk. Now, sales have already accelerated, so assuming we continue on that trajectory, at some point operating leverage should kick in, and maybe they should put a profitable quarter together sometime in the future. The company should break even at $140-150M revenues, but that is 19-25% growth compared to FY2024. If they exhibit strong growth in the coming financial quarters, the stock should re-rate. It is priced for a step before bankruptcy. After posting disastrous Q2 results, the stock barely moved. I think if they don’t go bankrupt, we only go north from here, but I’m starting to think that is a big “if.”

To valuation: In the worst-case scenario, excluding bankruptcy obviously, they burn $4 million in tangible book for the three coming quarters, which would leave them with a tangible book value of around $67 million. If they manage to turn a profit in three quarters, it makes sense to value it at 1x book value at least. This would mean an upside of 169% in a very bad scenario—but one step from bankruptcy. I am a little scared, to be honest, but the company has made improvements in Q2, and at least revenue is accelerating, so that is something. I’m not even going to make bullish scenarios on the company because the outlook is not particularly good.

Outokumpu (XHEL:OUT1V) / Cost basis: 3.29EUR, Weight: 6.8%:

For FY2024, deliveries are down significantly (8%), EBITDA is down, and FCF is down. The Board announced a 0.26 EUR per share dividend, which gives you a nice 7% dividend yield on the current stock price, which is a good capital allocation since the company, especially in today’s environment, will not generate more value by reinvesting the cash. As a matter of fact, the company has delayed or altogether suspended some investments it was going to make, like the cold-rolling investment in the US or the Small Modular Reactor in its Tornio facility. The company is prioritizing efficiency and debottlenecking operations before making new investments. It is also restructuring the German facilities to achieve more efficiency.

In the Stainless Steel Market, consumption was stable in Europe and increased in the Americas and APAC. Since third-party steel distributors play a large role in this market, it is important to underline that in this market context they have shifted their mindset from just-in-case to just-in-time; they only buy what is necessary for current operations and are depleting inventories. The company stated in its Q4 conference call that we are currently very far from normal conditions.

The Ferrochrome business is booming, and the company plays in a league of its own. They are the only Ferrochrome mine in Europe. This has considerable value in an industry where chrome is so critical. Recently, the company announced drilling results that showed a 95% increase in reserves, extending mine life to 2050. For context, the NPV of those reserves discounted at 10% to today would be 1.32 billion EUR, which covers almost the entire market cap. The CBAM kicking in 2026 should further boost the Ferrochrome segment.

For a closing, without the Finnish strike and some operational issues in the Americas that have been solved, EBITDA would have been 280 million instead of 177. This gives you an EV/EBITDA of around 6x in a very tough market environment.

Now to my valuation on a normalized basis. The company guided to 500M normalized EBITDA after all the cost-cutting initiatives they have been through since 2020. They have a very clean balance sheet. I think on a normalized basis, assuming around 2.1 million stainless steel deliveries at a price of 3000 USD per metric ton, average sales on ferrochrome and assuming 2% operating margins, they can do about 350 million EUR FCF if you normalize working capital (it’s at historic highs). This would mean a P/FCF of 4.15x. My fair value is around 6.5 EUR per share, which is 87% above the current market price.

Gold Royalty (XNYS:GROY) / Cost Basis: 1.32USD, Weight: 6.2%

I think royalties are the best way to play the current gold bull market that has been ongoing over the last year or so. While gold is up, the market has not been generous with most gold-related equities, including Gold Royalty. On a fundamental basis, they have royalties on very large, long-life mines in North America, like Coté Gold and Odyssey (the underground extension of the Canadian Malartic).

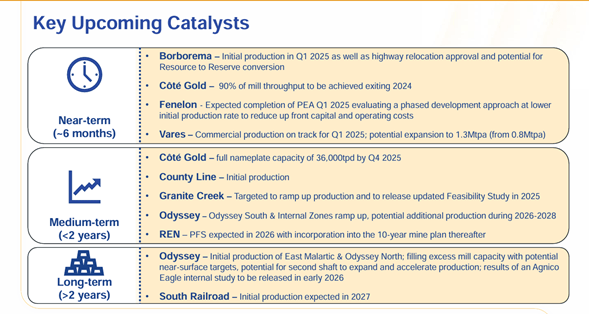

I will now give you the most recent updates on some key assets:

- Coté Gold: Ramp-up was successful, and they now expect production to roughly double in 2025 to 360–400 koz from 177 koz in 2024. This should equal about 2500 GEOs for Gold Royalty next year.

- Vares: It should reach a nameplate capacity of 800 ktpa in H1 2025. Once the ramp-up is completed, it should provide the company with 3825 GEOs.

- Odyssey: Sinking of the shaft is ongoing and on schedule, with a transition to mining from the shaft expected in 2029. In 2026, Agnico will update the market on an internal study regarding the construction of a second shaft. It’s tough to estimate exactly how many GEOs the company is expected to get from this in the near term, but it’s a lot—because the potential upside is huge due to the internal zones and potential for further resource base expansion. Currently, with production of around 80 koz per annum, the company should get about 2000 GEOs.

- Borborema: Construction is on time and on schedule with ramp-up by the end of this quarter. It should add around 1500 GEOs.

These are the main producing assets. There are other interesting projects, the most notable being the REN project operated by Barrick, which should produce 140 koz per year from 2027 onwards. I can see the company reaching about 12,500 GEOs in the near term.

Another very interesting detail is that the company announced an amendment agreement with the Bank of Montreal and the National Bank of Canada to amend and upsize its revolving credit facility. The upsized facility will bear an interest rate based on SOFT + 3% margin (a 100 bps reduction), allow for a further 45 million in availability, and extend maturity to 2028. This now means that the 40 million convertible debenture plus the 25 million drawn under the revolving credit facility will be due in 2028. The company is pretty levered, so I hope to see results soon—and I don’t want to have to be around by 2028 (or yes, it will depend on execution). The company is the most levered of its small-cap peers, but it also has the best assets, to be fair.

I expect the company to make around 20M in FCF in the near term, assuming around 12,500 GEOs, the current spot gold price, 10 million in SG&A, and 4.5 million in interest expense. At a P/FCF of 25 (well below peers), this thing should be worth around 500M. Assuming diluted shares outstanding of 200 million, this is a price of 2.5 USD/sh, 78% above the current share price. I think this is quite conservative.

Other positions & Portfolio movements:

I hold a position in Thyssenkrupp and Avance Gas, where I executed an arbitrage with the recent wind-off. I sold Valhi, CPI Card, and Netel after they more than doubled, as I wanted to average down on my losing positions. I sold Sachem Capital at a significant loss (around 40%), which turned out to be fortunate, as it has since dropped another 40%. A huge miscalculation on my part—I shouldn’t have invested in it in the first place. I also sold Mainstreet Bancshares at a small loss because it didn’t meet my return targets. Additionally, I sold Watkin Jones at a small loss to consolidate my portfolio, reinvesting the proceeds into Crest Nicholson. Ironically, after my sale, the stock surged by 60%.

Bullet points about my investment framework and how I think about the stock market:

- I am a finance guy, not an economics guy. Economic indicators are lagging, and you have zero edge in markets as an economist. Markets are forward-looking, and you might have an edge by knowing the business cycle well and recognizing patterns based on historical norms (especially in boom-and-bust markets like deep cyclicals, commodities, shipping, etc.). I don’t give too much importance to economics other than as a matter of pure personal interest.

- I see myself more as an odd-maker profiting from market swings than as a pure financial analyst. You can be an exceptional financial analyst, know the ins and outs of a lot of businesses, and still not make a dime in the stock market. I analyze the downside and upside of an idea and see if the risk-return fits me. Of course, this involves judgment, and you will make mistakes.

- I don’t care about a fancy idea; I care about things I can understand and expected return through a conservative analysis. I don’t mind paying reasonable multiples for companies I think are superior as long as the IRR is right. However, I will never pay expensive multiples. Anything in the mid-to-high teens P/FCF is expensive for me.

- I trailed the market last year by a lot, but I am outperforming by around 7% this year so far, simply because my stocks were relatively cheaper. I had some big winners (Valhi, CPI Card, Netel, Thyssenkrupp) and some big losers (Sachem), but in general, the companies I own the most of have not moved. I have a lot of catching up to do.

- Psychology is one of the most important things in investing. I am not active at all trading.

- Something that is cheap will probably get way cheaper before it turns around, especially falling knives. I will try not to rush into buying full positions directly. This hurt my performance a lot.

- I don’t use screeners and never will. I go A-Z through stock listings and eyeball thousands of businesses per year to keep maybe 10-15 that I think have a good risk/reward. By the way, none of my stocks start with the letter “A.”

- As my portfolio grew larger (by my standards), it doesn’t bother me to keep a little cash anymore (rarely exceeding 10-15% unless I can’t find new ideas).

- I value businesses based on KPIs, and I have no pre-made spreadsheet to value businesses. I value them all from scratch to get a better understanding of the business’s KPIs. My models are messy, not well-formatted, and simple (although not simpler). There is no edge in having beautiful spreadsheets unless you like them for personal reasons.

- I don’t even look at analyst estimates; they are useless and always way off. This is not particularly important to me since, for my companies, there are not a lot of analysts.

- Talking to management is hugely overrated. I did this somewhat in 2024, and they will either try to sell you the company or just tell you the same generic stuff they tell everyone. No edge.

- Reading conference calls is the best way to truly understand a business because sometimes there is value in them in terms of better understanding KPIs. Skip the generic stuff.

- Valuations are dynamic, and a stock dropping is not always a sign of an increasing margin of safety. Example: I adjusted my valuation down multiple times for $NAII as things kept going wrong multiple times.

- The market does not know at what price you bought your stock. Don’t anchor to your cost base—use common sense.

- Don’t buy the hot stuff. It will seem obvious in hindsight, but people always make up excuses for high valuations when stock prices go up.

- Avoid the big losers. This is also obvious in hindsight, but avoiding big losers is linked to not buying the hot and overvalued stuff.

- Every cheap stock is cheap for a reason. There are two spectrums of this quote: On one end, people say that because of this, you shouldn’t buy cheap stocks at all; on the other end, some believe stocks are cheap just because. I disagree with both sides. Find out why the stock is cheap, discount the obvious stuff that is already priced in, and see if you understand the business better than the market does—and why the market is off on that stock. Surprisingly enough, the market is right more often than not. You have to work your ass off and have nerves of steel to beat it.

- Concentrate and be aggressive if you’re young—you only have to get rich once.

Gonçalo

One response to “Where My Money Sits in 2025”

Thank you for the insight in $NAII. I have similar cost basis.

LikeLike