“There seems to be some perverse human characteristic that likes to make easy things difficult.”

― Warren Buffett

The Company

Catana Group specializes in the design, manufacturing, and marketing of sailing boats, particularly catamarans, which are boats consisting of two hulls joined by a frame. Catamarans can be either sail-powered or engine-powered and are known for their stability and spaciousness compared to monohull boats.

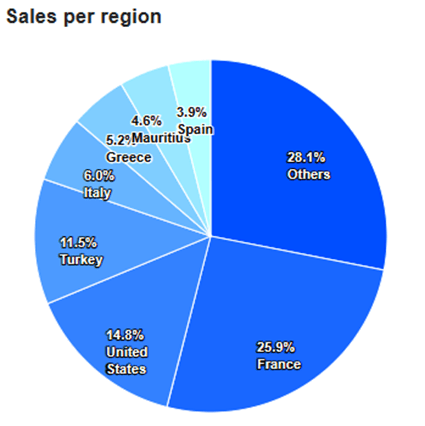

The company operates under three brands: Catana, Bali, and Yot. Catana and Bali are well-established brands, while the Yot brand is still being developed. Catana Group is geographically diversified, but its sales are heavily skewed towards the Bali brand, which has been highly profitable for the company since its inception.

Catana Brand

Catana Catamarans is a high-end brand with over 40 years of experience in the market. Renowned among sailors, Catana is not particularly exposed to the economic cycles of any specific region, thanks to its well-diversified client base.

In 2003, Olivier Poncin, father of the current CEO Aurélien Poncin, acquired Catana. As a mature brand with a unique savoir-faire, Catana initially focused on models under 50 feet. However, in 2013, the company launched the Catana 59, which was a significant success and marked the company’s entry into the large-sized boat market, traditionally less sensitive to consumer spending patterns. The Catana 59 was converted into the Catana 62 in 2015. Another milestone was the launch of the Catana 70 in 2014. With the Catana 62 and Catana 70, the company established a comprehensive portfolio of large-sized catamarans. Additionally, the Catana 53 was launched in 2014 and redesigned in 2017. In 2021, the company introduced a new model, the Catana Ocean Class, though its success has not been reported.

A crucial aspect of boat manufacturing is the payment terms, which impact working capital and the company’s cash generation capability. For the Catana brand, the payment terms are highly favorable: customers pay a portion upfront and make regular payments as the boat’s construction progresses. This arrangement means that the company does not need to commit its own capital to the manufacturing process.

Bali Brand

Bali is a young brand, created from scratch by Catana Group in 2014. It offers sailing and motor catamarans known for their large living spaces and openness. The forward cockpit and increased living area are key features that distinguish Bali in the market. The creation of this brand reflected the company’s desire to broaden its portfolio and establish itself as a leading manufacturer of catamarans, while also focusing on selling more new boats to boost profitability.

The first models introduced were the Bali 4.5 and Bali 4.2, produced in record time, showcasing the company’s industrial expertise. These models debuted at major European nautical salons and were an instant success. In 2015, the company introduced the Bali 4.3 and announced the development of the Bali 4.0. The production of the Bali 4.3 was almost entirely sold out that year, and a motoryacht version of the Bali 4.3 was also announced. By early 2016, the company had a portfolio of four sailing boats (4.0, 4.2, 4.3, and 4.5) and one motoryacht (4.3 MY).

In 2017, Catana Group acquired a 30% stake in its Tunisian subcontractor HACO and launched the Bali 4.1 and its largest model to date, the Bali 5.4. The Bali 5.4 became especially popular among boat loan professionals, who accounted for approximately two-thirds of its sales. In 2019, the company acquired the remaining stake in HACO, making it a subsidiary. That year, the Bali 4.8 and Bali Catspace were launched. The Bali 4.6 replaced the older Bali 4.5, and in 2021, a new version of the Bali 4.2 was introduced. Additionally, a motoryacht version of the Bali Catspace was launched.

Bali has been an explosive entrepreneurial success, becoming the third-largest catamaran manufacturer in the world within a decade. However, the payment terms for Bali models are less favorable for the company, with customers typically required to pay 30 days after the boat is completed.

YOT Brand

The YOT brand was created in 2023 with the ambition of further penetrating the motorboat market and expanding its total addressable market. To support this endeavor, Catana Group acquired a majority stake in COMPOSITE SOLUTION, a Portuguese family-run company, with the intention of making it a new production hub. YOT aims to produce multifaceted power catamarans, and its first model, the YOT 36, is already being commercialized.

Services

In addition to catamarans, the company also provides various services. The main hub for these services is the Port Pin Rolland in Saint-Mandrier. This port has more than 400 parking spaces for boats, where maintenance and repair can be carried out.

Catamarans Market

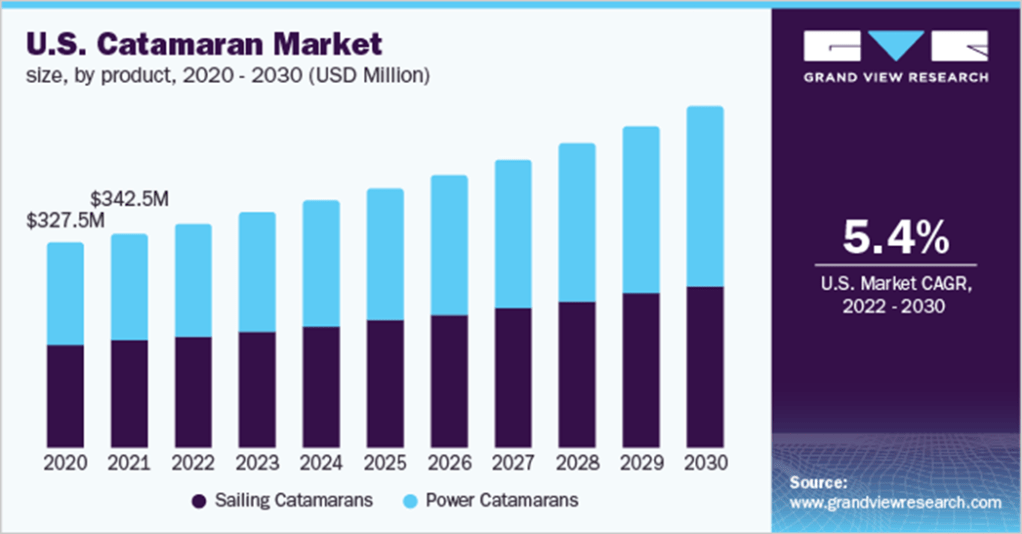

The Multihull Market is set to grow at a CAGR of 5.5% until 2030. This market is worth approximately 1.35 billion USD now and is set to almost double in size by 2030. Based on this assessment, Catana has approximately 15% of the market share.

The market is bifurcated into sailing and power catamarans. While sailing catamarans account for 54% of the market, power catamarans are set to grow faster than the overall catamarans market. So, it should not strike you as a surprise that Catana is trying to penetrate further into the motorboat market.

In terms of size, smaller catamarans (under 30 feet) are set to grow the fastest. Nonetheless, it is in medium-sized catamarans (30-50 feet) that the constructor can really differentiate its product. This is because adding a little more size allows designers and boat builders to dramatically broaden each hull, allowing for amenities like private staterooms, several bathrooms, and entirely separate eating and cooking areas. Catana is very well positioned in this segment.

Catamarans are mostly utilized for leisure purposes, but the sport segment is also very important. Catana’s portfolio appeals to both the leisure and sport sides.

Key listed players in this market are Beneteau and Fountaine Pajot. While Fountaine Pajot and Catana are more focused on high-end catamarans, which makes them more resilient to economic downturns, Beneteau is a well-established brand but a more generalist one in terms of quality. This led to Beneteau pursuing a premiumization strategy to compete with other more high-end brands.

The market is protected by significant barriers to entry. First, in shipbuilding it is essential to have shipyards that are well-located in proximity to the shore and with good exits to sea. This is very costly, and permits are difficult to obtain because of tight environmental restrictions. Then, equipment is very expensive, and you need significant fixed-capital investments. Finally, you need experienced teams, and the learning curve for new models is long and costly if you must build a brand from scratch. In the words of the former CEO, “new entrants should not be crowding in.”

All in all, it is a very pleasant market to be in and growth will be concentrated among the major producers. Beware that catamarans are a niche market and do not have the same market dynamics as, for instance, yachts or regular small motorboat builders. The former are almost uncorrelated to the economic cycle because they target ultra-high-net-worth individuals, and such boats take years to build. The latter is highly cyclical because the target customer is a middle-class one. The catamarans market is somewhere in between, not totally unaffected by economic cycles but also not highly cyclical.

Why I like the company

After a non-exhaustive analysis of the business and the industry, I will talk about why I like the company.

The first thing that struck me is its cheapness relative to the quality of the business, so much so that I thought all along that I had gotten something wrong. As a very price-sensitive value investor, I am used to bad and highly cyclical businesses popping up on my radar; this was a clear exception to my rule.

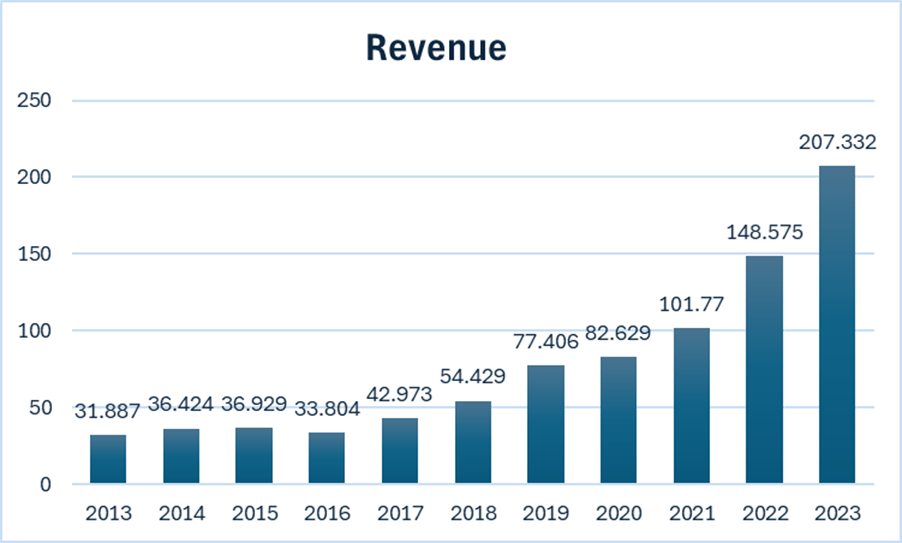

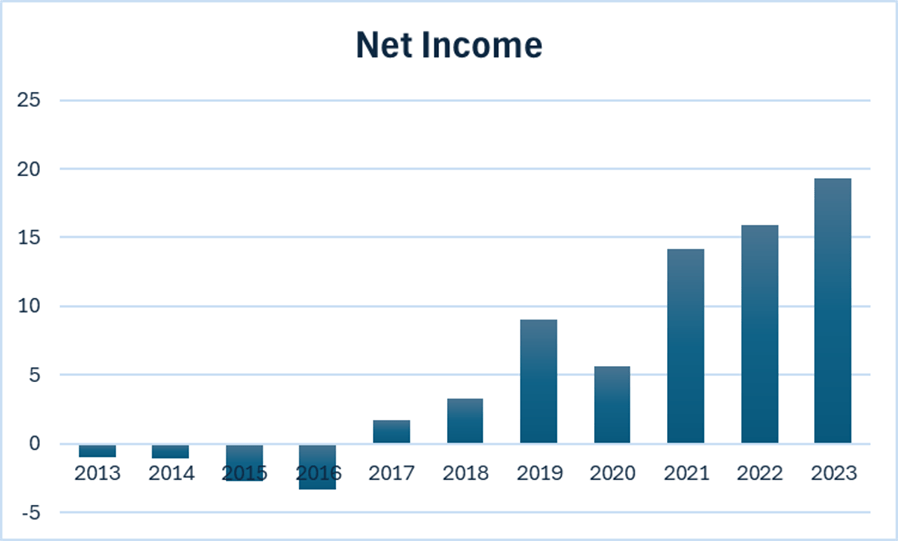

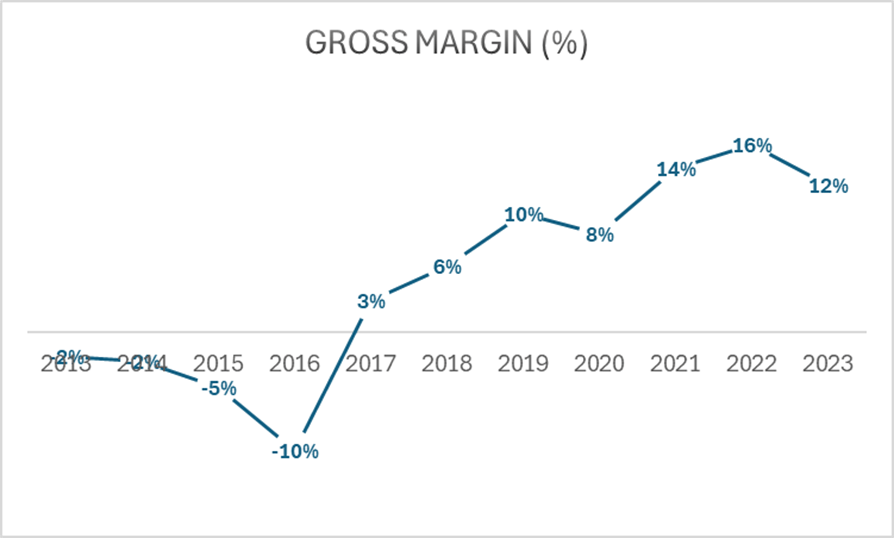

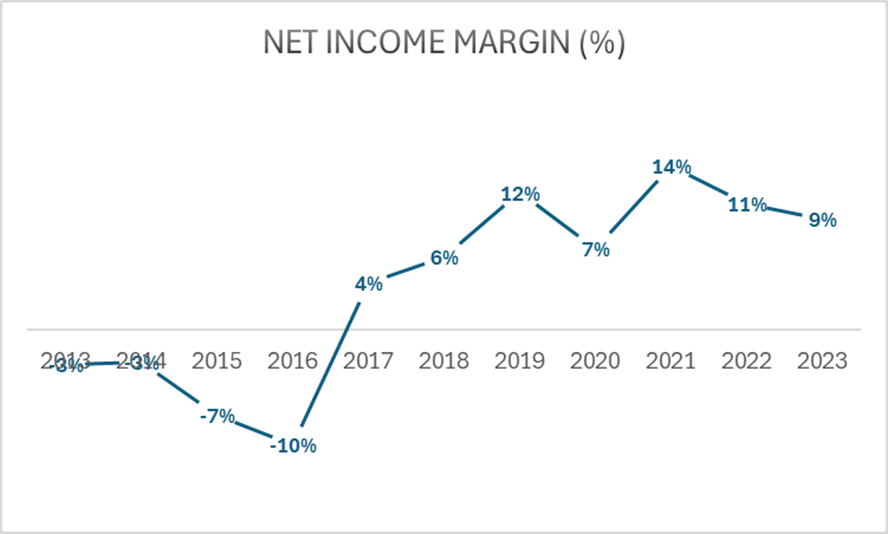

Revenue has grown at a staggering 21% CAGR over the last decade. But not only that, over the same time, net income has grown by 35% CAGR, signaling tremendous margin expansion.

Gross margin expansion is a sign of pricing power, which usually comes from higher quality products and substantial gains in market share. This expansion is mostly attributable to the Bali brand, which was and still is an absolute success.

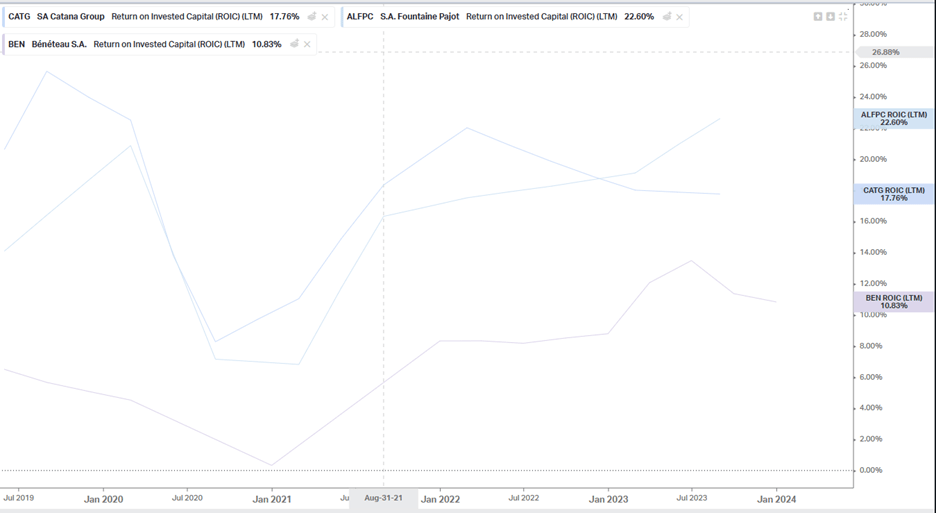

Not only has the company been able to improve the pricing and cost base of its products, but it has also dramatically expanded overall profitability as expressed by net income margin. This does not often come at the cost of an NTM P/E ratio of only 7.1x. This is still half the price of Beneteau, which is currently trading at a P/E ratio of 14x, despite having lower quality products and lower ROIC.

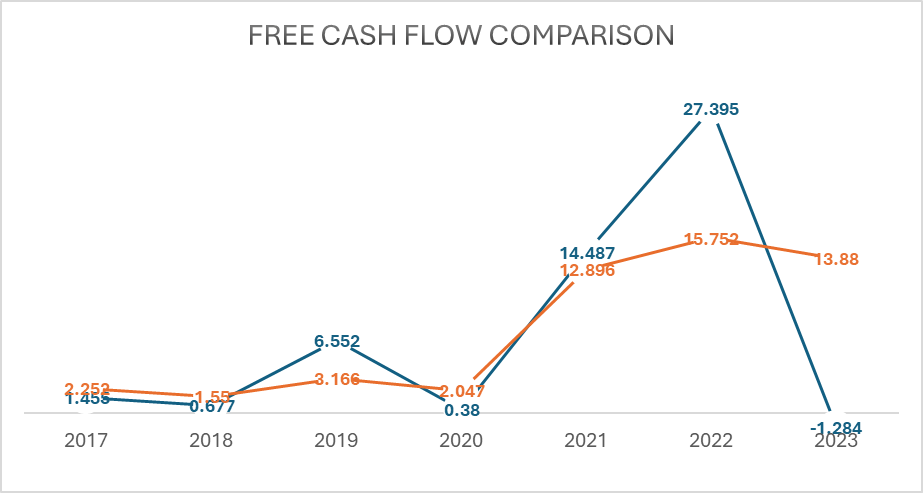

Adding to this, there has not been a substantial increase in competition due to the high barriers to entry already mentioned. This will probably add to the profitability of the industry in the future. Free cash flow generation is also very substantial, although more cyclical because of accounting for changes in net working capital, which is low relative to revenues but varies from year to year. Below you have a comparison between free cash flow after CWC (dark) and free cash flow before CWC (light).

Highlighting this anomaly, this should give you normalized FCF of between 15-20 million EUR. This would be a yield of between 9.4% and 12.5% FCF yield on a business with net cash of 38 million EUR. This essentially means that you are paying 121 million EUR for a business generating between 15-20 million EUR normalized FCF yearly (assuming no growth).

Risks

The only risk I can see is “no growth” risk or else bad execution risk. I have trouble imagining a scenario where such a cash-generative business with a solid balance sheet would go bust. Nevertheless, the no growth risk or slow growth risk might play out in the short term. People and recreational businesses often borrow money to buy a boat, which implies access to credit (currently not guaranteed) and reasonable interest rates. Given where interest rates currently stand in the Eurozone and the US, I think that criteria to buy a boat might not be met. However, the good news is that supply is not going to grow significantly in the high-end catamarans segment, and the company has a solid order book which gives it visibility on the future. For me, the biggest hedge is the price you’re paying. People used to buy this at roughly double the valuation it currently trades at. If nothing goes too wrong, I think this will be a money-winning holding.

4 responses to “CATANA CATAMARANS: Too good to be true.”

Thanks for another excellent piece.

Any thoughts on a catalyst for a re-rate?

LikeLike

That’s a tough one. I think it will re-rate naturally once visibility over the direction of the economy comes back (rate cuts in Europe are coming). Fundamentally, the company should continue to do fairly well, albeit growing at a slower pace. We will see how this one plays out.

LikeLike

Why do you prefer Catana Group as an investment instead of Fountaine Pajot?

LikeLike

That’s a good one. I’ve looked at both and I would argue that Fountaine Pajot is cheaper and even more broadly diversified than Catana. The main reason I haven’t invested is the general lack of information. The catamarans sector as a whole is very opaque, and they don’t seem to want to be re-rated by, for instance, making conference calls to explain business results. Understand that Fountaine Pajot is, as of 2023, mostly a monohull producer due to their acquisition of Dufour. I will not go into heavy detail, but in my opinion, catamarans have better market dynamics due to a mix of better performance/sailing experience and more living space, while also appealing to a much broader clientele. Nonetheless, I will underline some key points and comparisons between the two companies.

1. Both are well diversified among regions, but Fountaine Pajot has made itself very dependent on Europe over the years (65% of sales as of 2023).

2. ROIC and profitability are pretty similar, with Catana having slightly better margins.

3. Fountaine Pajot is much more diversified in terms of boat types, but as I said, I prefer Catana because I think a catamarans pure player could outperform the sector.

4. Catana has a coherent strategy to further penetrate the catamarans market with the introduction of a new brand (YOT), new sailing motorboats, and the manufacturing of larger boats in the Catana and Bali segment.

All in all, I prefer Catana because I can work with the information available. I think both companies will do well from here because they have a substantial valuation gap to fill in comparison with larger competitors. My Twitter is @goncalovalue1 in case you want to DM me, and I would be glad to exchange ideas. Cheers.

LikeLike