Business:

Liberty Latin America is an international provider of fixed, mobile and subsea telecommunication services, residential as well as B2B, across 20 countries in Latin America and the Caribbean through C&W Caribbean, C&W Panama, Liberty Puerto Rico and Liberty Costa Rica.

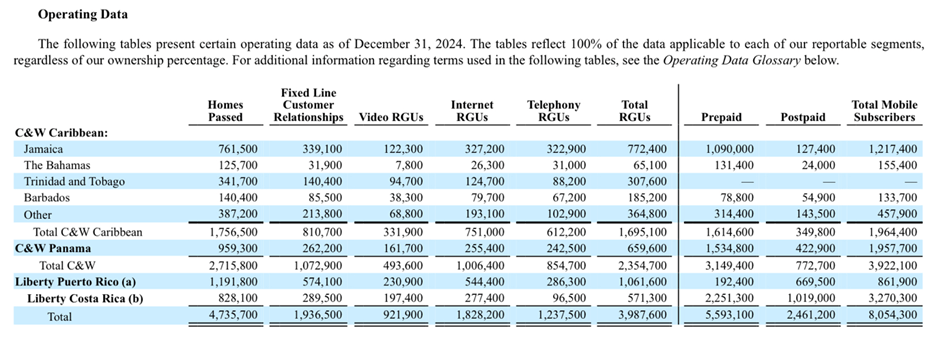

As you can see, the company is pretty big in the region. They have 8 million mobile subscribers, which is the most accurate definition of what one could call a “customer” for other businesses. To assess market share superficially, we can divide total population, which is around 14 million for the countries in which they operate, by total mobile subscribers, which would equate to an overall market share of around 57%, which is pretty consequent.

The opportunity in this region of the world for Liberty Latin is not growth in total mobile subscribers per se, although this constitutes an opportunity too, but rather to convert mobile subscribers, which are low value relationships, into revenue generating units.

As you can see, the disparity is huge between RGU’s and total mobile subscribers. If through successful marketing campaigns they can convert a big chunk of mobile subscribers into video, internet or telephony RGU’s through bundling of services, this would make a big difference in the bottom line.

This is especially the case, because their existing infrastructure of assets is currently heavily underutilized (more on that later), so economies of scale would kick in rather quickly.

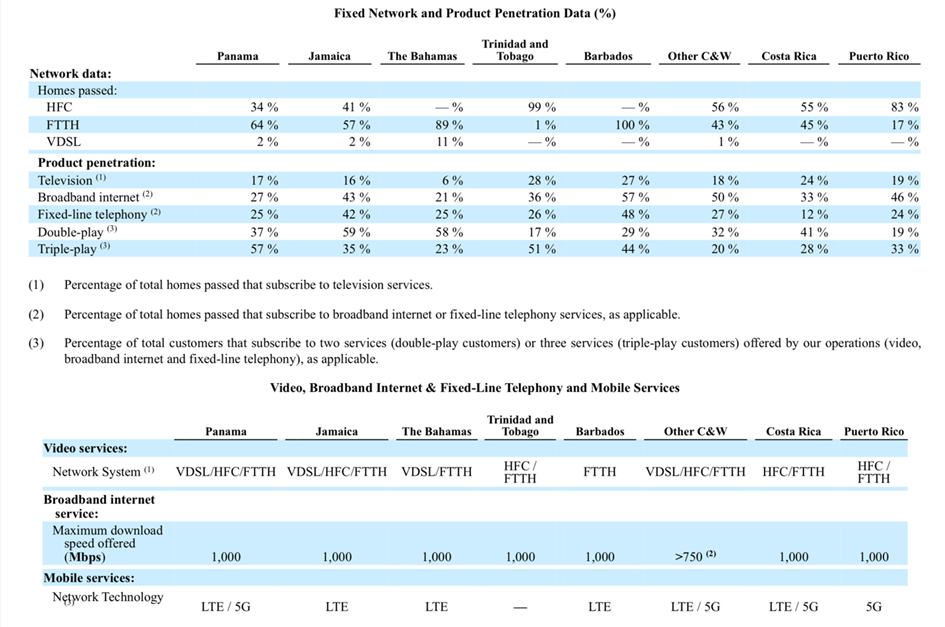

As you can see, Liberty Latin America has made the investment, and now is ready to harvest. They have cutting edge broadband in their existing markets (up to 1000Mbps, 5G, FTTH) and still a product penetration with room to grow, especially on bundled services.

So, all in all, business prospects look reasonable for growth, although every market has its specificities and needs a clear strategy, number of RGU’s has grown consistently over the years, and with room to grow, it shouldn’t be all too different in the future.

Overview of Assets, Silos and Capital Structure:

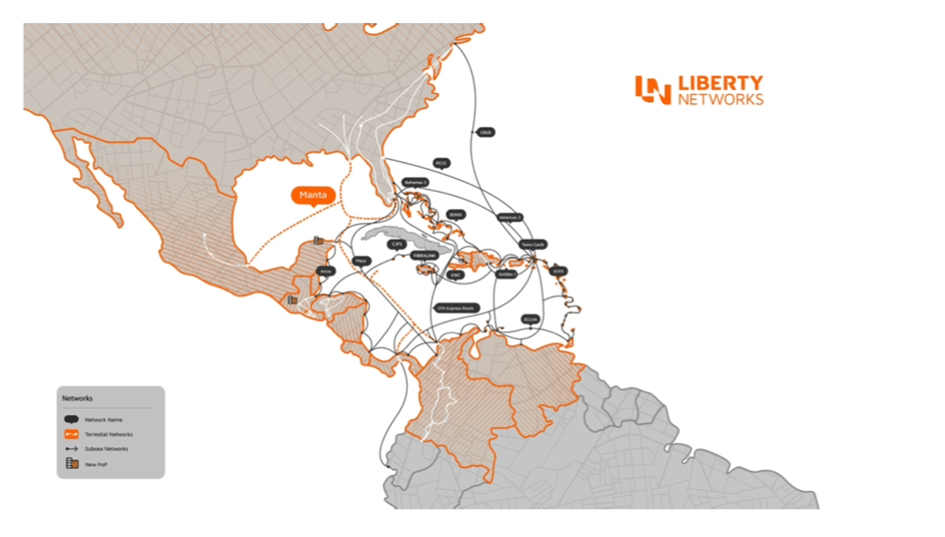

LLA as a consolidated company is heavily indebted, even for a telecom company. Their biggest asset is 50.000 km of cable in Central America. None of their other competitors has this footprint in the Caribbean/Central America.

LLA operates under three major silos, we will talk in silos, because those are also the most significant business operating units to look at in terms of understanding capital structure.

The first operating silo is C&W, which includes their Caribbean operations and also Panama, with brand names such as btc, Flow, +móvil. This unit was acquired in 2016 and rebranded into C&W Caribbean and C&W Panama.

The capital structure of this operating Silo is as follows:

- 735 million USD Senior Notes outstanding maturing in September 2027 at 6.875% interest

- 1000 million USD Senior Secured Notes outstanding maturing October 2032 at 7.125% interest

- 1510 million USD Term Loan B-5 Facility at SOFR + 2,25% maturing in 2028

- 590 million USD Term Loan B-6 Facility at SOFR + 3% maturing in 2029

- 435 million USD 2028 CWP Term Loan at 4.25% interest rate

- 125 million USD Regional and Other facilities

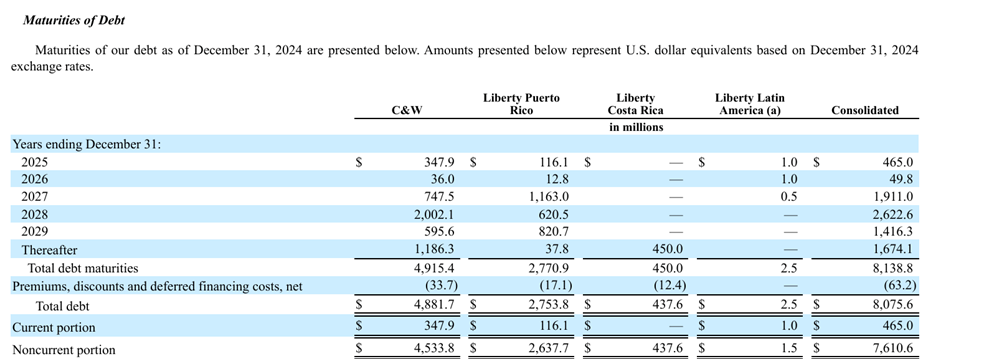

As you can see, pretty important leverage totaling 4395 million. No maturities in 2 years provides flexibility to deleverage, refinance or re-evaluate strategic options.

In this silo we have 3 businesses with totally different dynamics.

First, we have the Caribbean Cable & Wireless business.

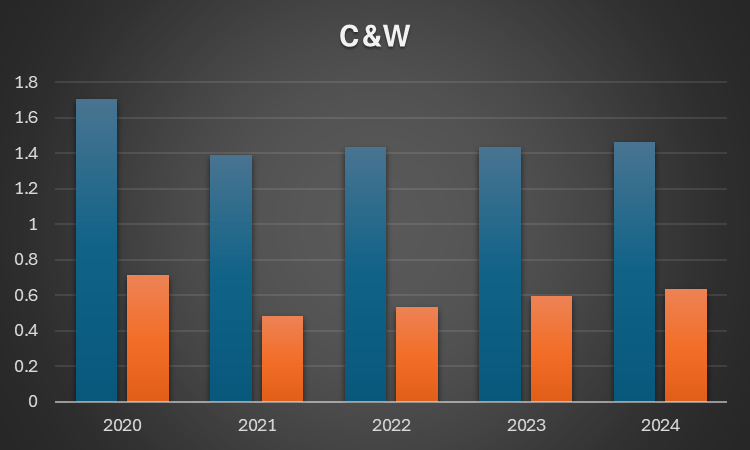

Revenue in blue, OIBDA in orange

With 43% Adjusted OIBDA margin and 633 million in Adjusted OIBDA, low single digit growth in Revenues and OIBDA, it deserves a low multiple of 5x EV/OIBDA. This equates to an EV of 3166 million. I don’t expect a lot more margin expansion, since this operation has largely matured. It is important to note that, if you look at pre-2021 reports, Caribbean and Liberty Networks, the B2B infrastructure unit of Liberty, are reported together. This inflates operating margins for the Caribbean operations, since, as we are going to see next, Liberty Networks is a higher margin business.

Then, Liberty Networks.

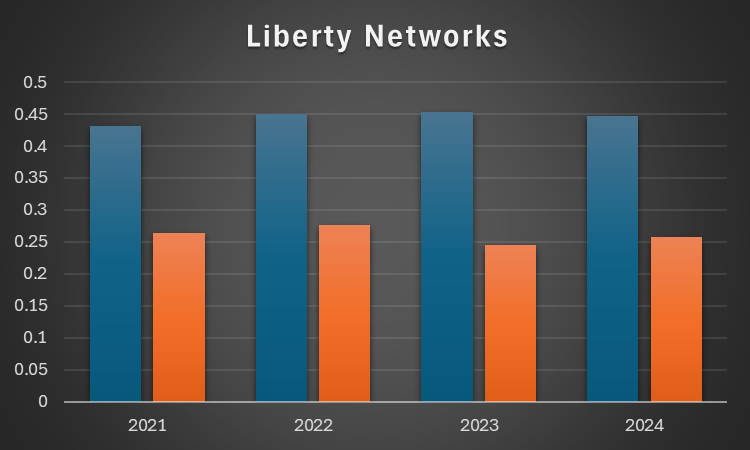

Revenue in blue, OIBDA in orange

This business is recurrent in nature since it provides valuable access to Liberty’s network to a wide range of institutions (government or private) and businesses. 57,7% margin, which might have some room for expansion based on margins of previous years, limited growth in revenues and in EBITDA, this unit deserves a multiple of 8x EV/OIBDA. This equates to an EV of 2066 million.

Lastly, inside the C&W silo, the Panama operations are the jewel of the crown. Revenues have been growing steadily, and while margin has compressed somewhat, profitability has been steadily increasing too. For this operation, which also still has some runway for HFC conversion into FTTH, a multiple of 7x EV/OIBDA is appropriate, which equates to an equity value of 1885 million.

The silos debt is a high but manageable. In total, the silos debt/oibda is 3,78x. It will deleverage pretty naturally as the Caribbean operations grow slowly and Panama continues its growth. But even if the business reaches steady state, I reckon that it can pay off its debt rather quickly since profitability is being overshadowed by high capital expenditures. On an equity basis, the silo is worth alone 2,723 billion, which is way above Liberty’s current market cap.

The second operating silo is Liberty Costa Rica, which includes the Costa Rican operation.

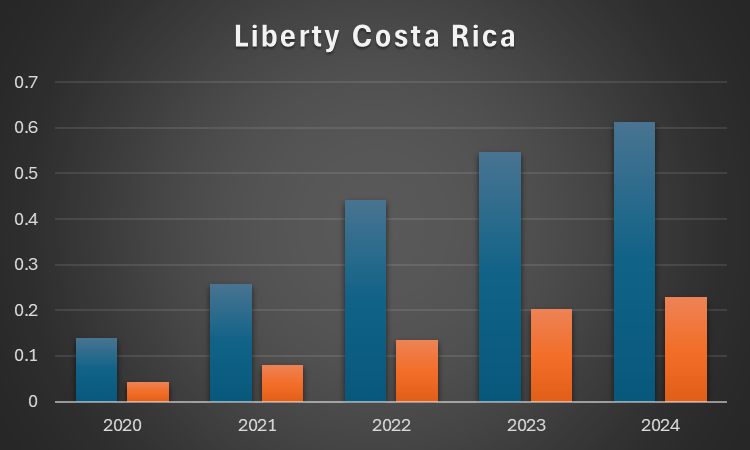

Revenue in blue, OIBDA in orange

The capital structure of this operating Silo is as follows:

- Term Loan A with 50 million usd outstanding maturing in January 2031 at 10.875%

- Term Loan B with 400 million USD outstanding maturing January 2031 at 10.875%

So in total, 450 million USD. For a 37,4% OIBDA margin with some runway to expand, this is a debt/ebitda ratio of 2x. Very solid and manageable for an operation which has exhibited high double digit cage growth in revenue since its creation. Also, there is still room to grow homes passed with FTTH broadband and increase bundled services. If we assume a modest 7x EV/EBITDA multiple for this operation, because of its lower leverage and better growing prospects, we get EV of 1603 million, less debt, equity value of 1155 million.

Lastly, Liberty Puerto Rico, which I call “the silo of shame”. The performance of Liberty Puerto Rico has been truly disastrous, a mix of intense competition from operators with a bigger reach than Liberty, natural catastrophes and over reliance on debt.

The capital structure of this operating Silo is as follows:

- 1161 million USD outstanding Senior Secured Notes maturing October 2027 at 6.750%

- 820 million USD outstanding Senior Secured Notes maturing July 2029 at 5.125%

- LPR Revolving credit facility with 50 million usd outstanding at SOFR+ 3,5% maturing in March 2027

- LPR Term Loan with 620 million USD outstanding at SOFR + 3,75% maturing in 2028

So all in all, 2651 million USD in debt, with maturities being much closer than other operating silos. Debt/EBITDA is way past 8x and this silo has essentially no value to me, it is a liability and is bleeding 200M cash per year.

Spinning-off Liberty Puerto Rico: The value unlocking move

As we have seen, Liberty Puerto Rico is the troubled division. The reasons are multiple and frankly, they don’t really matter.

Management has expressed the idea of spinning off the Puerto Rican division. The nature of the spin-off is unclear, could be an outright sale, or giving the business out to shareholders. LPR has the most debt and the worst profitability by far. Maturity wise, most of its debt is due in the period between 2027-2029.

This gives them some time to turn things around.

Management has highlighted the focus is the improve the capital structure inside the silo and to turn around operational porfermance. Profitability wise, the division has shown somewhat of an improvement in H1 2025.

Covenants are flexible and allow them to sell assets to raise capital to fund near-term liquidity needs. What worries me is the senior secured debt that is coming due October 2027 and I am afraid that, if Liberty can not successfully refinance it, it might spill over to other silos.

Management has not yet disclosed an exact date where the spin-off is set to take place, but is targeting first half of 2026. More importantly, the separation of LPR is not dependent on the liability management exercise.

Advisors on this deal are Moelis and Ropes & Gray, that worked on deals like Anheuser-Busch’s sale to INBEV, Yahoo’s defense against Microsoft’s takeover, Hilton’s sale to Blackstone. Citi and Liontree are also involved in the liability management.

Now, to the more technical aspect of the deal.

The Puerto Rican business has 1.3 billion revenue and 300m of adjusted OIBDA, whereas the rest of the business has around 3.1 billion revenue and 1.3 billion adjusted OIBDA.

To be very conservative, LPR is worth 0. It has no real value, at least for now, for the equity holder. It is FCF negative, adjusted OIBDA margins are under competitive and the debt burden is 8x oibda. It is expected the business will recover somewhat from the low point and management has expressed seeing “green shoots”, but lets not count on it.

The real magic happens when you remove the silo of shame from the rest of Liberty Latin America’s assets. LPR is a 200M drag on LILA’s FCF, which would mean, and 2024 being a bad year, that normalized FCF even with high capital expenditures is around 500M. If you apply to it a very conservative P/FCF multiple of 6, you get an equity value of 3000M. Our sum of parts valuation got us to a valuation of 3878M.

The new LILA has Net Debt/EBITDA of 4x, which is still a lot, but growth should deleverage the business naturally once LILA does not have to throw good money after bad on LPR. They also mentioned a new capital allocation strategy of paying regular dividends and share repurchases once the separation is done. Also, the OIBDA margins would jump up 5% at least post-separation. This catches the eye, so we are not relying on a multi-year rerating process, the re ating will be immediate.

What makes me like this even more is the incentives. As Munger used to say “show me the incentives and I will show you the outcome”. John Malone, the cable cowboy and chief consolidator of the cable industry, still owns a big chunk of the company and if we are talking power he owns even more because of his Stock A shares with 10 votes per share. The CEO, the main man that is in charge since Liberty Latin America exists as a standalone company, owns 22M worth of shares, which is good multiples of his base salary. In addition he also has some 3 million shares vesting at strike price above current market price.

So if things go somewhat right, we could be talking about a conservative equity value of 3.5 billion USD, an upside of almost 100% of the current share price. Say this takes 2-3 years to play out, we will still looking at an IRR between 24-40%.

If things go south, as they can, you get left with a handicapped company, but the stock should not go down significantly from here as even as a consolidated company prospects are getting better.

Risk to beware of

The first and most important risk is that the spin-off never happens, even if management is aligned and have expressed intentions of spinning off the business. You basically are left with status-quo and some modest, but real, bankruptcy risk in the medium term. I think the best exit strategy in this case is, if management does not announce anything in particular over the next quarters, just take the probable loss and go elsewhere.

Then, there is obvious refinancing risk in the medium term for LPR. Messing with the capital structure is not an easy task, especially in this credit silo.

Finally, there is always general market risk involved. The market in general seems to be a bit stretched so an event-driven idea in a defensive business like a telco might isolate you a bit from general market noise.

Gonçalo