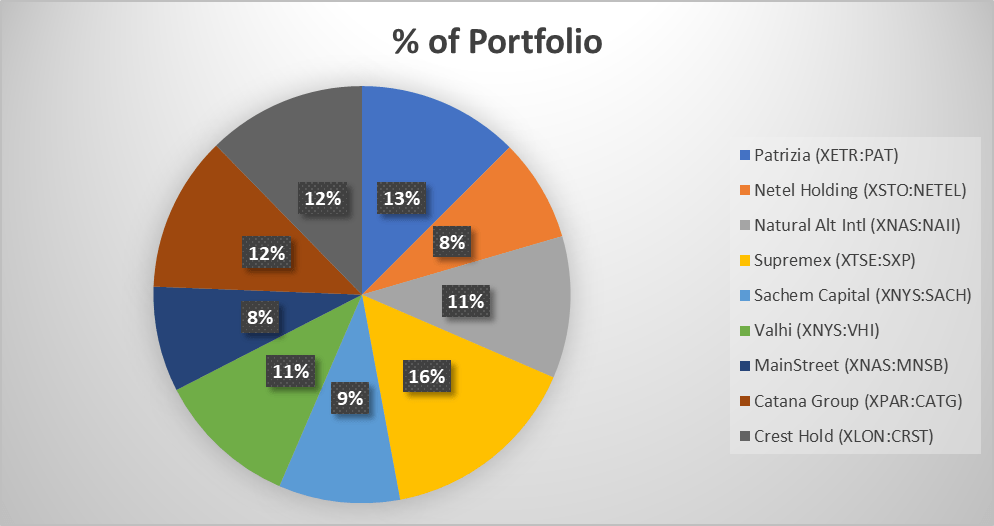

Portfolio at 01/08/2024

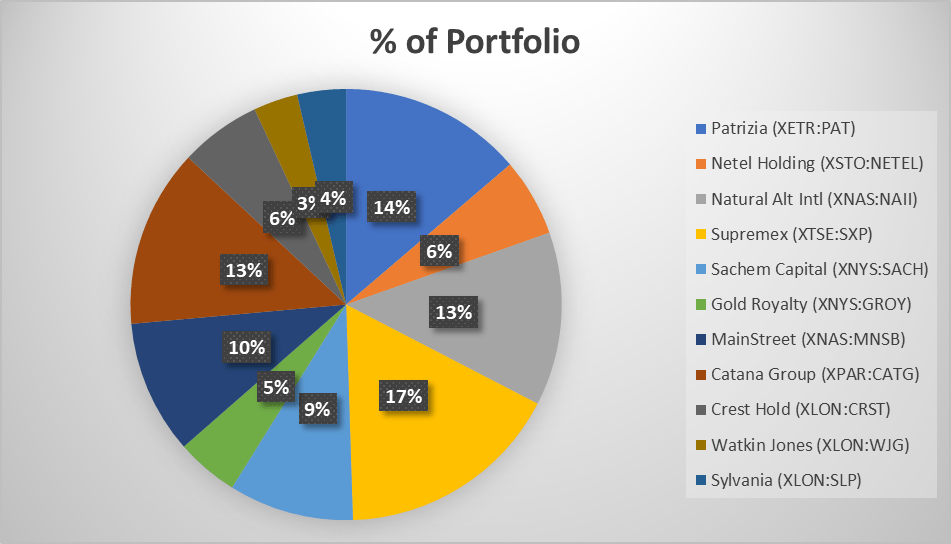

Portfolio at 01/09/2024

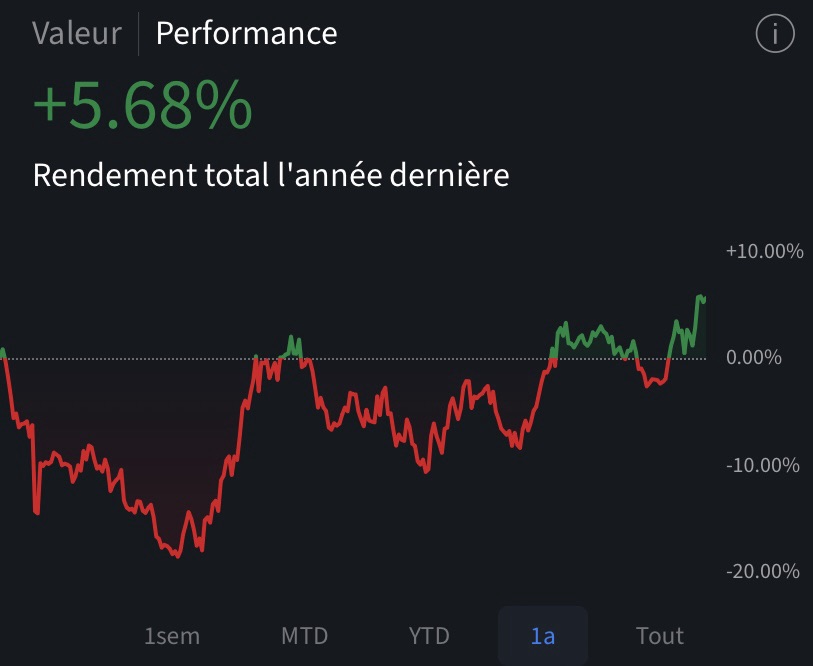

Returns & Some Thoughts

(Returns at 01/08/2024, Screenshot from Interactive Brokers)

I started my current portfolio with my current investment strategy of finding small undervalued stocks on August 1, 2023. It has been a wild ride since then. As soon as I began, my portfolio instantly dropped by 20%, then recovered, and crashed again. At the end of the first year, my performance shows a gain of 5.68%. While this isn’t great compared to the S&P 500’s 23.45% return in EUR during the same period, I think the stratification in the market is well known, and keeping up with Big Tech has been tough. This is beyond my control, and instead of making excuses, I aim to examine my portfolio, reflect on what I’ve done right or wrong, and learn from the experience.

Lastly, I want to reiterate that comparing my concentrated portfolio to the S&P 500 over a one-year period may not be entirely accurate. However, for the sake of intellectual honesty, I will do so nonetheless. Time will tell whether I am right or wrong, but regardless of the outcome, I enjoy investing. I like to spend time reading and researching companies to invest in. Now, let’s take a look at my positions.

Supremex (XTSE:SXP) : Circa 17% of my Portfolio, Cost Basis: 4.23 CAD

Supremex is an envelope and packaging manufacturer with operations in Canada and the US. In the Canadian envelope market, they hold a monopoly with a very large market share, while in the US envelope market, they are the second-largest player by market share. The envelope market is in secular decline, so they offset the long-term loss of sales volume by acquiring small competitors and consolidating the market. Cash flow from the mature envelope business is reinvested into the packaging operation. Packaging, driven by significant tailwinds like e-commerce, is a fragmented market that the company can also consolidate. Supremex has been using proceeds from its cash-flowing envelope business to conduct mergers and acquisitions in the packaging sector, primarily in Canada and in the US near the Canadian border.

As of now, the state of the business is as follows: The company has been weak since Q2 2023, mainly due to low volumes and some inefficiencies related to acquisitions. Q1 2024 was as expected. Margins recovered somewhat from the lows of Q4 2023, but the packaging segment has still underperformed significantly. This underperformance is largely because the recovery, especially in discretionary items, has been slower than expected, leading to subdued volumes. Recently, the company announced optimization measures for its envelope activities and a restructuring of the underperforming packaging segment. These measures are expected to enhance margins in the foreseeable future.

Despite short-term headwinds, I believe the company represents very good value and could potentially be worth 2-3 times its current market value. The company can reasonably expect to generate 20-30 million CAD in normalized free cash flow per year, with a market cap of 100 million CAD and only 80 million CAD in net debt. I think the company has a promising future, but patience will be required.

Patrizia (XETR:PAT), Circa 14% of my Portfolio, Cost Basis: 8.13 EUR

I have written extensively about Patrizia, a real estate-focused asset manager based in Germany, where around 50% of its client base resides. As is widely known, particularly among those familiar with European markets, Germany has lagged behind since the energy crisis. When I initially invested, I did so under the premise that interest rate cuts would eventually occur, leading to a recovery in the European—and by extension, the German—real estate markets. Unfortunately, this has not been the case yet. Germany has not recovered; in fact, its economy contracted in Q2 2024, and any signs of recovery seem distant. The silver lining is that interest rates may soon be reduced, which would provide a much-needed boost to European real estate markets. I still believe Germany will recover eventually, but I am aware that the ECB will likely be cautious with rate cuts, especially given its close watch on the Fed.

From a business perspective, not much has happened. The company recently published its H1 2024 results, which were disappointing but not unexpected. It has barely bought back any shares, but it does offer a solid dividend while we wait for the market cycle to turn.

Interestingly, the company released a plan to become a €100 billion asset manager by 2030, alongside a new organizational structure. Honestly, this announcement holds little substance. They’ve outlined a focus on five key areas: “Living, Value-add Strategies, Re-Infra & Smart City Solutions, European Infrastructure, and its Independent Advantage Investment Partners (fund of funds) platform.” While there isn’t much concrete information, the mere intention of management to grow the company is encouraging.

Now, let’s move on to the valuation. This is a cyclical business. However, the company has a very solid business model, and I believe that if management were more competent in capital allocation, the company would be worth multiples of its current price. While asset management—particularly with a retail client base—isn’t as great a business as it might seem due to its pro-cyclical nature (clients withdraw money when they should be investing and vice-versa), large asset managers focused on institutional clients are a different story. Patrizia’s clients are all institutional, with capital often tied up for years or even decades, making it a top-tier business.

The challenge with Patrizia is that a portion of its revenue came from performance and transaction fees, which have since dried up. Despite this, the company’s core business remains solid, continuing to generate significant income through recurring management fees.

For valuation, I’ll base my approach on reproduction costs, even though it might not entirely capture the company’s potential. If I were to value it based on normalized earnings, I’d end up with an unrealistically high target price—at least for now. I estimate the reproduction cost of its assets to be around €1.4 billion, which corresponds to approximately 1.1x book value. Historically, the company has often traded at around 2x book value, which is 3.5 times its current market price. The valuation is indeed absurdly low for a company that is unlikely to face bankruptcy, especially given its minimal net debt.

Catana Group (XPAR:CATG), Circa 13.5% of my Portfolio, Cost Basis: 4.86 EUR

This is a company I’ve labeled as “too good to be true.” It’s currently trading at around 4.5x EV/EBIT and has consistently delivered a ROIC in the mid-20s. I won’t delve too deeply into the business dynamics here, as I’ve covered them extensively in the past, but it’s clear they have years of growth ahead. The current multiple is simply too generous for a company of this quality.

The company is now focused on broadening its product portfolio, expanding into motorboats, larger catamarans, and more. They are also working to modernize their existing products. Their new YOT brand is expected to start impacting financials from the end of 2024 onwards.

Another notable development is the company’s strategic shift in its client base. They are reducing exposure to large boat rental companies, likely due to margin pressures from these clients. Instead, they are now targeting smaller and medium-sized rental companies, which make up about 70% of the total market.

Given these factors, I believe the company is worth around €12 per share.

Natural Alternatives International(XNAS:NAII), Circa 13% of my Portfolio, Cost Basis: 6.39 USD

This is an asset play, and while I’ve discussed it before, I want to emphasize that it’s not a great business and is highly cyclical. NAII manufactures products for the health and fitness industry as a subcontractor. The company has a very concentrated customer base, and despite efforts to diversify, these have largely been in vain. During the pandemic, which was a peak cycle for fitness products, NAII overinvested, resulting in a state-of-the-art but unutilized new factory for several months.

Fortunately, the new Carlsbad factory is now back in production, and the company expects to turn a profit in Q1 2025 (with the next reporting quarter being Q4&FY2024). This development is likely to surprise the market, as the company is currently priced as if it were headed for liquidation.

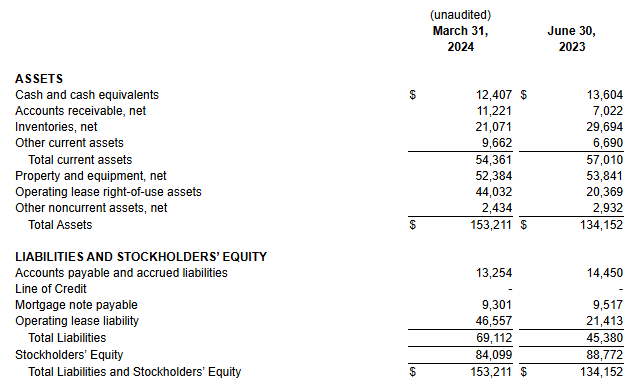

Given that a company’s strength is often reflected in its balance sheet, here is NAII’s balance sheet as of Q3 2024:

The company maintains a net cash position, though it does have a significant number of operating leases. These leases are tied to its factories, but since they are operating leases rather than finance leases, I wouldn’t consider them as debt—they are cancellable. The Property & Equipment line on the balance sheet consists of building improvements, machinery, and leasehold improvements, some of which have been partially reimbursed by the lessor. Overall, this results in a very solid balance sheet.

Given this strong financial position, my target price for the company is around $13.

MainStreet Bancshares(XNAS:MNSB), Circa 10% of my Portfolio, Cost Basis: 17.85 USD

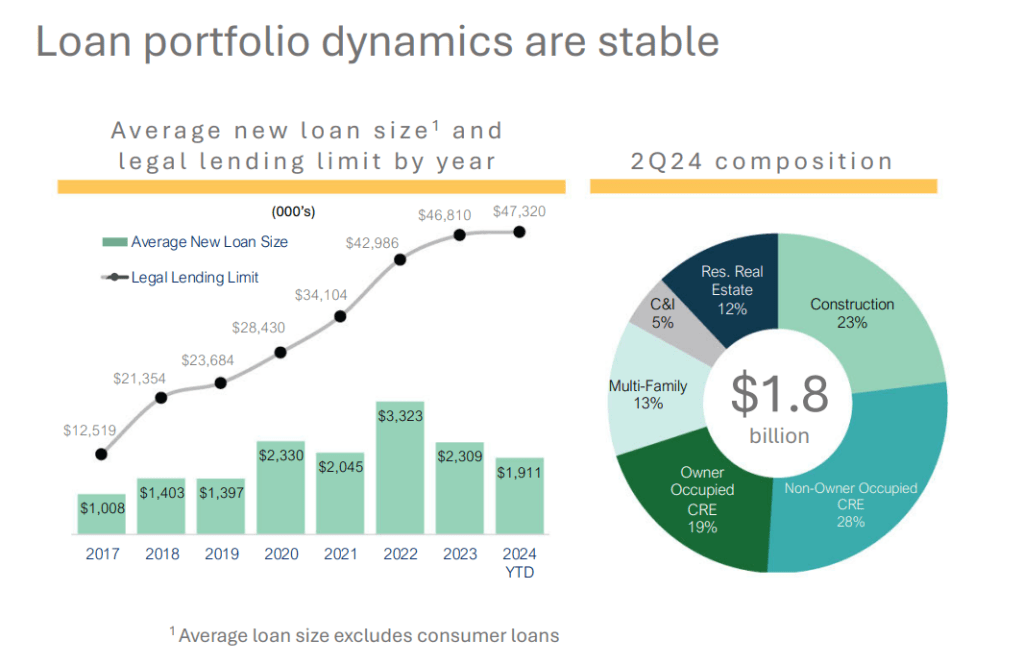

A solid community bank, currently trading at 0.6x its Book Value, presents an attractive investment opportunity with Return on Equity (ROE) in line with the industry average. Since 2016, the bank has demonstrated robust growth, increasing deposits per share by 10.3% and book value per share by 11.2%. The bank is financially strong, with 78% of its deposits categorized as core, providing a stable funding base.

Positioned in the dynamic Washington D.C. area, the bank is well-placed for future growth. A key growth catalyst is the imminent launch of its Banking-as-a-Service (BaaS) branch aimed at FinTech companies. Washington D.C. is home to a significant number of medium to large FinTech firms, making this a strategic move. After 15 quarters of development, the launch, initially delayed to Q3 2024 due to regulatory challenges, is now on track. The bank already has 7 FinTech clients onboard, with 5 more in the pipeline. Projections estimate that the BaaS branch will generate $200 million in Demand Deposit Accounts (DDAs) in its first year, scaling up to $1 billion by year five. This initiative is expected to significantly enhance the bank’s earnings, with minimal additional costs, estimated at $3-4 million, thereby boosting the bottom line.

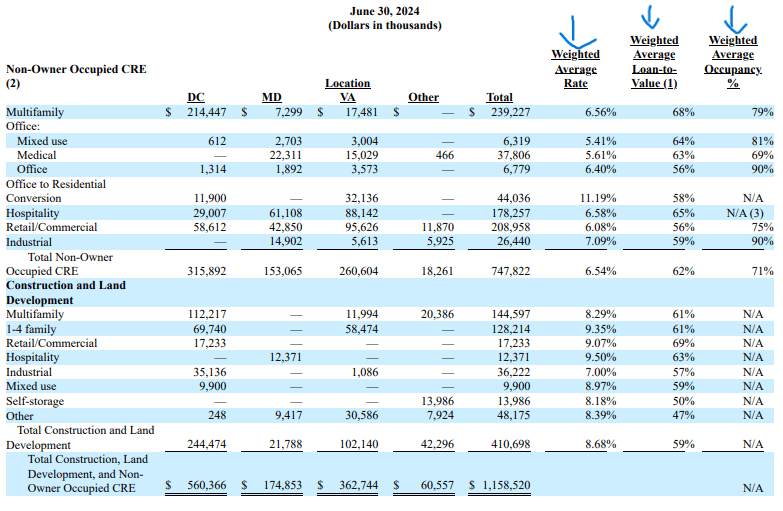

The bank’s loan portfolio is moderately aggressive. While 50% of the portfolio is conservative, the remaining portion includes higher-risk loans such as Construction and Non-Owner Occupied Commercial Real Estate (CRE). However, the bank mitigates this risk by charging appropriately higher interest rates, balancing the potential risks with returns.

If you’re still concerned about the more speculative portion of the portfolio, consider the interest rates charged (especially on construction loans), the low Loan-to-Value (LTV) ratios that provide a cushion in the event of a property price decline, and the generally robust occupancy levels.

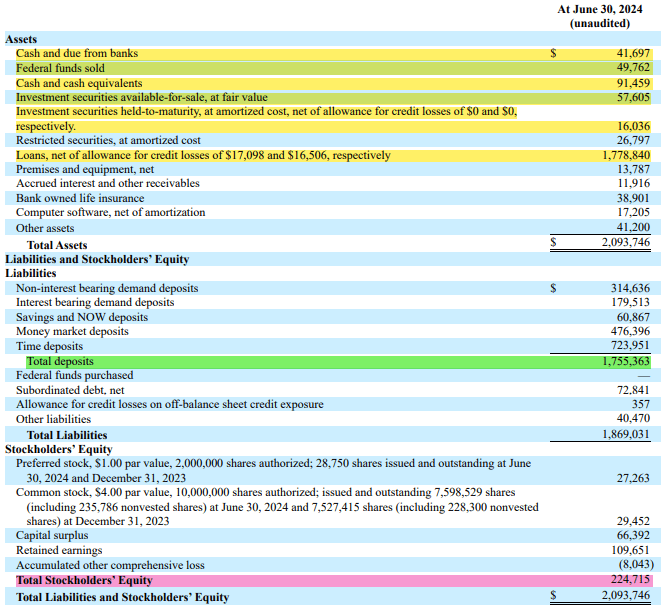

Now, turning to the balance sheet:

As you can see, the company holds cash and highly liquid, safe securities valued at approximately $256.6 million, nearly double its current market capitalization. Loans and deposits are nearly balanced, and the company has limited debt. While no bank is immune to a bank run, this one is very well-capitalized.

With potential rate cuts on the horizon, a loan portfolio primarily consisting of high fixed-rate loans (at least for the coming months or year), and the Avenu catalyst, I estimate the bank to be worth around $35 per share.

UK Construction Basket: Weighted 60% Crest Nicholson (XLON:CRST AND 40% Watkin Jones (XLON:WJG), Circa 10% of my Portfolio, Cost Basis: 2.32GBP CRST, 0.36GBP WJG

I have previously written about Crest Nicholson and the state of the UK Real Estate and Construction Market. Since then, the Bank of England has cut rates by 25 basis points, bringing them to 5%. Despite this cut, monetary policy remains restrictive, given that UK inflation is hovering around 2%. I anticipate further rate cuts, as economic activity continues to be subdued. The construction sector is particularly sluggish, with output in negative territory. Mortgage rates are at decade highs, making it nearly impossible for first-time buyers to enter the market and for existing homeowners to move. As a result, the market has dried up. Additionally, legacy construction projects are becoming loss-making due to construction material inflation, creating a perfect storm for the industry.

However, there are a few positive catalysts that suggest the situation might improve. First, further rate cuts are likely. Second, the new government under Keir Starmer has expressed a desire to simplify the permitting process to boost immediate housing supply and aims to build 1.5 million new homes over the next five years. This initiative, which seeks to revive the 300,000 annual new housing construction plan that has previously underperformed, could be highly beneficial for Crest Nicholson as a major housebuilder.

Crest Nicholson’s reproduction value is quite high. It is nearly impossible to enter the UK construction industry today and with the level of capitalization that the major players have. This gives them a structural advantage. The company’s free cash flow is also fairly steady, particularly in the years following significant inventory buildups, like the one currently in progress (with working capital release in subsequent years). Considering these factors, I estimate Crest Nicholson to be worth approximately £4.50 per share.

Recently, I’ve come across a niche player in the UK construction industry: Watkin Jones. The company operates in three segments: Purpose-Built Student Accommodation (PBSA), Build-to-Rent, and Accommodation Management under its brand Fresh.

PBSA is (apparently) a growing market. There’s a common perception that Brexit has negatively impacted this subsector due to difficulties in obtaining student visas and the high cost of living in the UK, which has led to a reduction in European students. However, European students only made up a small percentage of the total student population in the UK, and overall student numbers continue to grow. I say “apparently” because the company’s sales in this segment have declined by over 40% since 2018, and no clear explanation has been provided for this. It’s possible that PBSA is not currently a priority for Watkin Jones, but such a prolonged decline is unusual, to say the least. This segment has become relatively small due to a combination of margin compression and a decline in revenue. On the other hand, the Build-to-Rent segment has performed very well, thriving particularly in an environment where homebuyer affordability is low, forcing more people to rent. I expect this segment to continue performing well despite the short-term headwinds, such as legacy sites being nearly loss-making.

Accommodation Management, however, is the jewel of the crown. It has been growing significantly and now accounts for around 15% of Gross Profit, despite representing only 2% of Revenues (yes, gross profit is currently at cyclical lows, but you get the point). This business is very stable and high-margin.

As for valuation, in a normalized environment, the company can easily generate £25 million in free cash flow (FCF), translating to a 30% normalized FCF yield. The company has net debt of about £20 million when including lease liabilities. Unlike Crest Nicholson, Watkin Jones pre-sells its properties, eliminating the need for significant working capital. The past couple of years have been exceptional, with the company needing to deploy working capital upfront due to some construction partners going bust, forcing them to complete the projects themselves. Conservatively, I would value the company at £0.80 per share.

Precious Metals Basket: Weighted 50% Sylvania Platinum (XLON:SLP AND 50% Gold Royalty (XNYS:GROY), Circa 10% of my Portfolio, Cost Basis: 0.55GBP SLP, 1.39USD GROY

I won’t make the case for investing in precious metals, as it’s a well-documented topic with experts far more knowledgeable than I am specializing in it. However, I wouldn’t currently consider Platinum Group Metals (PGMs) as precious metals in the same way I view gold. Gold is renowned for its investment properties and the belief that it represents “real money,” while PGMs, though also used for investment, are primarily industrial metals. Both are relatively rare, but their uses differ significantly.

My first holding is Sylvania Platinum. I’ve written extensively about this stock, so I won’t go into much detail here. In my article on PGMs, I argued that PGMs are at cyclical lows, that Battery Electric Vehicle (BEV) growth is slowing, and that Internal Combustion Engine (ICE) vehicles and hybrids will likely remain prevalent longer than expected. More or less stable demand combined with declining supply should eventually drive prices up, although the timing is uncertain. Sylvania is the lowest-cost producer in the industry, and it remains profitable even at current prices. I suggested that even at these prices, the company offers a 10-12% yield through free cash flow and buybacks. They are also increasing production with the Thaba JV and recently updated their assessment of the Volspruit project. If PGM basket prices rise to more reasonable levels, I believe the stock could double or triple in value.

Gold Royalty Corp is another company I hold, which owns royalty claims on promising projects primarily located in Tier 1 mining jurisdictions. While management may be mediocre, near-term catalysts and an increase in Gold Equivalent Ounces (GEOs) should drive a re-rating of its current 0.5x P/NAV valuation. I’ve also written extensively about this stock.

Although I’m not a commodity specialist, I believe PGMs represent a straightforward bet, with the rate of return largely depending on how long it takes for a supply shock to occur. Regarding Gold Royalty, I’m seeking exposure to gold and hoping the company will deliver. I’ll be closely watching the next few quarters to see if the catalysts materialize.

Movements in my Portfolio

If you look back at my last portfolio update from the beginning of 2024, you will notice significant changes. First, I sold a large portion of my Netel position. It had substantial gains, and I still keep a bit because I believe the company still has some upside. Then, I sold my entire positions in CPI Card Group at an 80% gain, Valhi at a 100% gain, and Sachem Capital at a 30% loss. CPI Card Group and Valhi experienced significant price appreciation, and I felt the upside was limited, with better opportunities available to deploy the capital. As for Sachem, I still find the company’s prospects interesting, but I’m not willing to fight the market, especially when, first, I have other compelling opportunities available, and second, I’m not very comfortable with the debt repayment schedule and the actions management is taking.

Final Thoughts

I still have some maintenance to do in my portfolio, but overall, I am happy and confident about the near-term prospects of the companies I own. I have made significant progress as an investor over the last year, even if the performance numbers do not reflect it yet.

Gonçalo