Gold & the Royalty Business

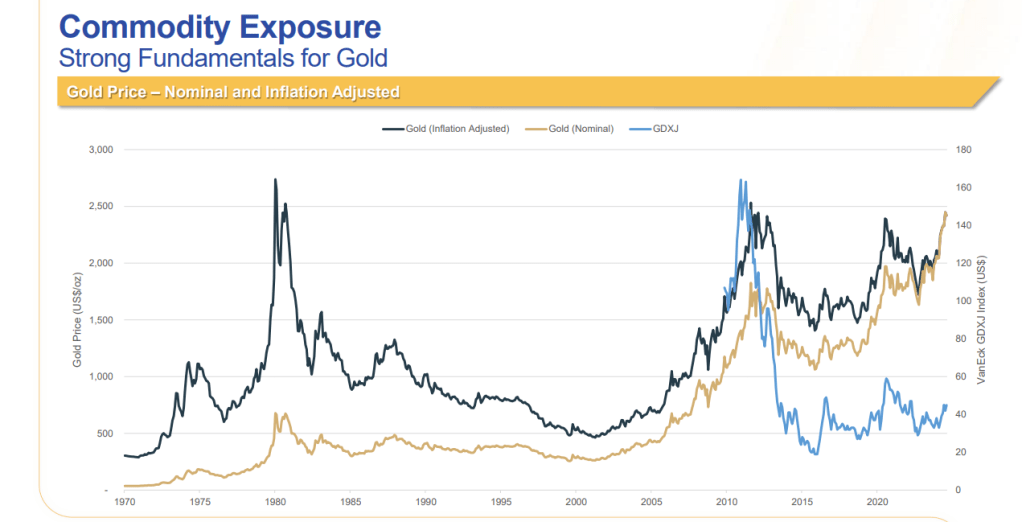

Gold has been an asset of interest to me for quite some time due to its intricacies as an inflation hedge and the protection it offers against the systematic devaluation of fiat currencies. Monetary expansion, particularly the QE programs implemented by central banks in Western economies after 2008, has significantly eroded purchasing power over time. Gold, along with equities for those fortunate enough to save and invest, has served as a hedge against this phenomenon. Since the abolition of the gold standard in 1971, Gold has been a one-way trade. Despite this, gold equities remain far from their all-time highs, even as the price of Gold continues to rise, presenting an interesting investment opportunity. I won’t delve deeply into the fundamentals of Gold (such as supply and demand), as they are already well-documented by people far more knowledgeable than I am.

When seeking exposure to Gold (or any other commodity), you have several options. You can purchase the physical commodity, invest in companies that explore, develop, or mine it, or buy shares in companies that hold royalties or streams over that commodity. Over the long run, royalty companies tend to outperform the other options by a significant margin, for several reasons.

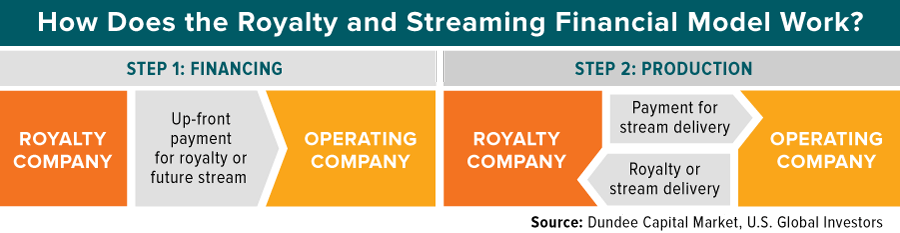

But first, what is a royalty contract? A royalty is a payment made to a royalty holder, typically based on a percentage of the minerals produced or the revenues or profits generated from the underlying project. This arrangement is beneficial for both the operating company and the royalty company. The operating company sells a perpetual right to a pre-defined percentage of its production in exchange for the financing it needs to start or expand operations. The royalty company, in turn, secures a claim on the production, allowing it to generate cash flows.

Why, then, are royalty companies better investments than miners? First, royalty companies don’t incur any operating costs from production, yet they are equally leveraged to the price of the commodity. Second, royalty companies are generally less risky because they are diversified across a broad range of projects—whether in exploration, development, or production. Lastly, and most importantly in my view, is the exploration upside on existing properties. This is what the industry commonly refers to as “optionality.” Since the royalty interest is already paid for, any additional contributions from exploration directly enhance cash flows.

Gold Royalty Corp.: Company History, Track Record & Management

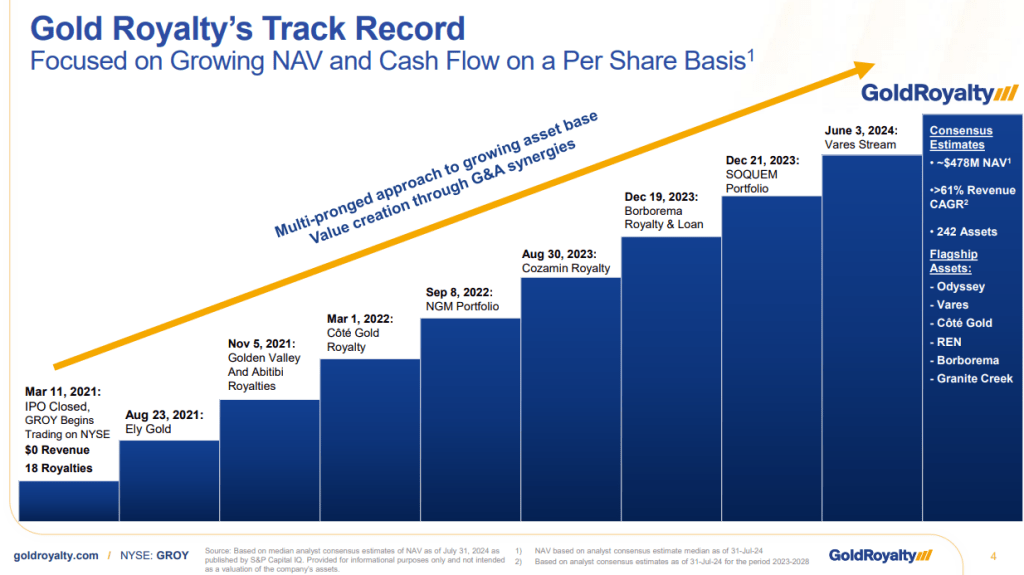

Gold Royalty Corp. was spun off from GoldMining Inc. in March 2021. At the time of its IPO, the company had no revenues and 18 royalties. The IPO was priced excessively, but the timing was impeccable, as 2021 was one of the hottest IPO markets in recent history. With its inflated stock price, which the company used as currency for M&A, Gold Royalty Corp. acquired Ely Gold (a prominent competitor), Golden Valley, and Abitibi Royalties. These acquisitions would have been impossible without the stock’s absurdly high valuation, driven by irrational exuberance.

In 2022, after the stock had already dropped significantly, they acquired the NGM Portfolio for $27 million in shares. In the same year, the company also acquired the Coté Gold Royalty, which has since become one of its most valuable assets.

In August 2023, the company acquired the Cozamin Royalty for $7.5 million in cash. Then, in December, they purchased the Borborema Royalty for a cash consideration of $21 million and provided the operating company with a $10 million loan. Also in December, they bought the SOQUEM Portfolio for $1 million in shares. Finally, in May 2024, they acquired the Vares Copper Stream for $45 million in cash and $5 million in shares. This last acquisition appears to have worried the market, as the stock has declined by over 30% since the announcement.

What I appreciate about their M&A strategy is their aggressive use of dilution when the stock price was extremely high, and their progressive reduction of dilution as the price declined, using cash and debt to finance their most recent acquisitions.

Here’s what the company’s balance sheet looks like:

To me, four key questions stand out for someone who hasn’t delved deeply into the company. I have highlighted them below.

First, what is a gold-linked loan? During the acquisition of the Borborema Royalty, the company provided Borborema with a $10 million loan maturing in 2030, bearing interest at 110 ounces of gold per quarter. The loan can be converted to a 0.5% NSR (Net Smelter Return) at maturity if Gold Royalty deems that the exploration potential of the Borborema asset (which we’ll discuss later) has been realized. This was a savvy move, as the gold price has risen significantly since December 2023. At today’s spot price of $2,500 per ounce, this loan will generate $1.1 million in interest annually, which equates to an 11% interest rate.

Second, the company has substantial debt for a royalty company. The Bank Loan is a revolving credit facility with the Bank of Montreal, providing up to $30 million, of which $25 million has been drawn. Interest rates are high. The convertible debenture is a private placement of $40 million in unsecured convertible debentures, so it is not purely a debt instrument. It bears a 10% interest rate, with interest payable in 70% cash and 30% shares. The debentures are redeemable at $1.75 per share and convertible at $1.90 per share. The maturities are 2025 for the bank loan and 2028 for the convertible debentures. While the company is somewhat leveraged, I believe the debt level is manageable for such a stable business.

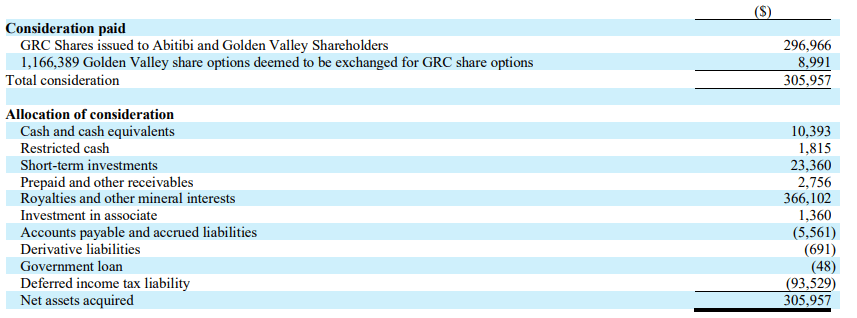

Finally, the company has a substantial deferred income tax liability. This is not an actual cash liability. It arises because the company executed bargain price acquisitions for Ely Gold, Golden Valley, and Abitibi. The company paid a total consideration of $305 million for these three companies, while the identifiable book value was around $400 million, necessitating the recording of a future tax liability on this unrealized “gain.” This is similar to recording goodwill as an asset when paying above book value for a company. While the balance sheet must balance, the deferred income tax liability will reverse over time as underlying assets are depreciated, amortized, or disposed of. This deferred income tax liability does not necessarily result in an actual outflow of cash.

The company’s management is experienced. Its CEO, David Garofalo, previously served as CEO of Goldcorp Inc. until its sale to Newmont and has also been CEO of Hudbay and CFO of Agnico Eagle. The rest of the management team also has extensive experience in the mining industry.

The economics of the royalty business are also very appealing. The company employs only eight full-time staff, and according to the CEO in an interview, the same team could manage a business ten times the size of Gold Royalty. This means that now that breakeven has nearly been reached, incremental revenue will flow directly to the bottom line. The company expects to be free cash flow positive by the end of FY2024 or early FY2025, which represents another near-term catalyst.

The shareholder base consists of insiders owning 4-5% of the company and sophisticated investors holding a significant portion. The free float is around 70%.

Key Assets

Before discussing key assets and NPV, I would like to note that I discount cash flows from producing assets at 9% and those from non-producing near-term development assets at 20%, with gold at current spot price. This might seem high to some, but I prefer to take a conservative approach. For exploration-stage royalties, I value them at cost, as attempting to assign an NPV to such uncertain assets would be disingenuous.

1. Odyssey Mine

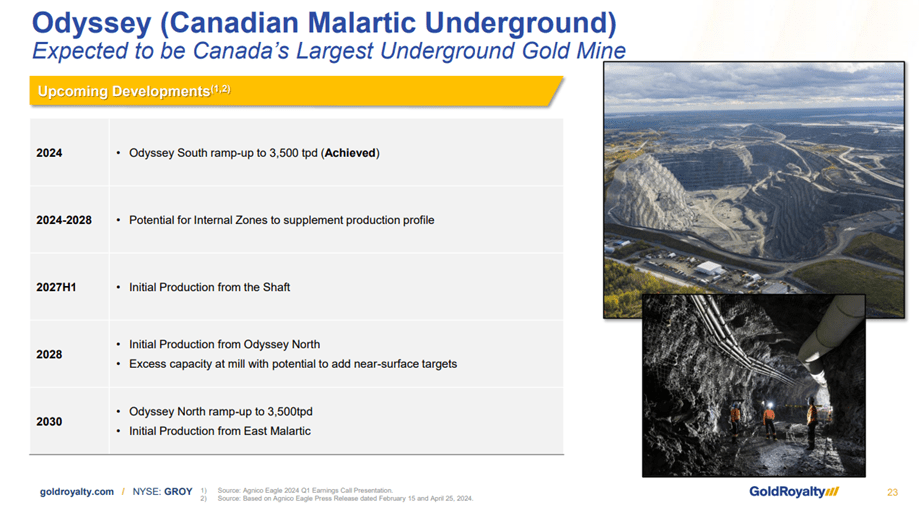

The Odyssey Mine is the underground extension of the Canadian Malartic Mine, which is the second-largest gold mine in Canada. Currently, the Odyssey Mine is producing around 50,000 ounces of gold annually. However, the mine plan envisions production of 500,000 to 600,000 ounces of gold per year until 2039 once fully ramped up. There is significant potential for additional upside, as the current mine plan incorporates only 57% of the existing reserves. As Rick Rule has noted, large projects often bring pleasant surprises.

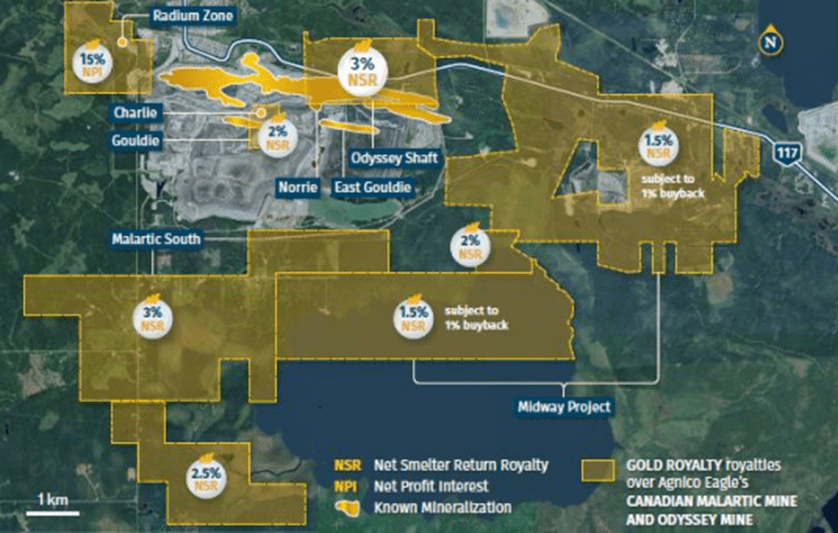

The company holds significant interests in the Odyssey North, Odyssey South, Internal Zones, and East Malartic deposits. Additionally, it has substantial royalties surrounding the Canadian Malartic complex. The Internal Zones represent the most significant catalyst, driven by strong exploration results and the potential for further resource base expansion. Production at East Malartic is expected to commence in 2030, while production at Odyssey North is scheduled to begin in 2028.

My NPV estimate for this royalty is approximately $100 million, assuming the operator meets its production targets. This is an exceptionally long-life mine, extending at least until 2042.

2. Vares Copper Stream

This royalty is often overlooked, possibly due to the operator, Adriatic Metals, being less well-known and Bosnia-Herzegovina being considered an exotic jurisdiction. The company holds a 100% royalty on the copper stream from the Vares Project, a polymetallic mine primarily focused on silver and with very low AISC (All-In Sustaining Costs). The project achieved its first concentrate sales earlier this year, with commercial production expected to begin in Q4 2024. The mine has a long life, with a minimum of 18 years, and there is potential for extension as a large portion of the property remains unexplored. The company will receive 30% of the copper spot price. This provides a favorable way to gain exposure to copper, a crucial metal for the green transition.

My NPV estimate for this royalty is approximately $50 million.

3. Coté Gold

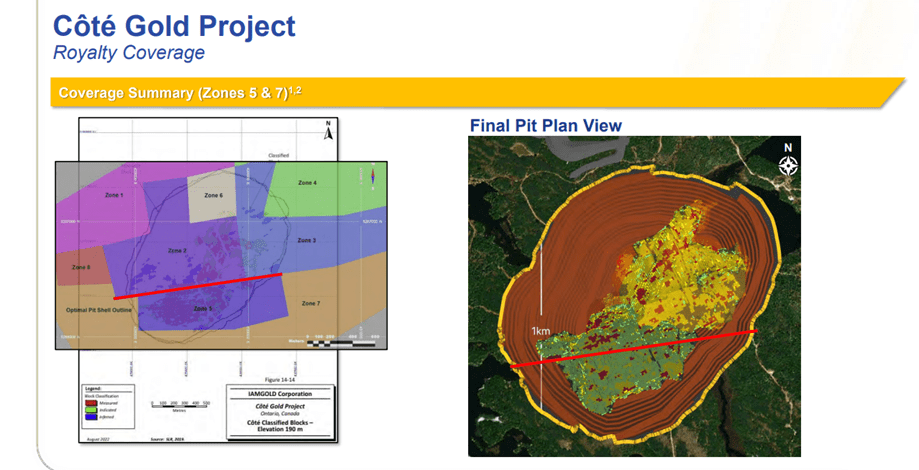

This mine is set to become the third-largest gold mine in Canada. Production for 2024 is projected to be around 220,000 ounces, with an average annual production of 365,000 ounces over its 18-year mine life. Once fully ramped up, it is expected to produce 500,000 ounces annually in the initial years. The ramp-up is anticipated to be completed by the end of 2024. The asset also has very significant exploration potential.

The company owns Zone 5 and Zone 7, with the red line marking the boundary of its royalty rights. In Phase 1 (the first 6 years), high-grade material will be mined within the company’s main royalty areas. This represents a significant catalyst for the coming years, as it will result in substantial cash flow for the company. In Phase 2, mining will expand to the north of the deposit, which will have less impact on the company’s royalties.

The optionality on this property is substantial. The red-colored area represents the measured reserves, and as you can see, there are still significant resources at depth that have yet to be drilled and potentially upgraded to reserves. This presents a major opportunity for further resource expansion and value creation.

My estimated NPV for this asset is approximately $40 million.

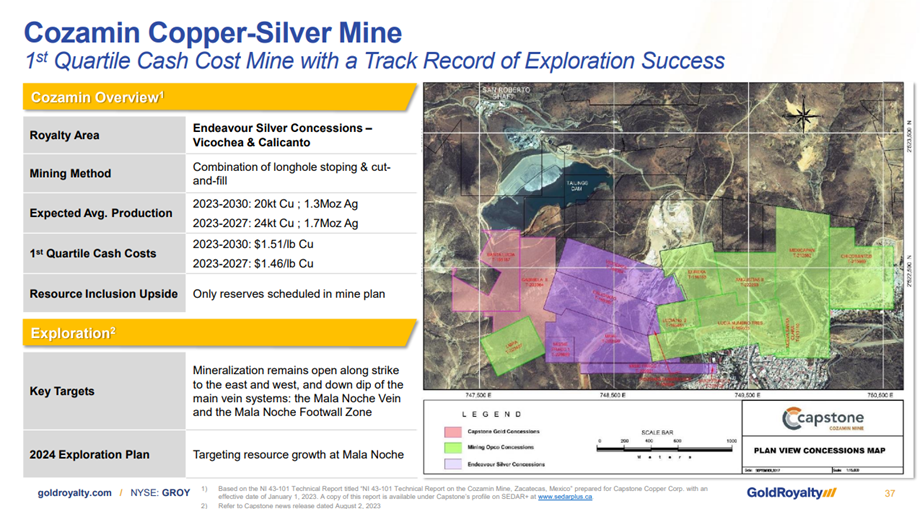

4. Cozamin

Cozamin is a copper-silver mine that was established in 2006 with an initial life of mine (LOM) of just 3 years. However, successful exploration has extended the LOM to 2030. This is a low-cost mine with high-grade underground deposits, which is particularly important as Mexico, where the mine is located, is considering a ban on open-pit mining. The value of this royalty lies in the mine’s excellent track record of exploration, consistently adding incremental resources. Currently, Cozamin produces around 1,000 gold equivalent ounces (GEO) annually for Gold Royalty.

I estimate the NPV for this royalty to be approximately $12 million.

5. Borborema

The Borborema Mine, located in Brazil, is a low-cost operation with an 11-year mine life and 812,000 ounces of gold reserves. A key hidden asset of this property is the planned relocation of a road, which would allow 1.265 million ounces of indicated resources to be converted into probable reserves. The company acquired Borborema for $21 million, along with an additional $10 million loan that matures in 10 years and can be converted into a 0.5% NSR if the exploration potential is realized.

I am concerned that the company may have overpaid for this royalty acquisition. My NPV estimate is around $10 million.

6. Ren Project

The Ren Project is an underground, high-grade gold deposit situated along the prominent Carlin Trend, where the largest gold mines in the U.S. are located. The Ren Project is essentially an extension of the Goldstrike deposit and is operated by Nevada Gold Mines, a joint venture between Barrick and Newmont. Ongoing drilling programs continue to expand the inferred resources. A pre-feasibility study (PFS) is expected in 2026, with commercial production anticipated shortly thereafter.

While it’s difficult to estimate the NPV for this project at this stage, it certainly represents a very interesting and promising opportunity.

Conclusions

I have highlighted some of the most interesting royalties the company holds, but there are additional assets worth exploring. I encourage you to conduct your own due diligence on the seven cash-flowing properties, the dozen in development, and the multiple exploration royalties.

This investment is a bit more speculative than I usually prefer, but it offers substantial downside protection as it trades at around 0.5x NAV. Although I am not a strong proponent of NAV as a valuation measure, I believe the near-term catalysts will support the company’s re-rating. I am particularly optimistic about the potential for positive free cash flow.

In my view, the company is likely worth at least double its current market capitalization.

Gonçalo