“Don’t look for the needle in the haystack. Just buy the haystack!” —John Bogle

Background & Description of the Business

Lately, I have been thinking about how to effectively and conservatively gain exposure to the expected wave of interest rate cuts in Western economies. Inflation seems to be easing, and real interest rates are dragging the economy down. This is evident in the Eurozone, which is struggling to regain economic growth, as well as in the UK.

Considering this, I found an interesting opportunity among UK housebuilders: Crest Nicholson. Crest Nicholson is a UK homebuilder with a straightforward operating model. They purchase undeveloped land plots in desirable locations, secure permits for construction, and then sell the newly built lots through various channels (in the open market and to government entities as part of affordable housing programs). This process can be carried out either individually or through joint ventures for very large-scale projects.

Peculiarities in the UK Real Estate Market

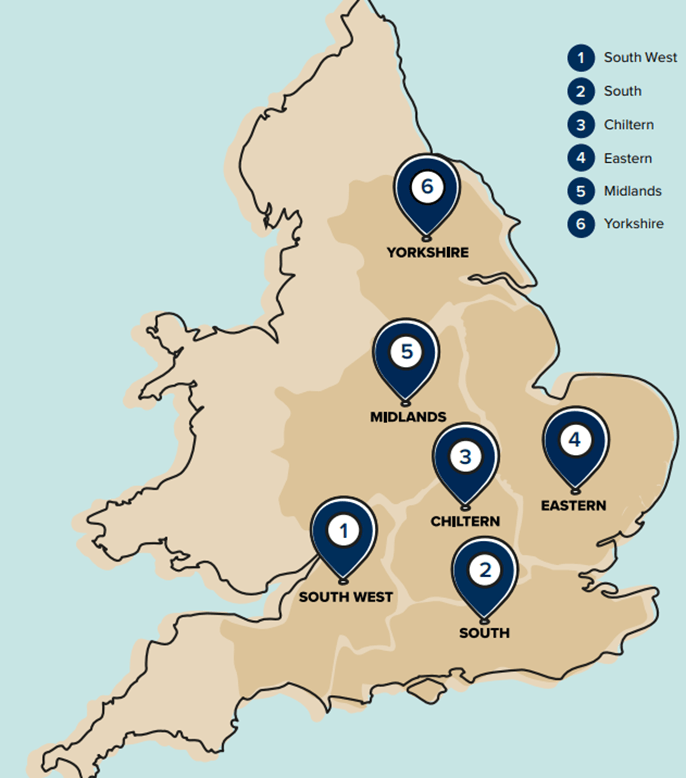

The UK market is very regionally focused. This is why Crest Nicholson operates specialized regional divisions, allowing each to concentrate its efforts on its respective market. Regulation varies from region to region, making a centralized approach impractical. The company operates in six divisions: The South West, the South, Chiltern, Eastern, Midland, and Yorkshire.

Formerly, the company concentrated its activities in the South, particularly in and around London. This changed around 2019/2020 when the company decided to exit some of its non-core assets that were losing money in London, even taking impairments due to this. The company announced it would shift its sales away from London, as it was no longer possible to acquire suitable land at reasonable prices.

It’s clear that in England, and the UK in general, London and the South East are the most dynamic regions. Nonetheless, they have also been the hardest hit by interest rate rises due to the high property valuations. The South West is well-connected to London but not very economically dynamic. The Midlands boast England’s second-largest city, Birmingham. Yorkshire is a promising division with good economic dynamism, relatively affordable land, and a regional financial center in Leeds.

This is a brief overview of the individual markets. While you can delve deeper into regional real estate markets, we will discuss the UK real estate market in general. The company’s regional diversification mitigates risk, which was not the case when it was heavily focused on the London market.

The big picture

In this section, we will delve into the state of the UK real estate market. Ignoring macroeconomic factors, which I call the “big picture,” is a deadly mistake for every investor. Investments should not be made solely in macro factors since they change frequently, but combining low valuation and macro catalysts is a very powerful return driver.

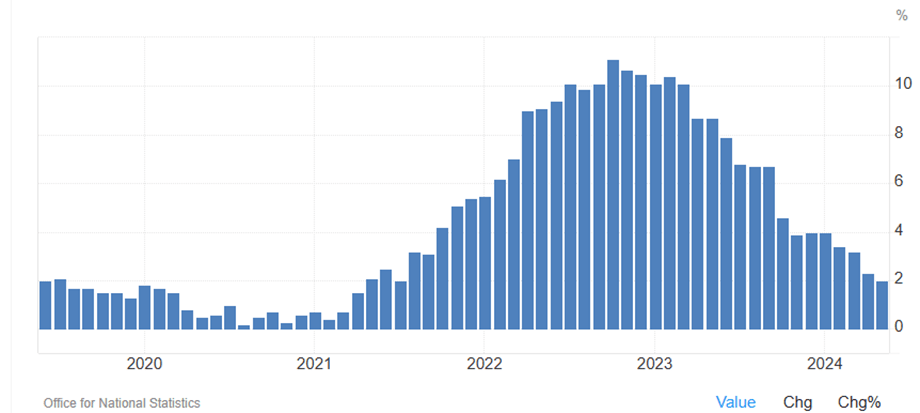

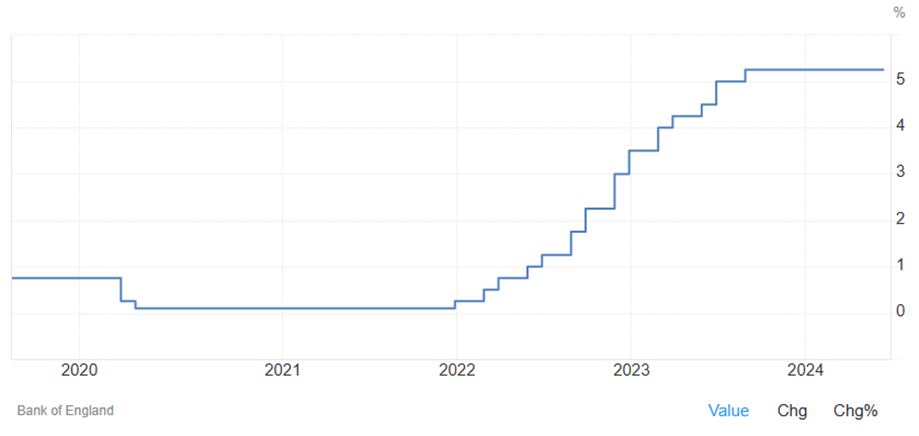

It’s important to note that the British economy and stability have been undermined since Brexit formally took place, with the pandemic exponentially exacerbating concerns and creating difficult trading conditions for UK economic agents. After the reopening of the economy in 2021, major supply chain shocks occurred, and inflation started to ramp up significantly in mid-2021. Everything was getting more expensive, and homebuilders were particularly affected by the rising prices of construction and building supplies. Initially, every Central Bank in advanced economies emphasized the “transitory” nature of what would soon become a persistent inflation wave. Consequently, Central Banks were late to respond and started hiking interest rates when inflation rates were already well above their long-term targets (5.5% CPI cs 2% Target in the UK). The Bank of England progressively hiked rates until August 2023, reaching the current 5.25%. Inflation, as measured by the Consumer Price Index, in the UK came down from a peak of 11% in October 2022 to around 2% as of April 2024.

Inflation YOY via Trading Economics

BOE Benchmark Interest Rate via Trading Economics

Additionally, Brexit and political instability have exacerbated these issues. This was illustrated by the Mini Budget turmoil (Trussenomics) in 2022, which triggered a systematic sell-off in the gilt market (UK bond market). Since then, 10-year Gilts have stabilized at around 4%.

Rate cuts are expected, and economic prospects don’t look very promising either. The UK experienced a modest recession in Q3 2023 but managed to return to growth in Q1 2024.

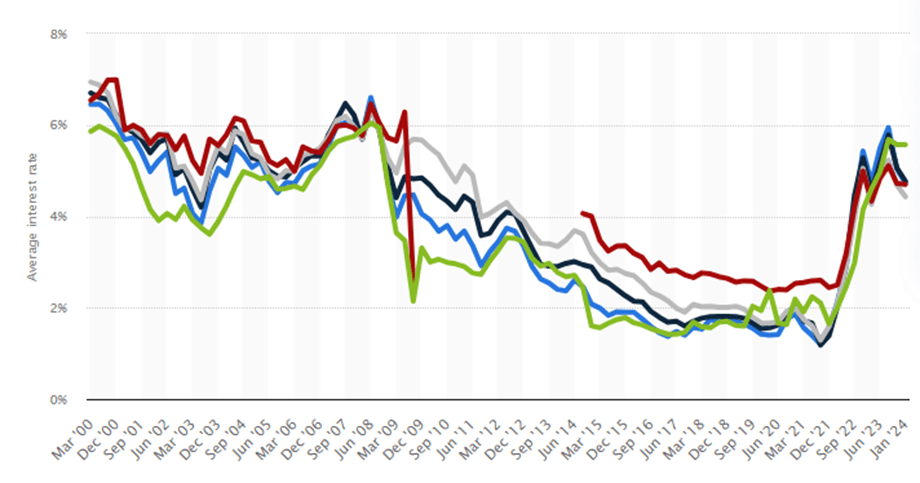

The good performance of the real estate industry relies on two factors: consumer confidence and mortgage affordability, i.e., low mortgage rates. The former remains subdued due to the political and economic environment in the UK. The latter is very low because high interest rates have made it almost impossible for people with low deposits to purchase a house.

Net mortgage approvals are lower than pre-pandemic levels, mortgage rates have skyrocketed, and housing affordability is very low.

Reasons to be optimistic

The UK remains, on a relative basis, an attractive part of the world to be in. Immigration will drive the real estate market in the future. Additionally, smaller households will require, if not more housing, at least a conversion of old housing stock into newly built apartments or houses. An interesting fact to bear in mind is that the UK has the oldest housing stock in Europe, with 38% of houses built before 1946. Transaction activity will eventually pick up. Real estate transactions are still subdued and construction orders have been down significantly in recent months, suggesting a weakening in order books for construction companies. Interest rate cuts might change this dynamic, especially because, once mortgage rates fall to more normal levels, housing affordability will increase in real terms.

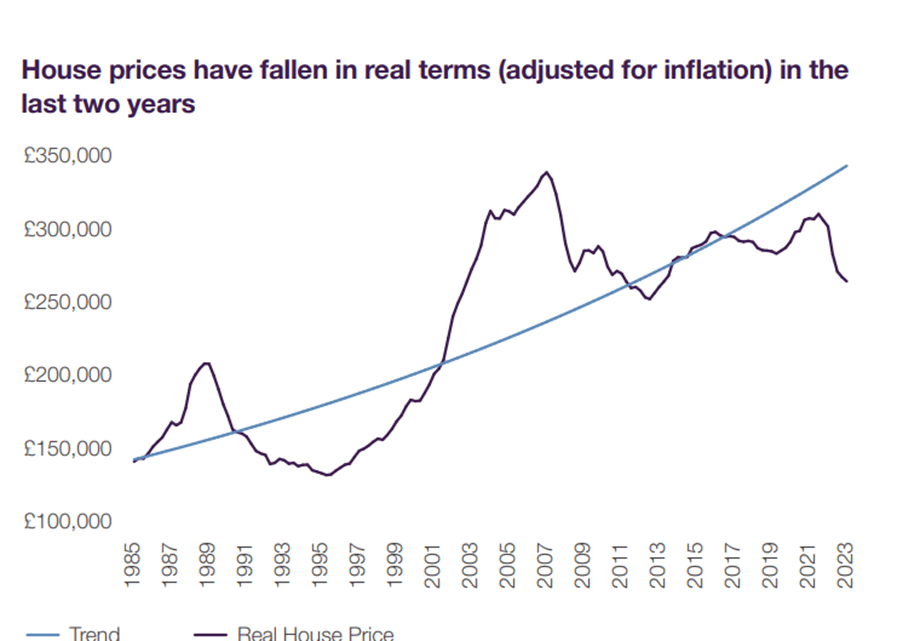

Housing prices in the UK have fallen in real terms, while wage growth has been strong. In nominal terms, the average housing selling price declined from the peak £291,293 in September 2022 to £284,691 in December 2023, a nominal decline of 2.3%. Adjusting for inflation using the CPI, this equates to a decline of almost 11%. Meanwhile, wages have increased. According to the Office for National Statistics, total average weekly earnings rose from £621 in September 2022 to £687 in April 2024, indicating a 10.6% increase in wages. Real wages (using the UK CPI as a deflator) have increased by about 2% in the same period. Therefore, housing has become, on a real basis, more affordable.

To close, the housing supply (or lack thereof) is also not indicative of a reversal in the tendency of houses to appreciate. The UK government had set a goal of building at least 300,000 homes per year, but this target was missed year after year. The Government’s long-term annual delivery target of 300,000 homes per year has only ever been achieved six times, all during the 1960s, when Government directly delivered around 40% of all new build homes.

Barriers to entry and Competitive Landscape in the UK Construction Industry

The UK construction industry benefits from significant and unusually sustainable barriers to entry, primarily due to the expertise required to navigate local authorities and the capital intensity involved.

The UK planning system is notably complex. Annual reports from UK homebuilders reveal their immense burden from regulatory requirements. Obtaining a permit involves providing local authorities with detailed studies on soil nutrients, water neutrality, recreational impact zones, air quality constraints, and more. Local authorities are often under-resourced and inefficient, making it difficult for small and regional housebuilders to cope with such bureaucracy. This has led to significant consolidation in the sector: there are only nine major homebuilders in the UK today, compared to 13 in 1988. The number of regional and small homebuilders has declined from 12,000 to 2,800. Consequently, future profits will inevitably accrue to the larger firms already established.

The capital intensity of the construction market presents another challenge for new entrants. Successful homebuilders need to invest significant capital upfront to acquire land and maintain a land pipeline for future profits, sometimes requiring working capital equivalent to a year’s revenue. New entrants would need to raise cash from investors or incur debt, the latter being particularly risky during low cycles. All public homebuilders maintain fortress balance sheets (most are in a net cash position). This is crucial because access to financing dries up during low cycles, which is precisely when land acquisition at good prices should occur. The need for a counter-cyclical investment process compels homebuilders to always have cash on hand and a robust capital structure.

The major public homebuilders include Taylor Wimpey, Persimmon, Bellway, Vistry Group, Berkeley, and Crest Nicholson. While they compete, they do so moderately to avoid driving down industry profits. The risk of disruption in the sector is very low.

A good opportunity in the UK Construction Market

As previously mentioned, Crest Nicholson is one of the major public UK homebuilders, with the capacity to build up to 3,250 homes per year. While they had set a target to expand capacity, this doesn’t appear to be a priority now. Currently, capacity utilization is low, with the company set to deliver 1,800-1,900 homes this year, representing at most a 58% utilization rate. Improved volumes should bring more operating leverage and better margins.

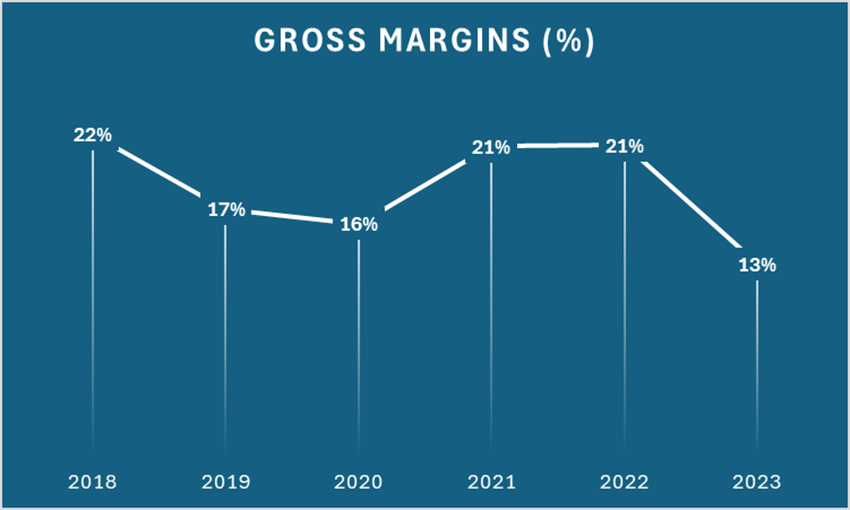

The company executed a turnaround in 2019, now complete, which focused on exiting complex projects and standardizing housing types to reduce operational inefficiencies and inconsistencies. This should enhance margins, which have been very volatile in recent years due to the significant surge in material costs, particularly for large projects with long completion times.

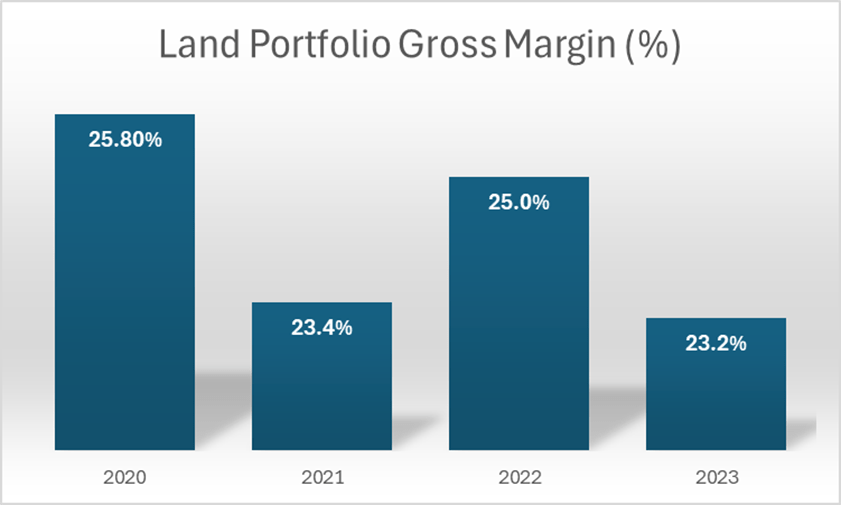

According to the recent half-year investor presentation, the share of the portfolio with low margins was reduced from 8% to 5%, and the sub-10% margin revenue is expected to halve by 2025. The company possesses sufficient land with advanced planning status into FY 2026 at stronger margins, indicating that margins might be at or near their bottom.

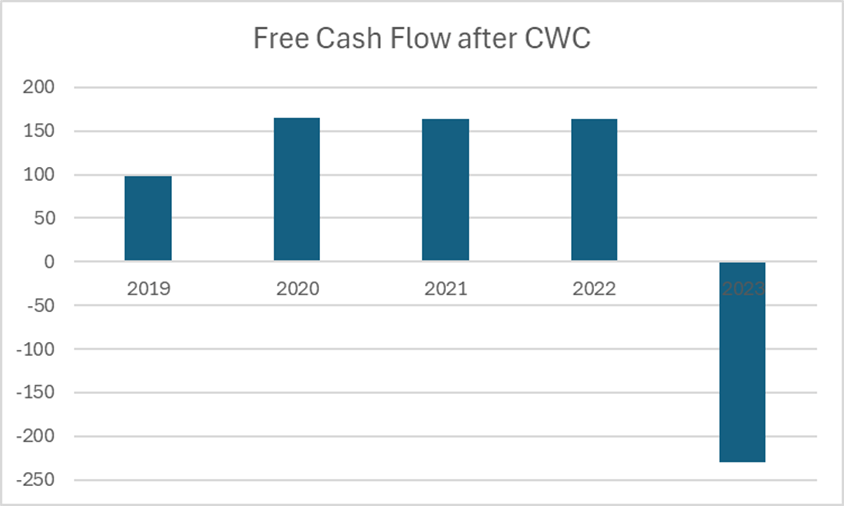

The company has stated it has a land pipeline sufficient until at least FY 2026, suggesting we may see some working capital release as a supplementary source of funds since the investment has already been made. Crest Nicholson makes almost no CapEx investments, as its investments are in the form of inventory (houses). Therefore, it is important to consider changes in working capital to avoid overstating free cash flow (FCF).

The company has generated healthy FCF after changes in working capital (CWC) over the years. The FCF is very negative in 2023 due to the working capital investments it has made. However, it is logical to expect that after this period of investment, the company will likely release working capital and enjoy improved cash flows.

The last important point I want to highlight is the fact that the company has a new CEO, Martyn Clark, who was previously the Chief Commercial Officer at Persimmon Homes. He will succeed Peter Truscott as the new CEO. In my opinion, Peter Truscott performed well during his tenure. He successfully executed the turnaround and leaves the company poised for its next growth phase. It will be interesting to see how Martyn Clark’s leadership influences the company’s direction and performance.

A sober Valuation and Risks

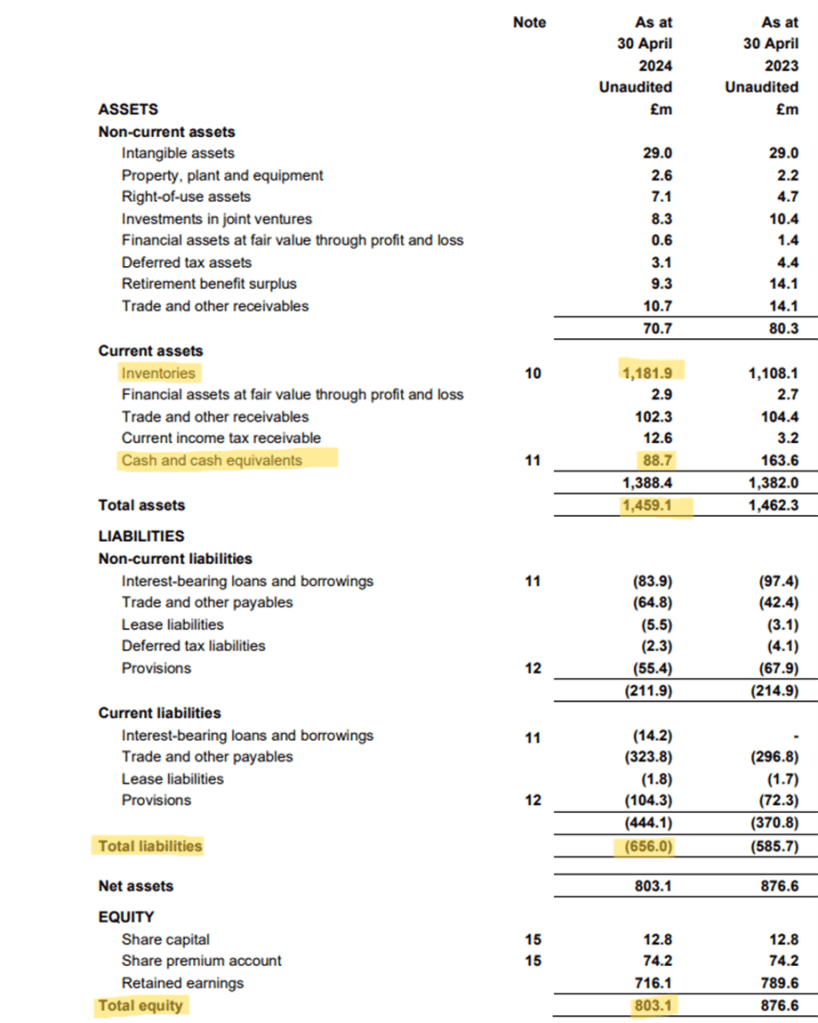

First, let’s start with a snapshot of the balance sheet:

The company has a Net Current Asset Value (NCAV) of £732.4million. The market cap as of today is £615 million, giving a P/NCAV of 0.84x. For reference, Bellway, the second cheapest competitor, is at 0.9x P/NCAV, which is a 17% premium. The other competitors are all above 1x (Taylor Wimpey 1.17x, Persimmon 1.46x). Therefore, the first thing to consider is that the P/NCAV should be at least 1. The market is discounting the company’s future earnings prospects. In other words, it is assumed that £1 inventory (valued at £1.181 billion) of land is worth approximately £0.52 today. A small discount to inventory might be understandable, but this is unrealistic. So, strictly on an asset basis, the company should be worth around £730 million, which is 19% above the current price.

Next, we can try to value it based on earnings, which is more logical because the business will not be liquidated. For illustration purposes, the median last 5-year FCF is £163.5 million (the average would be distorted by 2023’s massively negative FCF), which means the company is trading at 3.76x median 5-year trailing P/FCF. This is not very expensive, but I don’t expect those earnings to continue at that level.

In a conservative scenario, I would say that the company should deliver between 2,500-2,700 homes per year. Otherwise, it should downsize capacity (it does not make economic sense to have the capacity to deliver 3,250 homes when they are never delivered, as it drags on margins). The share of open market completions should be 75% of the total, at an average selling price of £367K (as disclosed by the company in H1 2024), and the share of affordable completions should be around 25% of the total, at an ASP of £180K. This would mean revenue between £800-865 million.

Onto gross margins. This is a very interesting but sensitive point, since margins vary. One thing I am almost sure of is that margins will bottom out soon. The company discloses forward gross margins on its land bank of 23.2% (2023 Annual Report), but I would not take this as a given. I think a 20%-22% gross margin is realistic to expect over the medium term. That would bring gross profit to a range of between £160-190 million.

SG&A will probably run at a rate of £55 million per annum. This would mean an EBIT target range of between £105-135 million. Net financial expenses (assuming a normalized net cash position) should run at £10 million per annum, and taxes are about 20% of net profits before tax. This should give a normalized net income of between £76-100 million. With a P/E ratio hovering around 8-10x, this would mean a valuation in a low scenario of between £608-760 million (76×8 and 76×10) and in a conservative base scenario of between £800-1000 million (100×8 and 100×10). I make no point of laying out very optimistic scenarios because you can reach any target price by making unrealistic assumptions.

For FCF, we need to consider CapEx, D&A, and working capital. CapEx and D&A run stable at £2 million and £2.5 million, respectively. Now is when the magic happens. The last time the company had such a large working capital position, it released that working capital over four years at a rate of approximately £53 million per year. Reduction of working capital means the company is cashing in on inventory, which should be added as a cash inflow to FCF. This should give a normalized FCF rate over the medium term between £129.5-153.5 million. This equates to a normalized free cash flow yield of between 21-25%. Make of it what you will.

What is the catch? Well, there is no catch. The company is surprisingly healthy given the valuation the market has assigned it. Tangible assets (what is more tangible than land) will protect your downside, and you likely won’t lose much money even if things go south. Note that Bellway plc, a competitor of the company, made a takeover offer at a price of 253 pence per share. The company rejected the offer because “it significantly undervalued Crest Nicholson and its future standalone prospects and was not in the best interests of Crest Nicholson’s shareholders.” So there you have it. What you need to watch, though, is the management’s tone and especially how margins evolve going forward, particularly gross margins. If gross margins do not improve over the next quarters, especially after the first few rate cuts, you should probably exit, but you will likely not have lost much money by then.

Gonçalo