Patrizia SE: Business model

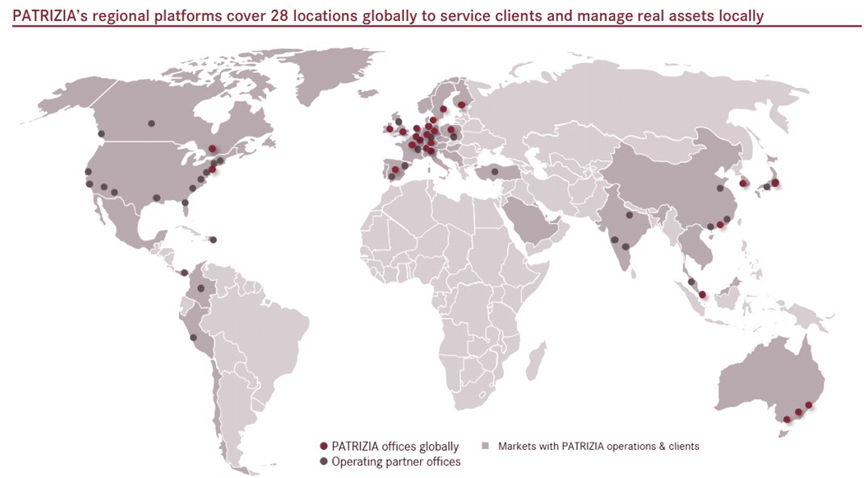

PATRIZIA is a prominent European independent real asset investment manager, employing 1,011 full-time equivalents (FTE) as of December 31, 2022, across 28 locations globally. The core focus of the company lies in real asset investment management, offering an extensive product portfolio that includes private and listed equity funds, private debt funds, and fund-of-fund products. These offerings are tailored to meet individual return expectations, diversification objectives, and risk preferences for over 500 institutional and 7,000 semi-professional or private investors.

In an endeavor to diversify its business model, the company is actively pursuing various acquisitions to broaden its product range and expand its investor base, a topic we will explore in more detail later. The product line encompasses all conceivable real estate assets, including office, residential, retail, logistics, and other alternative real estate investments.

In addition to charging various forms of fees based on Assets Under Management, Patrizia also utilizes its own capital in what it terms Co-Investments, a feature reflected on the balance sheet. Income generated from these investments is directly added or charged to the Profit and Loss statement under the “Income from participations” category.

The (Active) Asset Management Business

An Asset Manager is an entity responsible for managing funds on behalf of clients who delegate investment decisions, allowing them to concentrate on their core business or personal activities. Typically, asset managers levy management fees, which exhibit a highly recurring nature, in addition to transaction fees and, for active asset managers, potential performance fees.

Clients served by asset managers are generally either retail or institutional investors lacking the time or expertise needed to personally oversee their savings. The Asset Manager engages in understanding the client’s financial objectives and risk appetite, delivering customized financial products accordingly.

Asset Management represents a structural growth business, with funds regularly flowing into clients’ investment accounts. Clients often commit their capital for extended periods, and the industry lends itself to cross-selling, given that most clients subscribe to multiple products. Consequently, maintaining a reputable image is crucial in this sector.

While the business exhibits a recurring nature due to management fees being charged irrespective of market conditions, it is not impervious to economic fluctuations. Asset managers can significantly benefit from favorable asset price movements and volatility, generating income through transaction and performance fees.

The industry faces challenges from the rise of passive Index Funds, which exerts pressure on the overall fees that asset managers can charge. This trend has emerged from years of underperformance compared to ExchangeTraded Funds (ETFs), leading investors to favor the lower fees associated with passive investment strategies. This competitive landscape is expected to persist in the foreseeable future.

German Real Estate Market

Before delving into the analysis, it’s crucial to understand the structural distinctions between the German real estate (RE) market and other European RE markets. This variance is attributed to Germany’s federal economic structure, boasting numerous robust economic centers across its regions. Unlike the centralized nature of the European real estate market, particularly for offices, where concentration is primarily in the capital and one or two additional cities, Germany boasts a highly diversified RE market, encompassing major metropolitan cities and regional economic hubs.

The renowned “Big 7” cities in Germany include Berlin, Cologne, Düsseldorf, Frankfurt am Main, Hamburg, Munich, and Stuttgart. Despite facing a significant downturn towards the end of 2022 and 2023, these cities maintain low vacancy rates in both office and residential spaces. However, uptake in these areas is slow, and looking ahead, rents, especially in prime locations, are anticipated to continue rising. This trend is attributed to the diminishing supply of new office and residential projects due to prevailing major economic uncertainties. A notable example is Deutsche Wohnen, a key player in residential housing in Germany, significantly scaling back on new construction.

In the office market, a subtle capitulation is evident. While there’s a prevailing notion that the office market is declining due to the increasing popularity of remote and hybrid working schemes, a nuanced perspective is necessary. A noteworthy point from the CPI Property H1 report suggests that a primary reason for remote work is to save time in public transport. Given the efficiency of public transportation in Europe, full remote working is unlikely to reach a disproportionately significant scale, in contrast to the US where less efficient public transportation contributes to higher office vacancy rates. Additionally, WFH research indicates that remote work decreases worker productivity by about 10%, prompting business owners to likely demand employees to come to the office at least a few days a week.

Furthermore, second-tier cities in Germany are experiencing a surge in demand as real estate availability in the Big 7 cities becomes scarce. This trend is particularly pronounced in the logistics sector, where space in major cities is limited. The logistics sector, known for its resilience, benefits from long-term rents indexed to the Consumer Price Index (CPI), and landlords are sometimes contractually permitted to increase rent annually. This results in stable cash flows driven by the expansion of e-commerce and increased trade between European countries.

In general, similar to the situation in the United States, the transaction market in German real estate has witnessed a significant downturn, with transactions in some markets declining by 50% or more. There is a scarcity of transactions as real estate heavily relies on leverage. Uncertainty surrounding future policy rates is causing both buyers and sellers to adopt a cautious approach, waiting on the sidelines for more clarity.

Thus, despite short-term concerns related to macroeconomic headwinds (which remain pertinent), the German real estate market is underpinned by robust underlying fundamentals that are currently not fully reflected in current pricing.

Expectations and Consensus Views Among Big Players in Real Estate

Building my thesis on Patrizia, I undertook a comprehensive review of the real estate (RE) market across Europe. As a reminder, the geographical distribution of the Patrizia Asset Portfolio reveals a concentration in Germany, with the next substantial portion located in the UK and Ireland, and the remainder spread across Europe, Asia-Pacific, and North America.

In analyzing comparable companies to Patrizia, I aimed to distill the core ideas and views prevalent among the most prominent RE players in those regions, providing insights into the general state of the Assets Under Management (AUM) portfolio.

Firstly, I observed subtle distress, cleverly veiled, among various RE participants, particularly concerning leverage. The debt maturity profile of many participants is concerning, with a substantial amount of debt maturing in the coming years. This issue is particularly noticeable in Switzerland, where there seems to be an almost religious belief that Swiss RE always appreciates. This phenomenon is indicative of the failed risk and liquidity management strategies employed by most participants. They relied on short-term debt, assuming easy refinancing at favorable rates in a zero-interest-rate environment. However, this narrative has now crumbled, leading to some participants, including developers and landlords, grappling with modest yet tangible liquidity issues. To bolster their balance sheets, they are resorting to selling properties to capitalize on investments. Some are even implementing substantial investment disposal plans, reaching into the billions (cf. CPI Property). Fortunately, the overall rise in RE values in recent years allows them to realize profits on properties purchased only a few years ago, creating an illusion of a better financial state than reality. While I don’t foresee a meltdown akin to 2008, there is a risk of some participants going out of business if the “higher-for-longer” policy persists, compelling them to liquidate investments in an increasingly illiquid market. Most participants are underestimating their liquidity risk.

Higher financing costs pose a challenge going forward, especially as central banks tighten monetary policy in most places. However, this tightening could also lead, as mentioned earlier, to long-term bullishness in RE due to supply/demand imbalances. New construction is scaling back in an already inventory-poor environment, potentially boosting demand for RE, particularly in prime areas.

Another noteworthy observation from various participants in different markets is the widening disparity between rents and prices in prime locations versus “subprime” locations. This phenomenon is attributed to the so-called “flight to quality” among investors. In challenging times, investors gravitate towards best-in-class assets, contributing to a divergence between “safe assets” in desirable areas and “unsafe assets” in more remote locations. This trend bears similarity to the Junk bond spread over the US 10-year treasury.

Lastly, there is a discernible shift in RE towards sectors and subsectors. While everything seemingly surged during the Zero Interest Rate Policy (ZIRP) era, the current environment is revealing the intrinsic values of different assets. In the words of Warren Buffett, “It’s when the tide goes down that you see who is swimming naked.” Certain assets, such as certain types of commercial real estate (shopping malls, high-street retail), and office real estate, are not as robust as perceived. Conversely, often overlooked assets, such as logistics and infrastructure, demonstrate predictability and resilience during challenging times.

M&A Opportunity for Patrizia

As previously mentioned, the Asset Management business is undergoing consolidation, with one in six asset management groups predicted to disappear by 2027, either going out of business or being acquired by larger entities. Recognizing the importance of M&A in the future landscape, let’s delve into the company’s M&A track record.

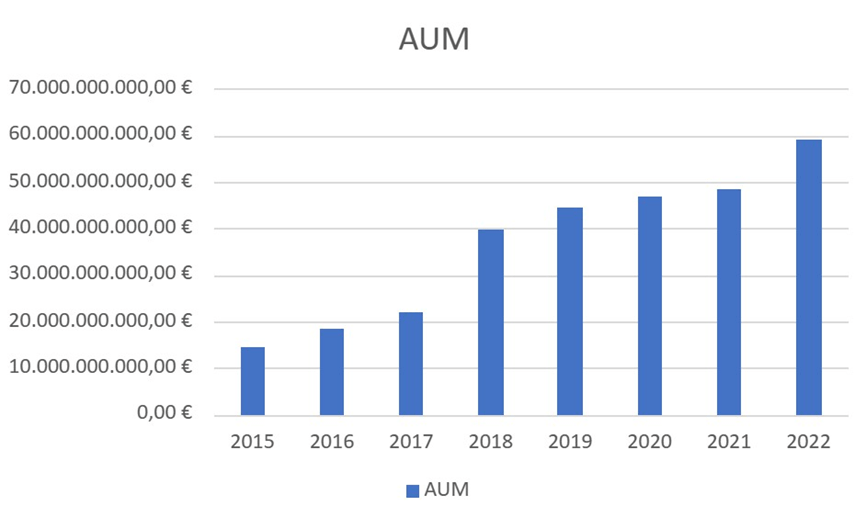

Since Patrizia redirected its core business to Asset Management, it has been focused on expanding its geographical footprint, diversifying its product and asset range, and gaining access to more institutional clients. Notably, the company achieved remarkable success, growing its Assets Under Management (AUM) from 14 billion to almost 60 billion EUR in just nine years, representing a staggering 17% Compound Annual Growth Rate (CAGR), largely fueled by acquisitions.

The company embarked on its M&A journey in 2010 with the acquisition of LB Immo Invest GmbH, a subsidiary of HSH Nordbank AG. At that time, this real estate company ranked as the eighth-largest German provider of specialized real estate funds based on Assets Under Management (AUM). Their portfolio comprised 180 properties.

Subsequently, in December 2012, the company capitalized on depressed valuations to enter the UK market through the acquisition of Tamar Capital Group. In addition to its primary presence in the UK, Tamar Capital Group had operations in France, Scandinavia, and Belgium, emphasizing industrial real estate and office properties.

After divesting its Property Management segment in 2016 to concentrate solely on the Asset Management segment, the company embarked on a series of acquisitions in 2017. These three acquisitions nearly doubled Patrizia’s Assets Under Management (AUM) from 21 billion EUR in 2017 to 39 billion in 2018.

It commenced by acquiring Triuva, a prominent provider of real estate investments in Europe. The Frankfurt-based company managed approximately 40 funds, boasting around 80 institutional investors and maintaining 15 locations across Europe. Triuva specialized in commercial real estate, including the office, retail, and logistics sectors, as well as infrastructure. At the time of acquisition, Triuva’s Assets Under Management (AUM) hovered around 9.8 billion EUR.

In the same year, the company proceeded to acquire Sparinvest. Sparinvest, based in Copenhagen, operated as a fund-of-funds investment manager, focusing on the small- and mid-cap segment. At the time of acquisition, the company managed assets totaling around 1 billion EUR.

Finally, in late 2017, the company acquired Rockspring, a London-based fund manager specializing in managing capital for global clients. This acquisition expanded the group’s international footprint and fostered synergies, not only in business terms but also in terms of human capital. Rather than providing explanations myself, I will share with you Wolfgang Egger’s (the CEO) comments on the transaction and the overall performance in 2017:

“Rockspring has an outstanding track record and reputation for European property fund management and client services and is a perfect fit for PATRIZIA in terms of shared vision and culture and its focus on real estate business. This acquisition represents an important milestone for PATRIZIA in achieving our vision to become a global provider of European real estate assets for our clients.

The clients of PATRIZIA and Rockspring will benefit from access to a stronger independent platform which will offer broader access to markets and products while PATRIZIA will strengthen its market position significantly in its core European markets. Moreover the global client base is complementary and will allow both sides to profit from longlasting trusted relationships which have been built on long-term performance. PATRIZIA has been preparing for the acquisitions of Rockspring, TRIUVA and SPI in a careful and strategic way for several months now and I’m delighted that we have been able to finalise each of them this year. It represents a unique strategic opportunity to be able to bring the three businesses into PATRIZIA in one comprehensive integration process “

In 2022, Patrizia made its latest acquisitions, including Whitehelm Capital, an international infrastructure manager. This acquisition is transformative as it introduces Patrizia to a market that has not been substantially exploited. The acquisition tripled Patrizia’s infrastructure AUM to around 5 billion EUR. With over 60 investment specialists in Australia and Europe and a track record of more than 100 infrastructure investments, Whitehelm has achieved an Internal Rate of Return (IRR) of 11.9% for global core infrastructure investments since its inception 23 years ago.

Last but not least, in December 2023, Patrizia acquired ADVANTAGE Investment Partners, a diversified multimanager with both institutional and wholesale distribution channels. The company manages USD 1.2 billion in feebearing assets.

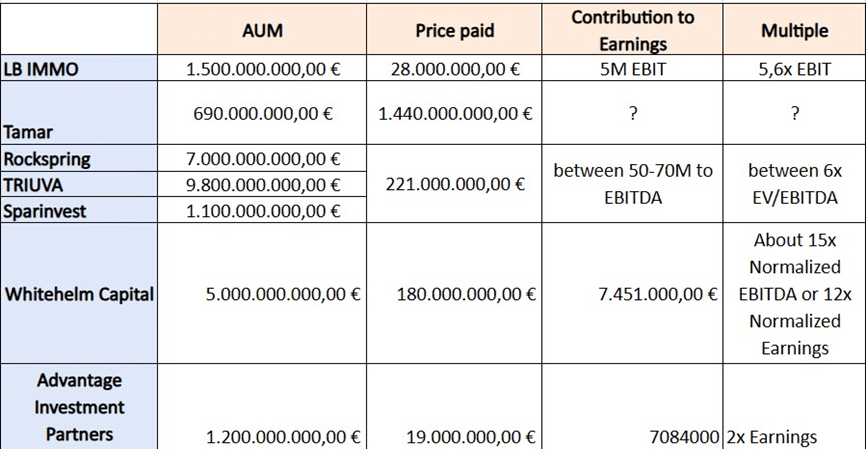

For illustration purposes, here is a table with all disclosed acquisitions. I attempted to estimate multiples for the acquisitions; however, these figures should not be regarded as a reference as they are likely imprecise.

Overall, I believe the M&A execution aligns with the strategy the company aims to implement. Patrizia appears to be price-sensitive, and unless there are significant miscalculations on my part, it also demonstrates selectivity and sensitivity to multiples when acquiring a company.

What I like about the company?

For a couple of months now, I have been interested in the real estate (RE) industry in general due to low valuations. I anticipated encountering challenges, but the reality exceeded my expectations.

As discussed previously, I have been utterly baffled by the lack of risk management preparation among most RE participants. They took the Zero Interest Rate Policy (ZIRP) era for granted, accumulated massive short-term debt, and relied on a consistently liquid market to exit positions. Fortunately, I discovered something exceptional in Patrizia.

Firstly, Patrizia boasts what Jamie Dimon terms “a fortress balance sheet.” With a debt-to-equity ratio of only 0.20x and sufficient cash to instantly pay off all its debts. In the general RE landscape, participants such as developers, constructors, and promoters maintain significant cash and cash equivalents because ample liquidity is essential in this sector. However, to enhance returns in a market where yields were heavily depressed by competition, many opted for substantial leverage. The issue arises when, to save a few percentage points in interest, they took on debt with a very short-term maturity profile, banking on refinancing this debt at the same rate in the future. With the onset of tightening monetary policy, most participants will now face the challenge of refinancing this debt at rates that will likely further compress their yields. Patrizia, however, does not encounter this problem as its maturity profile is controlled, and management has not taken on excessive debt.

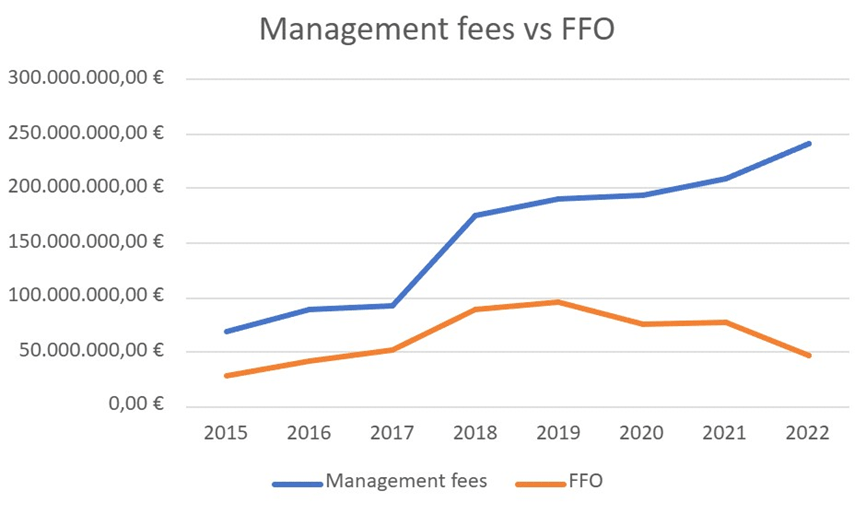

Additionally, as an asset manager, the company benefits from recurring management revenues that have consistently increased over the years, paralleling the growth in Assets Under Management.

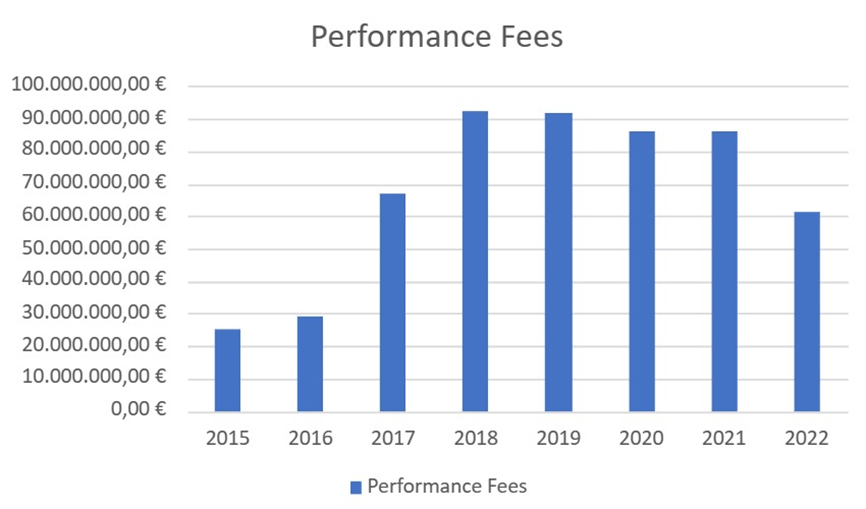

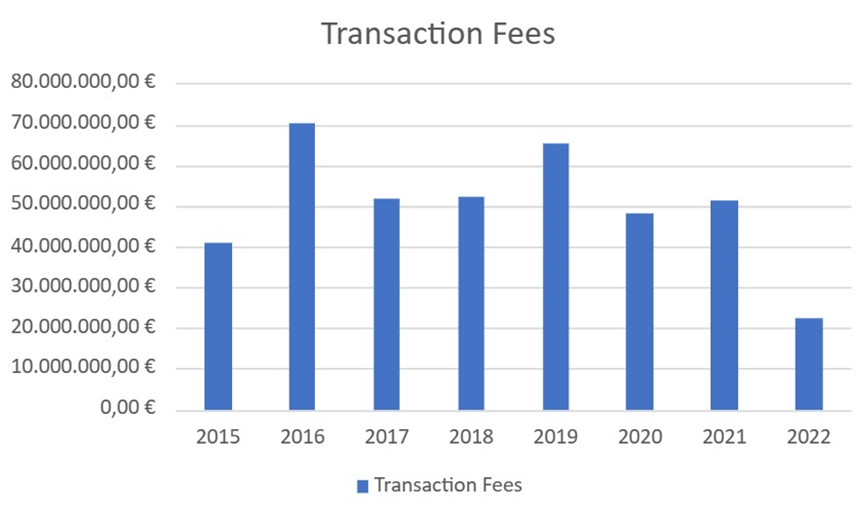

Nevertheless, despite the highly recurring nature of the asset management business, it is influenced by the economic cycle. The company relies on transaction and performance fees, which are high during real estate (RE) booms and low in RE downturns. Consequently, the growth in recurring management fees has not translated into increased profitability, as measured by Funds from Operations. This is because the rise in recurring management fees cannot offset the market-driven decrease in transaction and performance fees.

This divergence between recurring management fees and profitability has led to poor stock performance, as the market is not expecting the company to recover soon. Personally, I think this is a distorted view of reality. It is true that the market is in dubious shape, but liquidity will eventually return, and the fundamentals in the RE markets where Patrizia has its assets are of prime quality. Once Patrizia gets the chance to execute more transactions (elevating transaction fees) and eventually outperforms the market (as it has done over the economic cycle, cf. performance fees), fee revenues will explode.

As you can observe, Performance and Transaction fees are at an unsustainably low level. Performance fees are at 2017 levels, when the company had only 20 billion EUR AUM. Transaction Fees are at cyclical unprecedented lows, mainly due to the severe lack of liquidity in the market.

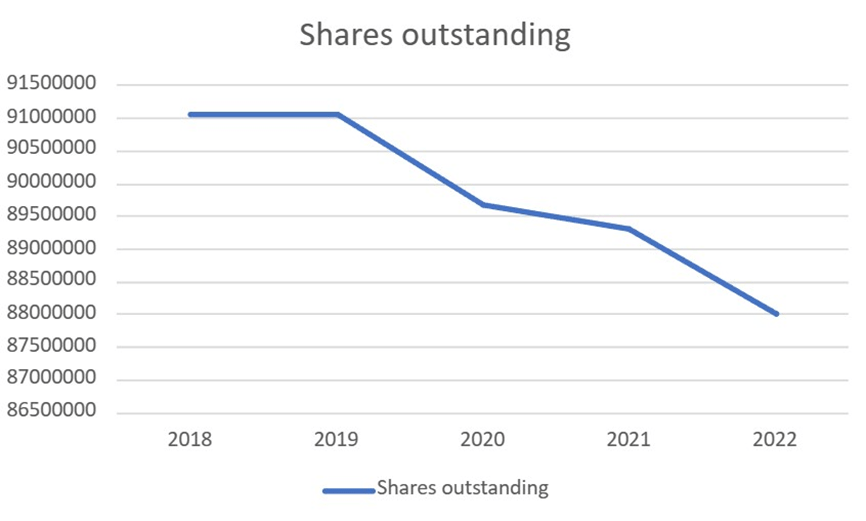

Lastly, after discussing what I like about the company from an operational point of view, I would like to address Capital Allocation. The company has been paying out a dividend since 2018. The dividend was 0.25 cents per share back then, and for FY2022, they had grown it to 0.32 cents a share. This amounts to a CAGR increase in dividend payouts of 6.3% over the last 5 years. The dividend is estimated to be 0.33 cents a share for FY2023. I don’t know if they are going to lower it based on the weaker than expected results, but this dividend would amount to a dividend yield of about 4%. You could argue that it might be better that they retain these earnings to grow the business, pay down debt, or repurchase shares. Paying down debt is unnecessary since the interest on the debt is not very significant. Growing the business through M&A would be a good use for the money, but it is hard to get transactions done at the moment. Regarding the repurchase of shares, the company has been doing it for a while.

Since 2018 (coincidentally the year the company has started paying a dividend), the company has also been active in share repurchases. The current shares outstanding as of Q3 2023 are 86,087,000 million. This means that since 2018, the company has reduced shares outstanding at a pace of 1.1% CAGR. It has lately been more aggressive, and during 2023 alone, it reduced shares outstanding by 2.2%, profiting from low prices. This might not be huge, but I think it will have a positive impact on TSR going forward.

Lastly, I like (especially in high concentration ideas) skin in the game. The CEO and founder, Wolfgang Egger, owns half of the stock outstanding through a holding company. This will assure you that if the ship were to sink, he will lose his money too.

Valuation & Risks

I like ideas where the question is not if but when. I know almost certainly that over the medium run, the company will recover to a more reasonable earnings level, but the question is how much time that will take (opportunity cost) and to what extent will the recovery be relevant.

If the RE market normalizes (liquidity comes back), the company would most certainly bounce back. We will be making projections for FY 2025, since I think 2 years is a decent wait for the RE market to recover in Germany.

I expect AUM to be between 61-65 billion EUR for 2025. This would mean management fees ranging between 244 and 260 million EUR (historically the management fees have hovered around 0.4% of AUM).

Now let’s model the more cyclical transaction and performance fees. A normal transaction level over the last business cycle on the company’s platform has been 5.5-6 billion EUR per annum. The historical transaction fee has been 0.7% of total transactions, which leaves you with a normalized transaction fee income of between 38.5-42 million EUR per annum. This level is still far below historical averages since I am assuming fee compression.

For performance fees, they historically range from between 0.15%-0.20% of AUM. I will model between 0.12%-0.15% to be sure to account for multiple compression. This gives you normalized performance fees of between 7396 million EUR per annum.

Adding this up, normalized fee income would range between 355-398 million EUR. Operating expenses will remain high, so I will be modeling an operating margin (EBITDA) of between 20-25% (well below the average 34%). I don’t usually use EBITDA, but in this case, the company has a too high depreciation expense in relation to revenue and earnings (because of fund contract management assets). This gives you an EBITDA of between 71-99 million EUR.

I will assume EV/EBITDA multiple of between 10-12x EBITDA. So this gives you a valuation of between 710-1188 million EUR for the company. Assuming no further share repurchases, that would be a price of between 8.24-13.79 EUR, for an average (very) conservative target price of 11 EUR per share.

This would mean a pre-tax CAGR of 17.7% in 2 years (2025FY) excluding dividends and not accounting for any other share repurchases. As I previously said, this is only accounting for a normalization of business conditions, I am not being optimistic at all. If this normalization fails to happen, my whole thesis would be more or less obsolete, but my downside would still be protected by about 9 EUR per share in tangible equity.

Gonçalo