Returns for 2023

My annual return stands at approximately +3.68%. My portfolio significantly lagged behind major indexes throughout the year, with the Russell 2000 gaining about 16.28% year-to-date (YTD) as the primary benchmark, the S&P 500 rising by 24.72% YTD, and the Nasdaq soaring by 44.69% YTD.

While I believe that a single year might not provide a comprehensive assessment of performance or portfolio management skills, transparency remains essential. The downturn in the sectors where I hold investments exerted substantial downward pressure on my returns, reflecting their current lack of popularity in the market.

Portfolio Breakdown and In-Depth Investment Review

I maintain a relatively low cash position, having identified compelling investment opportunities. Predominantly, my portfolio is concentrated in Financials, Consumer Cyclicals, and Materials (IBKR’S asset classifications being somewhat strange). I will now proceed to delineate my positions in descending order of weight.

Netel Holding AB

Netel stands out as a prominent player in critical infrastructure within Northern Europe, boasting a remarkable track record of over two decades in executing projects and providing services and maintenance for major industry stakeholders in power, telecommunications, water, heating, and sewage.

My significant investment in Netel is primarily driven by its nearly twofold increase in stock price within a few months. From a business standpoint, Netel operates in a competitive yet fragmented industry, where major players hold significant market share, leaving room for substantial growth through mergers and acquisitions (M&A) and organic means. The sectors in which Netel operates are propelled by powerful megatrends.

While the company has exhibited revenue growth and improved profitability in recent years, the infrastructure segment is facing challenges due to a slowdown in investments by key players in the relevant sectors. Despite this, Netel’s backlog continues to expand, currently standing at 4.1 billion kr, equivalent to 130% of 2022’s revenues.

A noteworthy concern revolves around the company’s debt burden, with 900 million kr maturing between 2024 and 2026. Although Netel has generated substantial free cash flow (albeit with room for improvement in working capital management), the need to refinance part of the debt poses a potential risk. Elevated inflation in Sweden, coupled with a policy interest rate of 4%, adds to the apprehension. However, there is still time to navigate this challenge, and a pivot by the Sweden Central Bank may alleviate some concerns.

Despite Netel’s robust fundamentals and a seemingly low valuation (trading at around 7x EV/Ebit and 6x P/E and) considering its sector and strong backlog, I am contemplating reducing my position. The rationale behind this decision lies in the significant unrealized gains already accrued and the substantial proportion of my portfolio that the Netel position represents

CPI Card Group

CPI stands out as a leading card manufacturer for the financial industry, offering instant card issuance services to a diverse range of financial institutions in North America, including major players and small to mid-sized entities. As with all my investments, the company’s business model is straightforward, and as it has been previously covered, I won’t delve into extensive details.

The year 2023 posed challenges for CPI, as customers worked through their substantial card inventories without replenishing stocks. Consequently, the company anticipates a modest, low single-digit decline in both revenue and EBITDA. This trend is a shared concern within the industry, with major competitors facing similar struggles. The root cause can be traced back to the turbulence witnessed in the financial sector in March 2023, prompting banks to exercise caution.

Despite these short-term setbacks, the company’s long-term prospects remain robust, supported by adept management in capital allocation. Efforts to deleverage the company’s balance sheet include the retirement of outstanding notes, and a significant step in this direction is the announcement of a 20 million share repurchase program set to expire at the end of 2024, representing approximately 10% of the market cap. Importantly, there are no substantial debt maturities looming in the near future.

However, the market seems to undervalue these positive attributes. Even under the assumption that the company may not swiftly return to 2022’s profitability levels and experiences only modest growth (high-single digit), which seems improbable given the 10% compound annual growth rate in cards in circulation over the last three years and the increasing prevalence of card usage over cash payments, the company presents an enticing upside potential with limited downside risk. It’s noteworthy that this assessment doesn’t factor in potential share repurchases, which could further amplify the company’s earnings per share.

Sachem Capital Corporation

Sachem Capital Corp. specializes in the origination, underwriting, funding, servicing, and management of a portfolio primarily comprising first mortgage loans. The company exclusively offers short-term loans, typically with durations of one year or less. This strategic focus affords Sachem significant flexibility, as short-term loans are less sensitive to interest rate fluctuations, eliminating the need for adjustments to its loan book value.

Initially, I had concerns about Sachem, particularly regarding its substantial debt burden and the impending maturity of outstanding notes totaling approximately $60 million in June and December 2024. However, the company has soothed these worries by maintaining sufficient cash and cash equivalents, enabling it to meet all upcoming maturities in cash—a prudent approach in the current uncertain economic environment.

Notably, Sachem exhibits a Weighted Average Cost of Capital (WACC) significantly higher than its industry peers, hovering around 10%. This divergence could be attributed to heightened stock volatility, a perceived higher risk by the market, and the company’s rapid growth, which has resulted in shareholder dilution. Despite this, Sachem’s investments have generally been value accretive.

The hard money lending industry is confronting challenges exacerbated by increased borrowing costs in a highly leveraged industry. Sachem, with a comparatively lower leverage ratio of 2.7:1 (compared to the industry average of 3:1), appears resilient. Additionally, the current stagnation in the real estate market and reduced transaction volumes present challenges. However, Sachem can leverage this situation, especially as traditional banks become less willing to lend, thereby creating an opportunity for Sachem to cater to creditworthy developers sidelined from the conventional financial system.

Having uncertainties about my current position, I opted to conduct a more in-depth analysis of the hard money lending industry. In this exploration, I discovered a competitor—Manhattan Bridge Capital—that functions in nearly identical markets but is notably smaller in scale and exhibits lower leverage. Here are some noteworthy points I found during my research on this competitor.

Opportunities for attractive returns emerge when credit conditions become more stringent.

A hard money lender places emphasis on the intrinsic value of assets rather than focusing on cash flow.

Typically, more business opportunities arise during challenging economic periods. An excerpt from Manhattan Bridge Capital’s 2008 Letter to Shareholders highlights that in tough times, developers often opt for loans at less favorable rates, leading to an expansion of the loan pipeline for hard money lenders. However, such periods also come with increased risk as borrowers may exhibit higher levels of financial instability. As emphasized by Sachem’s management, careful selection of borrowers becomes crucial in such environments.

I also opted to reevaluate my thesis on Sachem and closely examine its mortgage portfolio. The proportion of non-performing loans has surged to approximately 12% of the portfolio. While this would be a concerning situation for a bank, it appears relatively normal for Sachem. The current state of the US real estate market poses challenges for developers to sell their projects, considering the low transaction volume and liquidity. In my perspective, these non-performing loans are largely temporary, and Sachem is likely to extend the loans to provide developers with the necessary time to sell their properties.

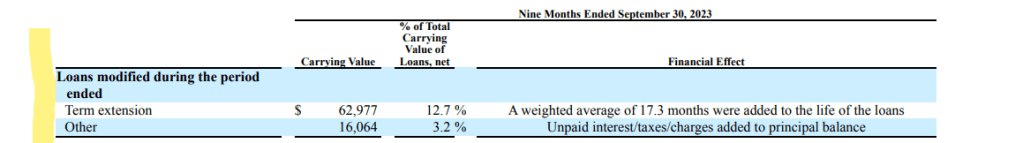

You can observe that a significant number of these loans have already undergone extensions, along with the specific terms under which they were extended.

I also conducted a renewed examination of the market conditions in the locations where the company holds its assets.

The majority of the company’s assets, comprising 51% of the total portfolio, are situated in New England. New England encompasses six states, with a primary focus on Connecticut , where the company is most active. In Zillow’s list of the top 10 most popular markets, seven are located in New England, with four of them specifically in Connecticut.

In Connecticut, the housing inventory remains notably low, with transactions experiencing a downturn of nearly 30% propelled by increased borrowing costs. Despite this, median selling prices continue to rise, and the enduring trends of robust population growth, driven by its proximity to New York, coupled with its appeal in terms of living quality, and an underexploited market, remain intact.

In the realm of commercial real estate, the office sector continues to face challenges with high vacancy rates (24.5% for Hartford and 17.8% for New Haven). Conversely, industrial real estate maintains relative strength, boasting a 3.7% vacancy rate, although it is experiencing a pullback due to recession expectations. Nevertheless, Connecticut remains an attractive destination for companies.

Hartford Office MarketBeat (azureedge.net)

New Haven Office MarketBeat (azureedge.net)

Zillow’s Most Popular Markets of 2023 – Zillow Research

MARKET NAME Industrial QX 20XX (azureedge.net)

Connecticut Commercial Real Estate Data | Creinformation.com

In the state of Florida, which constitutes a considerable portion of the company’s portfolio, robust fundamentals persist. Florida is currently witnessing a significant influx of migration. Although there has been a substantial decrease in existing home sales, with a notable 28.4% of homes experiencing price drops as of September 2023, the average and median sale prices continue to ascend, and the inventory remains scarce.

Florida Housing Market: House Prices & Trends | Redfin

The Current State of The Florida Housing Market – 2023 (ibuyer.com)

The credit quality of the portfolio remains strong, with approximately 71% of customers boasting a credit rating of 701 or above. However, it’s worth noting that credit scores have limited significance in hard money lending, given the already high interest rates charged in this lending model.

I am optimistic about a potential reevaluation of the company’s valuation in 2024, especially in anticipation of improved industry conditions. Nevertheless, I believe the company should exercise prudence in managing its indebtedness and asset coverage ratio, which currently stands at 1.58. A decline in the asset coverage ratio below 1.50 could pose challenges, as this threshold is often a prerequisite in many of the company’s credit line agreements with banks

Natural Alternatives International

NAII provides private-label contract manufacturing to supplement companies. Additionally, the company also has patent and trademark licensing segment , which primarily includes direct raw material sales and royalty income from the license and supply agreements associated with the sale and use of beta-alanine under the CarnoSyn® and SR CarnoSyn® trade names.

The thesis on this company remains relatively stable, which is inherently positive. It’s fundamentally an asset-oriented investment, and I find it perplexing that a company of this nature is trading at a mere 0.5x Price-to-Book (P/B) ratio. Over the years, the company has consistently turned a profit, maintains a respectable Return on Equity (ROE), and exhibits alignment in its management. Despite these strengths, it appears the company might have expanded excessively during the COVID-19 years, anticipating a demand level higher than what is currently observed in its market.

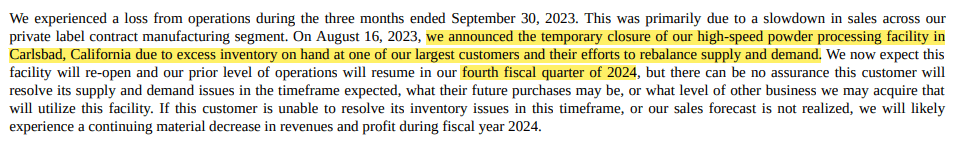

In Q1 2024, the company incurred an operational loss due to challenging market conditions. The following is an excerpt from their 10-Q:

Customers are currently working through surplus inventory, and the destocking process may extend for a considerable period, eventually correcting, likely in tandem with the overall economic recovery. During this interim period, given the company’s substantial operating leverage, there is an anticipated impact on earnings, and I foresee a net loss for fiscal year 2024. Given its nature as an asset-focused investment, my attention will be directed towards monitoring the company’s asset and book value, which have shown relatively stable trends over the past year.

Additionally, as a supplementary observation, the company is generating positive cash flow from operations, and given the industry’s weak economic stance, where substantial investments are unlikely, I anticipate the company to exhibit positive free cash flow for the year.

Supremex

Supremex, the second-largest envelope manufacturer in North America, is expanding its regional presence in packaging around Montreal and the North-West of the US. Operating ten facilities in Canada and six in the United States with approximately 1,000 employees, Supremex serves major corporations, government entities, SMEs, and solutions providers. Leveraging the mature yet fragmented envelope industry, the company strategically employs M&A activities, utilizing proceeds to penetrate the growing packaging business.

The company faced challenges in recent quarters within its Envelope business, primarily attributed to decreased volumes and substantial operating leverage. As this segment constitutes the core of its revenues, it continues to exert downward pressure on earnings, a trend I anticipate will persist. Despite these difficulties, the overall business is resilient, and I maintain confidence in this position due to my favorable impression of the management and the robust unit economics.

The company demonstrates proficiency in capital allocation and is actively repurchasing a significant number of shares at favorable prices. Additionally, the company maintains a manageable level of debt, with no principal repayments due until 2026. While interest payments have surged, there is an expectation of normalization over the medium term, particularly in relation to earnings, as the incurred debt was primarily for accretive acquisition purposes.

Valhi

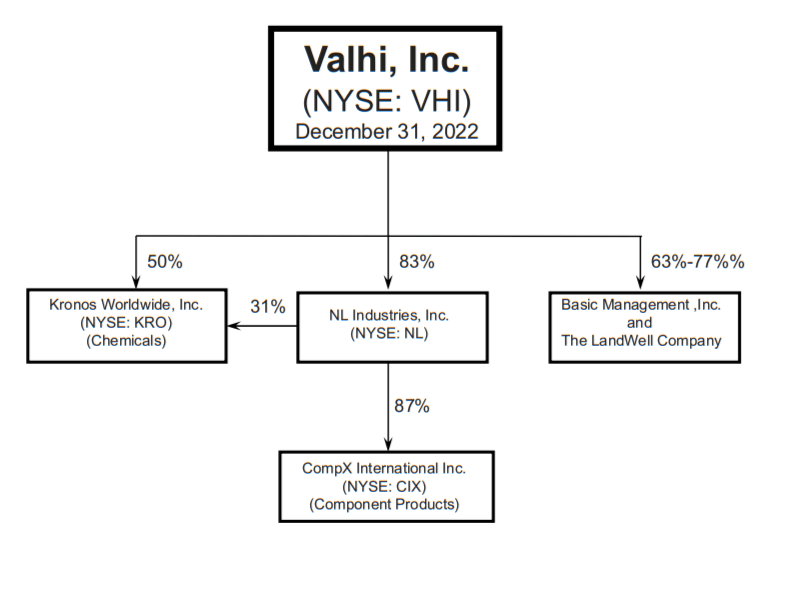

Valhi is a holding company that holds a controlling interest in Kronos Worldwide, a prominent producer of titanium dioxide (TiO2), and also has investments in NL Industries and COMPX International. The corporate structure, when visualized, is relatively straightforward, and for clarity, an illustrative representation is provided below:

This one is a no-brainer. The company’s holdings in the mentioned traded companies alone, all marked-to-market, total $1.309 billion, for a market cap of $428 million USD—an evident asset-play. The company has never witnessed such a low Price-to-Book (P/B) value.

Briefly touching on its Chemicals business, which constitutes the majority of its revenue and earnings, the TiO2 industry is currently experiencing a temporary downturn after prosperous years. TiO2, a product used in coatings, paints, plastics, cosmetics, etc., is poised for a potential replenishment of stock by customers, although the lingering uncertainty may persist. Furthermore, the company holds approximately $342 million in cash and cash equivalents, an astonishing figure considering the market cap of $428 million USD.

In addition, I have minor holdings in MainStreet Bancshares and Svedberg, but I won’t delve into the specifics as their weight in my portfolio is relatively small.

Learnings from 2023 and Outlook for 2024

Reflecting on 2023, it wasn’t a particularly favorable year for small-cap stocks overall, although a year-end rally somewhat improved the apparent performance. Lingering uncertainties persist, and while inflation has moderated in the US and much of Europe, I remain skeptical of the soft landing narrative. The contraction of manufacturing PMI in the US and Europe, especially in Europe, throughout 2023 explains the narrow stock market breadth, with only Tech Mega Caps showing momentum.

As I look ahead to continue my investing journey in 2024, I eagerly anticipate observing how events unfold and adapting to market dynamics. Despite the challenges, I maintain a positive outlook on the long-term prospects of the global economy and am committed to expanding my knowledge of financial markets. Approaching 2024 with optimism, I recall Churchill’s wisdom: “I am an optimist. It does not seem too much use being anything else.”