The Business

CPI Card Group specializes in payment solutions. They make the credit and debit cards we use every day, which are issued by banks, fintech companies, and more, on the Visa, Mastercard, American Express, and Discover networks. Besides their main product, they also provide debit prepaid cards.

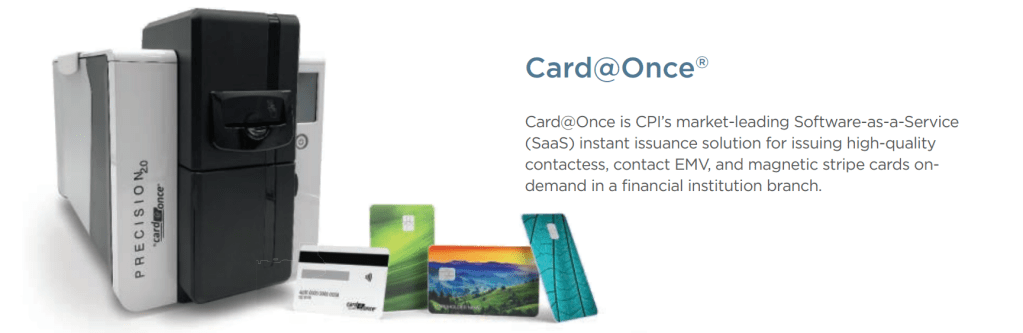

On the service front, the company offers Instant Card Issuance Services to their customers under the Card@Once brand.

The company went public in 2015 (under the ownership of a private equity firm) carrying a substantial amount of debt and preferred stock. As a result, while sales were on the rise, net income struggled to keep pace due to the burden of preferred dividends and steep interest expenses.

This challenge was compounded by a turbulent industry landscape between 2016 and 2018, primarily stemming from the unexpectedly prolonged shift from traditional stripe cards to EMV cards. This presented a setback for a company that was otherwise performing admirably. It’s worth noting that the company has maintained profitability almost consistently since it is public and has a history of generating healthy free cash flow.

Strategy and MOAT

The company offers a fundamental product that everyone relies on – the debit and credit cards they produce. Even with the rise of tap-to-phone technology in the post-pandemic era, it is unlikely to significantly impact the growth of cards in circulation. That’s because, most of the time, you still need a physical card to access these features.

The company leverages its service segment to bolster profit margins and broaden its product portfolio while capitalizing on competitive advantages in terms of switching costs. Customers can enjoy seamless solutions by partnering exclusively with CPI, eliminating the need to engage with multiple enterprises.

In addition to serving larger institutional customers, as mentioned earlier, CPI is also eyeing opportunities among smaller banks. Small banks issue a substantial portion of the cards in circulation, and this market is still quite fragmented, offering considerable potential.

Moreover, with over two decades of experience in the industry, the company has developed valuable technical expertise that matters a great deal to its clients.

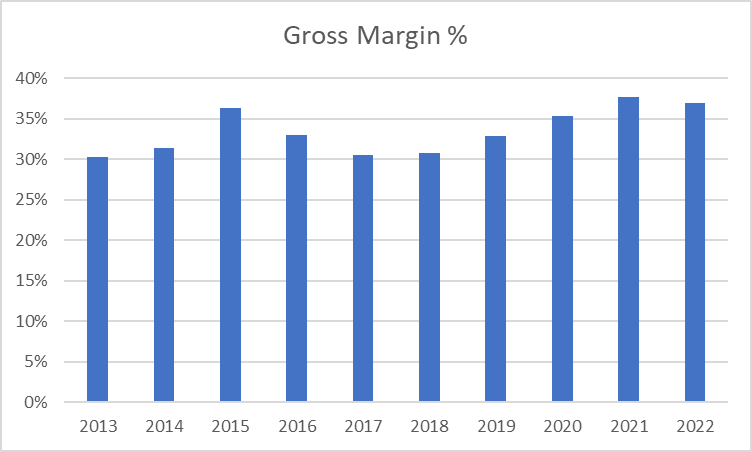

The Gross Margin Stability indicates that the company hasn’t just held onto its competitive position but has actually strengthened it over time.

The Industry

The industry is set to benefit from long-term trends. The shift from magnetic stripe cards to EMV cards is not complete yet, leaving room for the expansion of card usage, especially in our increasingly cashless society compared to a few years ago. To put it in perspective, the number of cards in circulation has grown at an average annual rate of 10% over the past three years.

Disruption in this industry is unlikely due to the unattractive returns for new entrants, the high fixed costs and the need for expensive facilities, among other factors. Furthermore, the industry is highly consolidated, with the top players well-positioned for growth. During a recent conference call, the company expressed confidence in its potential for further expansion.

Comparison with other major player in the industry: CompoSecure

There are only two publicly listed manufacturers of payment cards: CPI Card Group (PMTS) and CompoSecure (CMPO). Given this, it seemed logical for me to conduct a comparison of these two companies.

From an operational perspective, both companies engage in similar activities, primarily manufacturing the credit and debit cards we use. However, the key distinction lies in the range of services they offer. Both firms have been actively pursuing diversification strategies aimed at providing comprehensive solutions and expanding their service portfolios. Offering services can be an effective way to enhance customer loyalty.

As mentioned earlier, CPI decided to specialize in providing instant card issuance services, which not only yield high margins but also align closely with their core product offerings and operational expertise. On the other hand, CompoSecure has taken a different approach on the services front by offering storage and security solutions for cryptocurrencies and digital assets under its Arculus brand. I find myself pondering whether this specific segment is a suitable pursuit for the company, as I am uncertain about how they can leverage their card manufacturing expertise in this particular area.

Another aspect of CompoSecure that I find concerning is its heavy reliance on JP Morgan and American Express, which together account for more than 67% of its revenues. This reliance suggests that CompoSecure may have experienced less impact from the turbulence in the banking sector, as its clients are major institutions that have benefited significantly from increased deposits and flows into money market accounts.

CompoSecure does enjoy better margins overall, but this could be attributed, at least in part, to its customer concentration and the presence of long-term contracts with its clients.

Market Fears

The CEO, Scott Scheiermann, who played a pivotal role in turning the company around and driving its recent success, is stepping down. This change in leadership has cast some uncertainty over the company’s future, but we can expect the announcement of a new CEO soon.

The company has faced significant challenges amid recent banking turmoil. Many issuers have cut back on investments and are primarily relying on their existing card inventory without making new purchases.

Another concern is the company’s high debt interest rate, which hovers around 10%. Given that the company’s debt is set to mature in 2026, it might be beneficial for them to explore opportunities to refinance the debt at a more favorable rate.

Bullish Thesis

I’m quite optimistic about this company because I have a positive outlook on the payments industry as a whole. I believe that this sector is experiencing strong long-term trends that will drive its growth for years to come.

If the shift from cash to card payments and the transition from magnetic stripe cards to EMV cards continues as expected (which seems highly likely), the company will be in an excellent position to benefit from this growth. Furthermore, cards have to be replaced once every few years, so the business is very recurring in nature.

As I mentioned earlier, the company’s debt is set to mature in 2026, so we’ll have to wait and see how interest rates behave until then.

The company does have a moderate level of customer concentration, with one customer accounting for 16% of its business and the top 10 customers contributing to two-thirds of its revenue. However, it’s important to note that this level of customer concentration is common in the industry due to limited suppliers. While in the case of CompoSecure, customer concentration was excessively high, I believe that the moderate customer concentration for CPI reflects the trust that clients have in the company. It is unlikely to lose a major customer because of the contractual arrangements in this industry. The company has established long-term relationships and agreements, as well as short-term contracts that specify product quantities or services to be provided. This means that, in the short term and in times of uncertainty, customers may temporarily postpone purchases. However, they will eventually need to restock their inventories (sometimes aggressively) and accelerate their orders.

The company is one of the few providers with the capacity to handle both high-volume and custom low-volume orders on demand. In such cases, they can adjust pricing to compensate for the lower volume.

In summary, I believe the company has a promising future and is poised to perform quite well.

Valuation

To play it extremely safe, I took a rather pessimistic approach when valuing the business.

First, on the revenue front, I projected a modest 8% growth over the next two years, following a 5% increase in 2023. This might seem overly cautious, especially when you consider that the company has achieved a 10% compound annual growth rate (CAGR) over the past decade, even during the tough period from 2016 to 2018 when revenues dropped by 17% and 28% respectively. In the last six years, the CAGR was an even more robust 13%. So, I’d say this assumption is bordering on being overly conservative.

Next, I factored in a lower gross margin (35% compared to 37% in 2022) to account for potential competitive pressures or pricing challenges. I also assumed lower operating margins (15% compared to 17% in 2022) and net income margins (6% compared to 8%) just in case the incoming CEO encounters difficulties in cost management.

Assuming a consistent share count (as the company has not engaged in stock buybacks but has not diluted either), the projected EPS for 2025 comes out to be $3.06.

Considering a reasonable PE multiple of 10, which is in line with industry standards and the median PE, this would imply an intrinsic value of $36.7 per share. That represents a potential upside of 102% in just two years, equating to a remarkable 42% compound annual growth rate (CAGR).

In my opinion, if my thesis holds reasonably true, the likelihood of losing money on this investment seems quite low.