“The time to buy is when there’s blood in the streets, even if it’s your own.” -Mayer Amschel Rothschild

The Company

The company underwent an initial public offering (IPO) in 2016, during which it issued 2.6 million shares at a price of $5 per share.

The company is involved in short-term real estate lending activities, primarily securing first mortgage liens on real properties located in the Northeastern and Southeastern regions of the United States.

Typically, the borrowers are real estate investors or developers who utilize the loan proceeds to finance the acquisition, renovation, rehabilitation, development, and/or enhancement of residential or commercial properties intended for investment or sale. These specific types of loans are referred to as “hard-money” loans within financial terminology.

Business Model and Market Opportunity

The company manages a portfolio of short-term loans, each backed by real estate assets. Connecticut constitutes over 60% of the company’s loan portfolio.

Connecticut real estate market experienced a period of stagnation throughout a significant portion of the previous decade, resulting in inadequate investment and the deterioration of a substantial number of properties. However, following the advent of the pandemic and the subsequent enactment of novel policies by local authorities, the market has undergone a resurgence in both population influx and capital investment.

Here is where the company comes into play: they provide loans to developers or investors seeking to “fix and flip” properties within markets with stable real estate values and where substandard properties are improved, rehabilitated and renovated.

The company’s net interest income is ascertained by the difference between the interest earned on the loan portfolio and the cost of capital.

Loan Portfolio and Underwriting Criteria

Short-term loans inherently exhibit a higher default rate compared to conventional loans, enabling the company to apply elevated interest rates. These loans typically have an average term of 6 months until maturity, with an average interest rate hovering around 11%. A majority of loans are settled before reaching maturity. However, in certain instances, extensions are granted, contingent upon the borrower satisfying underwriting criteria. It’s worth noting that loan extensions are treated as new loan arrangements. In cases where the borrower is insolvent or fails to meet underwriting prerequisites, the company enables foreclosure proceedings.

To ensure a safety margin, the company maintains a loan-to-value ratio of no more than 70%, utilizing appraisals of collateral value to accurately determine loan size and corresponding interest rates. Amid the current tumultuous banking climate, the company has prudently reduced its loan-to-value ratio to 50%.

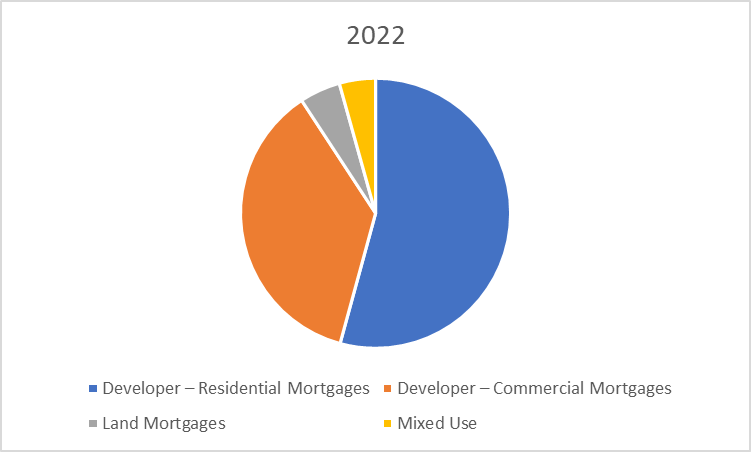

A market concern revolves around the company’s vulnerability to commercial mortgages. It’s essential to highlight that the company does not operate within distressed commercial real estate markets. Although management recognizes issues like vacant office spaces, they maintain the view that this crisis will not significantly affect the company’s earning power in the long-run.

The MOAT and Bullish Arguments

First, the company operates in a very strategic niche market (Connecticut, providing short-term loans to developers) where it has an extensive knowledge and few competitors. The banking turmoil eroded the few competitors there were because they were undercapitalized and banks are not willing to partner with them as credit conditions tighten. The company will most likely be more aggressive on pricing.

Then, the company can structure the loans in accordance with the customer’s needs because it is nor too small nor too big of a company. They are flexible and can act quickly to take market share from troubled lenders.

Moreover, the company is focusing on funding larger loans backed by quality assets rather than wasting too much time and effort on smaller loans. The company has low leverage compared to peers so it could amplify returns in the future by leveraging up.

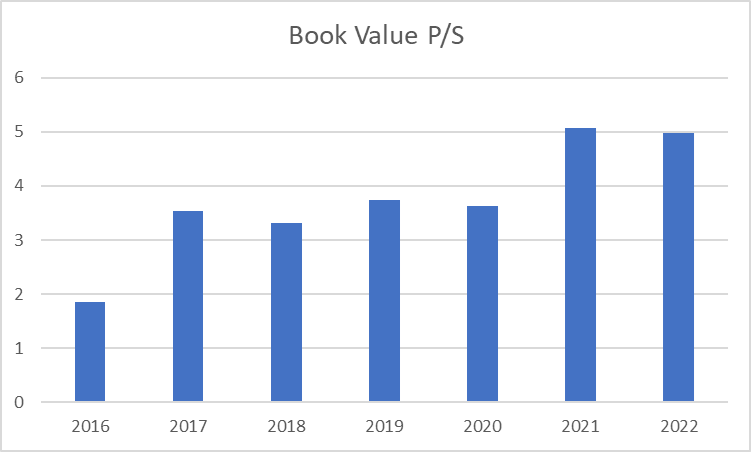

The management is not only competent but also adept at execution. The company is under the ownership and operation of CEO John Villano, who holds a substantial portion of shares. It’s evident that the company’s book value per share has experienced substantial growth since its inception, even in the face of considerable dilution.

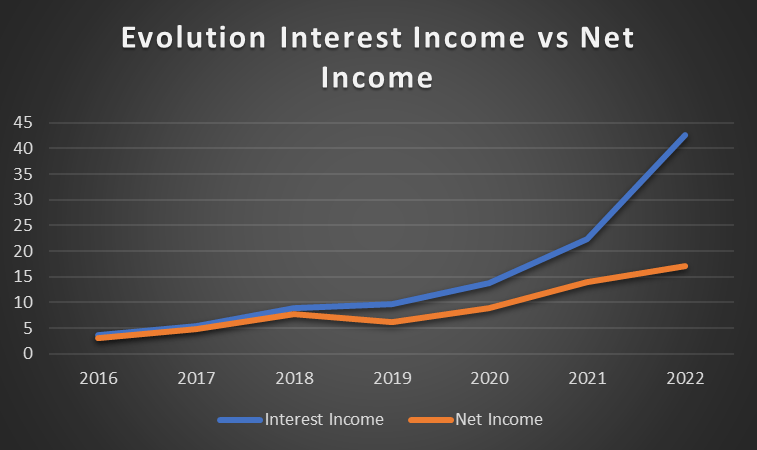

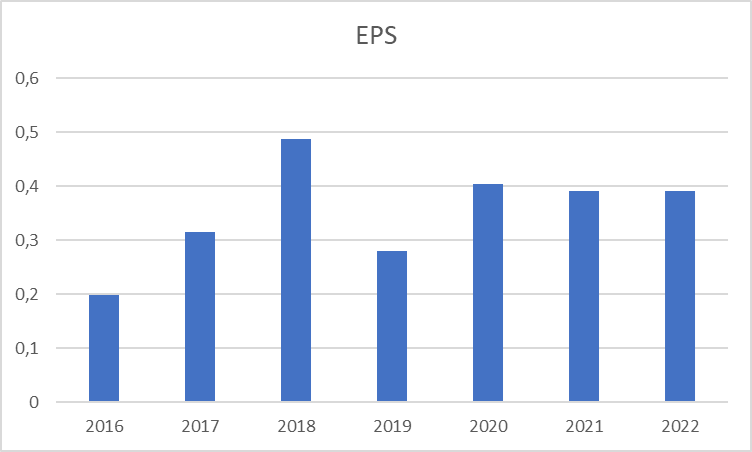

Interest Income has consistently expanded, and though Net Income saw more moderate growth, this was attributed to the increase in Selling, General, and Administrative (SG&A) expenses, which are tied to the company’s growth strategy. The company’s EPS has displayed considerable volatility over the same period due to significant dilution.

Company-Specific Risks and Industry Perspectives

The primary concern for the company lies in the potential decline of real estate values within its operating market. This could result in a reduction of collateral value, potentially precipitating significant challenges. In certain areas of the US, real estate prices have already displayed stagnation, largely attributed to the impact of rising interest rates. Nevertheless, I hold the perspective that a substantial decline in real estate values is improbable, particularly within the company’s operational markets. These markets are predominantly characterized as attractive, underdeveloped areas with limited inventory. Furthermore, the company’s cautious underwriting criteria are expected to effectively mitigate this risk.

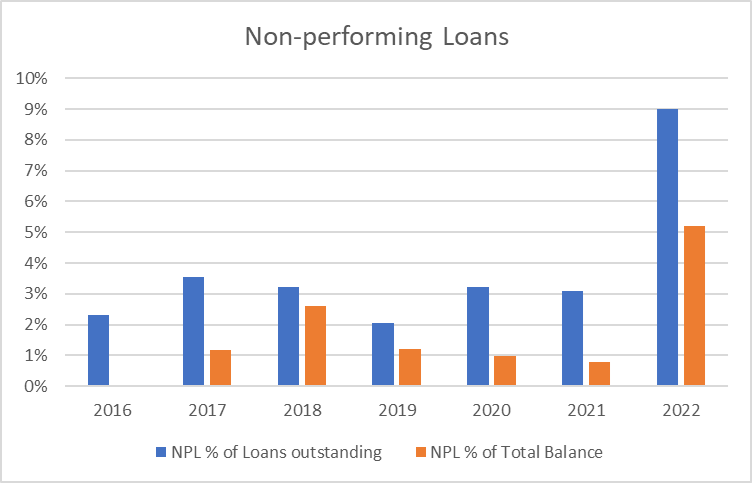

The key question revolves around whether developers can effectively adapt to the current environment of relatively high interest rates, which is putting some pressure on the company’s lending operations. Short-term challenges such as higher borrowing costs in an industry that heavily relies on leverage, along with sluggish demand, could impact earnings. This, along with the recent banking troubles a few months back, has resulted in more loans not being repaid on time. As a consequence, it becomes tougher for developers, especially the smaller ones, to get loans to support their operations. To strengthen its position, the company has been wise in maintaining a solid amount of cash, with $20 million in Cash and Cash Equivalents, along with $35 million in Short-term Investments. Moreover, when compared to other companies in the same sector, this company isn’t overly dependent on borrowed funds. Its Debt-to-Equity Ratio is just a bit over 1.5, showcasing a more balanced financial approach.

Lastly, a substantial portion of the company’s debt, approximately $60 million, is scheduled to mature by June 2024, followed by an additional $60 million in 2025. While the company maintains a satisfactory level of liquidity, prevailing market apprehensions revolve around the potential necessity for the company to refinance its debt at a higher cost. This could exert pressure on the company’s interest income, which is contingent upon the variance between its cost of capital and the pricing of its loans.Right now, the company has been handling the higher borrowing costs quite well, but there’s still a sense of uncertainty in the air.

Valuation and Conclusion

Taking all these factors into account, I reckon the company is a pretty attractive investment with not much risk involved. Right now, the stock is trading at around 0.7 times its Book Value, which is the lowest it’s been apart from during the pandemic, and its Price-to-Earnings ratio is 7. The potential downside is kind of cushioned by the company’s Book Value. So, you’re pretty much getting all the growth for free. Also, the company has about $0.5 per share in cash.

If the industry manages to bounce back over the next few years and the company keeps up its strategic execution, I’m of the opinion that the stock could potentially double in the near future. In the meantime, the company offers an appealing 15% Dividend Yield and, thanks to its REIT status, it’s required to distribute cash to shareholders. So, it’s highly likely that you’ll find it beneficial to hold onto this stock.