The Business

NAI is a leading manufacturer of dietary supplements that provides a comprehensive range of services to its customers. These services include scientific research, clinical studies, product testing and evaluation, marketing management and support, packaging and delivery system design, regulatory review, and assistance with international product registration.

Furthermore, NAI holds a valuable patent estate related to the raw material ingredient beta-alanine. This patent allows NAI to engage in direct sales of the raw material and establish supply agreements with third parties for its distribution and use. NAI markets beta-alanine under the CarnoSyn® and SR CarnoSyn® trademarks.

The majority of NAI’s revenue, approximately 90%, is generated from their private-label contract manufacturing services. These services involve producing dietary supplements on behalf of other brands. Additionally, NAI receives royalties from owning the patent for beta-alanine, contributing to the remaining portion of their revenue

Brief Overview of the Company’s History

The company traces its origins back to 1980 when it was founded by Mark LeDoux, the current CEO and Chairman, who still maintains a 17% ownership stake in the company.

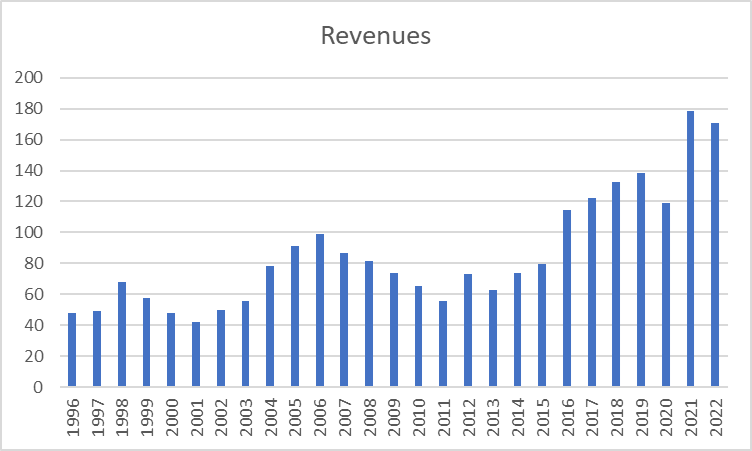

After a successful decade in the 1990s, NAI encountered significant challenges in 2000 when it lost one of its most important customers. This loss had a profound impact on the company as it heavily relied on a concentrated customer base. In 1998, the top two customers accounted for 54% of revenues, and this percentage remained unchanged in 2022. Consequently, NAI faced several years of stagnant earnings as it struggled to recover from this setback.

Just as the company was making progress in recovering from the loss of the major customer, the financial crisis hit, further hindering its growth. For nearly a decade, NAI faced stagnant financial performance as a result of these challenging external factors.

However, starting from 2016, the company experienced an upward trend in its revenues, accompanied by increased profitability. It is important to note that earnings still exhibited volatility due to the presence of operating leverage, which can magnify the impact of changes in revenue on profitability

The company’s Revenue Performance Across Business Cycles

The Moat

Throughout its illustrious history, NAI has demonstrated a strong commitment to investment in capital expenditures and fixed assets. This strategic focus on expanding its operational capacity has been driven by the company’s recognition of the significant market opportunity in the dietary supplement industry.NAI is the only publicly traded manufacturer of dietary supplements.

During the financial crisis, many of NAI’s competitors faced dire circumstances and ultimately went out of business. This event further solidified NAI’s position as a resilient player in the industry. Moreover, the dietary supplement industry has evolved and matured since the early 2000s, reducing the likelihood of NAI losing any major customers due to market dynamics.

NAI has garnered numerous certifications that validate its adherence to industry safety and quality standards. These certifications, prominently displayed on the company’s website, reflect the rigorous and lengthy audit processes conducted by regulatory authorities. Acquiring such certifications represents a significant barrier to entry for potential competitors, further fortifying NAI’s market position.

In summary, NAI enjoys economies of scale due to its unmatched ability to handle large volumes, setting it apart from competitors. Additionally, the company benefits from the protection afforded by heavy industry regulations, which, paradoxically, create a barrier to entry for newcomers.

Risks and flaws in the company‘s business model

Undoubtedly, the potential loss of a major customer represents a critical risk for the company. While NAI has not experienced permanent customer losses in recent years, the possibility remains, and such an event could have a long-lasting negative impact on the company’s financial performance. The absence of a major customer would likely depress the company’s figures for an extended period, making it a vital risk to consider.

Additionally, NAI operates in an industry that requires significant upfront working capital to support its operations. This necessitates the company to maintain a substantial cash reserve, as evidenced by its historical financial statements and 10-K reports. Having adequate cash on hand is crucial for meeting working capital requirements and ensuring smooth day-to-day operations.

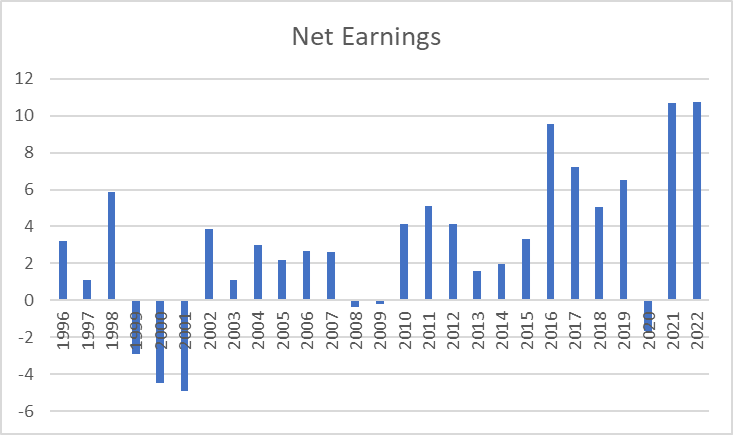

Furthermore, NAI’s business model is subject to the effects of operating leverage, leading to substantial fluctuations in earnings. This volatility can be attributed to the fixed costs involved in the company’s operations. It is important to note that fluctuations in revenue can significantly impact profitability due to the high fixed costs relative to variable costs.

Lastly, considering the company’s ongoing investments in fixed assets, it is essential to anticipate potential future capital expenditure requirements. NAI’s commitment to expanding its operational capacity through investments in fixed assets should be taken into account when assessing its financial outlook and planning for future growth.

In summary, the potential loss of a customer, the need for significant working capital, the impact of operating leverage on earnings, and ongoing investments in fixed assets are crucial factors to consider when evaluating the risks and prospects of NAI.

The company’s earnings and the impact of operating leverage

Bullish Thesis

One notable aspect that appeals to me is the management’s “skin in the game” approach and their capital allocation strategy, although not explicitly mentioned, can be inferred from the numbers.

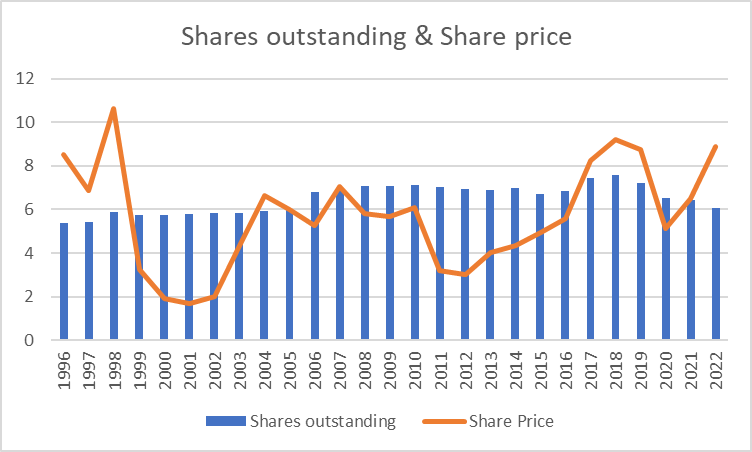

Looking at the chart, it is evident that when the share price was high (taking the lowest share price of the year for conservatism), the company issued new shares, while during periods of low prices, the share count remained constant or they bought back stock. This disciplined capital allocation strategy is uncommon among small companies. In recent years, the company has reduced the share count to approximately 5.9 million shares, representing a 12% decrease since the COVID-19 pandemic.

Furthermore, the company has demonstrated a commendable ability to create value for shareholders. Over a span of 26 years, the company has compounded book value at a rate of 6.5%. Additionally, the company has historically maintained a Return on Equity (ROE) of about 10-12%, which has improved in recent years.

However, what truly makes the company appealing to me is the price at which the market is currently valuing it. Trading at approximately 0.5x book value, the company’s valuation appears absurdly low considering its decent fundamentals. While slightly higher than the lows experienced during the COVID-19 pandemic, it is significantly below the 26-year low range average of 1.1x book value. This suggests that the stock would need to double to reach a remotely fair valuation or that a substantial portion of the company’s book value is perceived to be at risk of becoming obsolete.

It is important to note that the market anticipates negative net earnings for the company this year due to the expected 10-15% decline in sales, as indicated by the company’s guidance. Despite this short-term setback, the attractive valuation and the company’s historical track record of value creation make it an appealing investment opportunity.

Valuation

Valuing the company based on Book Value and Price-to-Book ratio is a prudent approach given the stock’s nature as primarily an asset play, and the challenge of accurately predicting the company’s future earnings or cash flows, at least for the time being.

By focusing on Book Value, which represents the company’s net assets, you can assess its intrinsic value based on the tangible assets it holds. This approach allows for a more tangible and conservative assessment of the company’s worth, without relying heavily on uncertain projections of future earnings or cash flows.

Calculation= 2022 Book value per Share * (Possible discount to account for this year’s loss) x ((Low Multiple+Base Multiple+High Multiple)/3)) = Intrinsic Value

Bullish Price=14.535 (No Discount Applied but no Growth either) x ((1.1+1.5+2)/3)) = 22.287 (212% Upside)

Base Price= 14.535 * 7% Discount x ((0.75+1.1+1.3)/3)= 14.193 (99% Upside)

Bearish Price= 14.535* 30% Discount x ((0.5+1+1.1)/3)= 8.81 (23% Upside)

I am not accounting for any growth or increase in earnings power or earnings predictability. I think if my thesis is approximetaly right I will make money.