A delve into the company’s employee compensation and capital allocation

Alphabet Inc (Alphabet), the holding company of Google, is a global technology company. It offers a wide range of products and platforms, including search, maps, calendar, ads, Gmail, Google Play, Android, google cloud, chrome, and YouTube. The company’s competitive advantages, known as its “moats,” are well recognized.

In this article, we will examine Alphabet’s employee retention strategies through its Stock-Based Compensation (SBC) plans and analyze its capital allocation choices.

EMPLOYEE STOCK-BASED COMPENSATION

Stock-Based Compensation (SBC) refers to a type of compensation offered to employees in the form of company stock or stock options. SBC can take the form of stock grants, stock options, or restricted stock units (RSUs). This type of compensation is commonly used by technology companies with limited cash resources (typically startups) as a way to attract, retain, and motivate employees.

As a shareholder, you should be aware that SBC decreases your ownership percentage in the company. This occurs because the issuance of new shares to compensate employees increases the total number of outstanding shares, thus reducing the proportion of ownership held by existing shareholders. As an Alphabet shareholder, you should wish for SBC to be balanced; not so low that it does not sufficiently align employee and shareholder interests, but also not so high as to excessively dilute your ownership.

However, in my opinion, Alphabet’s Stock-Based Compensation appears excessive. The table below showcases a comparison of Alphabet’s SBC expense with those of its major competitors:

| SBC Expense (2022) in Millions of USD | Alphabet | Microsoft | Apple | Meta |

| 2018 | 10794 | 4652 | 6068 | 4836 |

| 2019 | 12991 | 5289 | 6829 | 6536 |

| 2020 | 15376 | 6118 | 7906 | 9164 |

| 2021 | 19362 | 7502 | 9038 | 11992 |

As is evident, Google is offering more shares to maintain high-quality personnel. Additionally, Alphabet is providing its employees with significantly higher salaries compared to its competitors ( its SG&A (Selling, General, and Administrative) expenses are nearly double those of Apple, Microsoft, and Meta).

The issue at hand is whether this strategy is reasonable. Is Alphabet, with its exceptional culture and exceptional management team, not attractive enough for people to work for? I believe that Alphabet lacks cost discipline compared to its peers and needs to adapt to a changing macroeconomic environment where its revenue growth is expected to slow down. The company already announced workforce reductions and is working on adjusting the cost-base. This lack of cost discipline prompts a closer look at the poor capital allocation decisions made by the company.

Cash piling up

One notable aspect of Alphabet is its capability of producing robust and predictable cash flow. However, for Alphabet shareholders, it is disheartening to observe the accumulation of cash in a manner that does not effectively generate value.

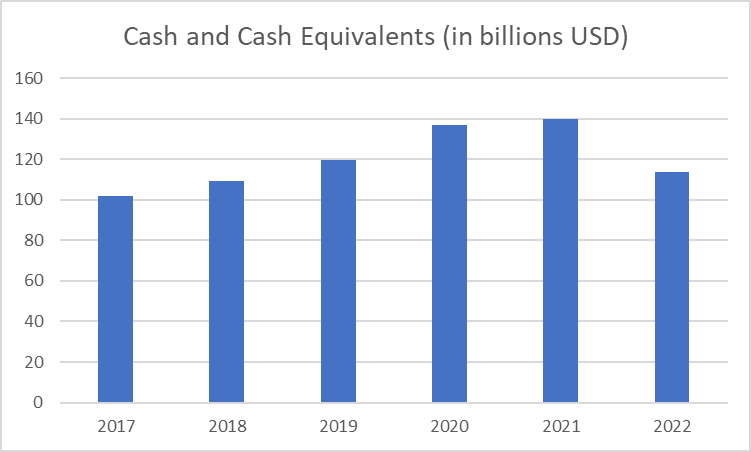

As of December 31, 2022, Alphabet held a cash stockpile of 113 billion dollars. Given that the working capital of the company is negative, there is no need to hold as much cash.

Ways for Alphabet to Enhance Shareholder Value

- Providing Employees with Increased Cash Compensation Instead of Stock: Our evaluation indicates that the stock-based compensation (SBC) plans for Alphabet employees are overly generous and detrimental to value. By paying employees compensation with cash as opposed to stock, the company could use some of its cash in a value-enhancing way. Also this would most likely increase Free Cash Flow since the SBC expenses would be reduced (you should always account for SBC Expenses in FCF calculation!).

- Opportunistic Share Buybacks: Due to its extensive stock-based compensation (SBC) plans, the company is obligated to purchase shares regardless of market conditions to avoid dilution. As a result, the number of shares has remained unchanged for years despite significant share buyback efforts. The company should use cash to buy back shares when the stock is trading below intrinsic value. This can help increase earnings per share and create value for shareholders.

From my perspective, Alphabet should not pay dividends to shareholders because it has the capability to reinvest its profits and earn a decent return on capital. This can lead to long-term growth and increase shareholder value in the future..

Conclusion

Despite questionable capital allocation strategies, I am confident about Alphabet’s future. As Microsoft seeks to enter the search market and challenge Google’s dominant position, it is crucial for the company to focus on utilizing its resources in an efficient and effective manner.